Bitcoin’s current decline is extra critical than only a technical correction. It’s approaching the extent of immediately impacting the economics of the mining business and altering the chance profile of the market.

Round $70,000, Bitcoin transitions from a purely trader-driven market to at least one the place community economics, miner habits, and the chance of pressured gross sales start to matter. That’s the reason this degree is extra vital than development traces or transferring averages in the meanwhile.

Bitcoin is getting into a mining stress zone

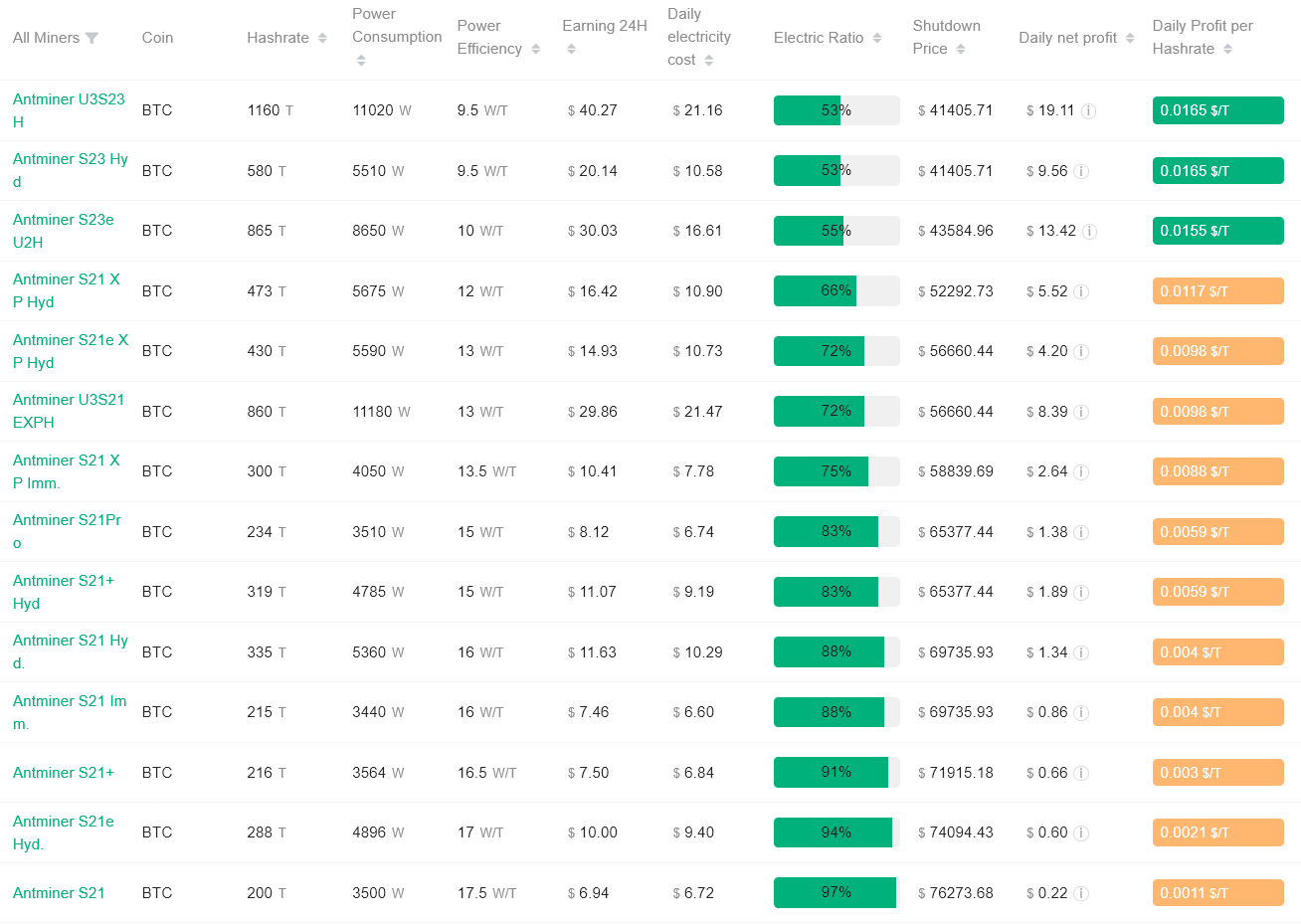

Within the present community difficulties and electrical energy invoice scenario, $0.08 per kWhnew mining information exhibits a transparent strain zone.

Many of the Antminer S21 collection machines, which account for almost all of the trendy international hash charge, have shutdown costs concentrated within the following ranges: $69,000 and $74,000 round $BTC.

Merely put, beneath this vary, Many miners cease getting cash simply by working.

Most Bitcoin miners have a shutdown value of lower than $70,000. Supply: Antpur

Bitcoin frequently strikes 1000’s of {dollars} in both route. What makes this second completely different is that particular person feeling burdenednot how rapidly costs change.

Above $70,000, mining stays broadly worthwhile. Under that, profitability turns into selective. Due to this fact, solely environment friendly miners will survive, and middle-tier operators will face losses.

This isn’t nearly value; Money move, steadiness sheet, and habits.

Shutdown value doesn’t imply ground value

Accuracy is vital.

The shutdown value is should not have Assured assist degree. Miners don’t management the worth of Bitcoin, and the market can commerce beneath the break-even level for mining for lengthy durations of time.

Nevertheless, the closing value might be marked Zone the place habits adjustmentsit’s habits that strikes markets throughout instances of stress.

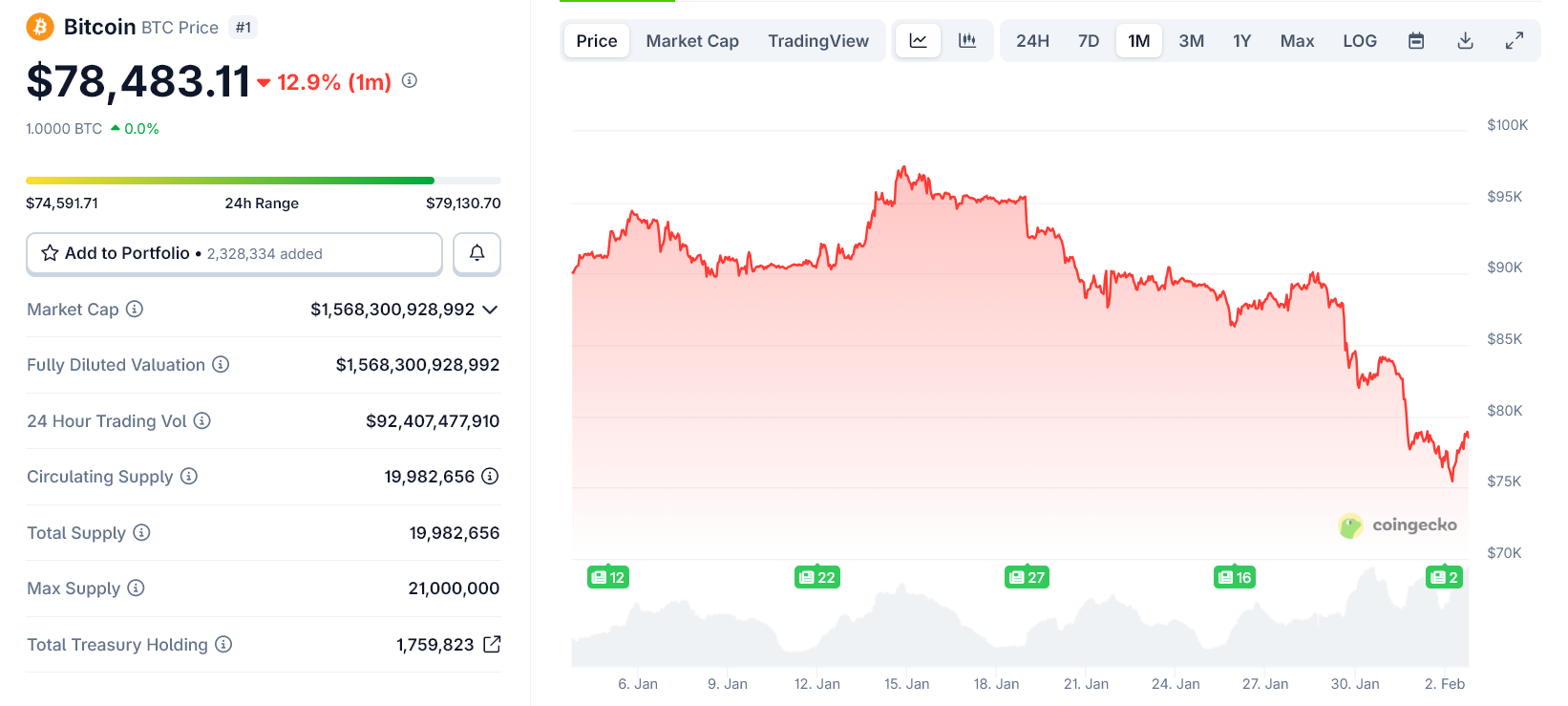

Bitcoin value over the previous month. Supply: CoinGecko

What occurs if Bitcoin falls beneath $70,000?

Even when Bitcoin briefly dips beneath $70,000 and recovers rapidly, the impression might be restricted. But when the worth keep beneath At that degree, some secondary results begin to add up.

First, weak miners might promote $BTC This can be a reserve to cowl electrical energy and internet hosting prices. Some miners might shut down their machines and cut back hashrate.

Most significantly, detrimental sentiment is amplified as headlines shift from “volatility” to “mining stress.”

None of those are deadly on their very own. If they arrive collectively, the decline might be magnified.

When mining stress turns into harmful, overlaps with liquidity stress.

At present, Bitcoin is already grappling with points akin to:

- International liquidity squeeze

- Lowering threat urge for food

- ETF outflows and derivatives liquidation

These elements, mixed with mining stress and compelled promoting, may trigger the market to say no quicker than fundamentals alone would justify.

On this approach, sharp and chaotic actions happen. It is not as a result of Bitcoin is damaged, A number of pressures are aligned directly.

The put up When Main Bitcoin Miners Face Shutdown Danger $BTC Falls Under $70,000 appeared first on BeInCrypto.