Welcome to our e-newsletter “Crypto Lengthy & Brief”. this week:

- Canary Capital’s Josh Olszewicz talks about early however tentative indicators of a bullish flip in equities, liquidity, and cryptocurrencies.

- Joshua de Vos analyzes 10 main blockchain ecosystems and developments to observe in 2026.

- High headlines for instructional establishments to observe, compiled by Francisco Rodríguez

- “Solana’s danger urge for food returns” on this week’s chart

Thanks for becoming a member of us!

-Alexandra Levis

Knowledgeable insights

Markets are excessive, cryptocurrencies are nonetheless ready

– Josh Olszewicz, Head of Buying and selling, Canary Capital

macro and inventory background

The broader inventory market continues to hit all-time highs (ATH). Within the S&P 500, the Equal Weight Index (RSP) is exhibiting notable power alongside the brand new ATH, and QQQ additionally seems to be poised to problem the highs. Sector management stays broad-based, led by power, commodities, protection, aerospace, biotech/prescription drugs, and small caps. The principle drag on the inventory market stays the Magnificent 7, with relative weak spot outdoors of Google, Amazon, and Tesla.

Rates of interest, liquidity, and provide

Following right this moment’s unemployment price report, which was barely stronger than anticipated, the market’s January FOMC rate of interest odds have decisively shifted to the “no price reduce” camp. That is in step with the Fed’s latest emphasis on labor knowledge relatively than inflation. That stated, the broader inflation story stays dovish. Torflation’s real-time inflation measure is beneath 2.0%, whereas the Fed’s inflation nowcast exhibits the PCE worth index, the Fed’s most popular inflation measure, has declined month-over-month since October.

Wanting forward, President Trump’s alternative for Federal Reserve Chairman Jerome Powell has not but been named, however the Fed is broadly anticipated to start a rate-cutting cycle within the second quarter. Importantly, after the formal finish of quantitative tightening late final 12 months, the Fed’s complete belongings have begun to rise once more, indicating that new liquidity is flowing into the system.

Relative efficiency of digital currencies and rotation danger

Whereas many trades are performing effectively, gold and silver specifically are paradoxically one in every of Bitcoin’s largest headwinds. BTC$97,654.92 and ether Ethereum$3,370.58. Capital could ultimately return to cryptocurrencies, however the timing stays unsure. At present, the digital foreign money market faces the next dangers: Ready for Godotcaught anticipating a farewell that by no means comes.

Two of the extra viable trades proper now appear to be Metaplanet and Monero. Metaplanet, thought of an analogue to Japan’s MicroStrategy (MSTR), has accomplished a bearish-to-bullish reversal after an 82% drawdown from its June excessive. In distinction, MSTR itself continues to flounder close to its lows, with no clear technical proof of a sturdy backside. Monero XMR$712.55which is usually traded inversely to Bitcoin, has been in an ascending triangle for a decade and seems poised for a worth rally, particularly because the privateness coin saga has gained momentum just lately. Zcash’s developer exodus may push additional funds into different privateness cash, offering a bullish tailwind. XMR.

Bitcoin expertise and construction

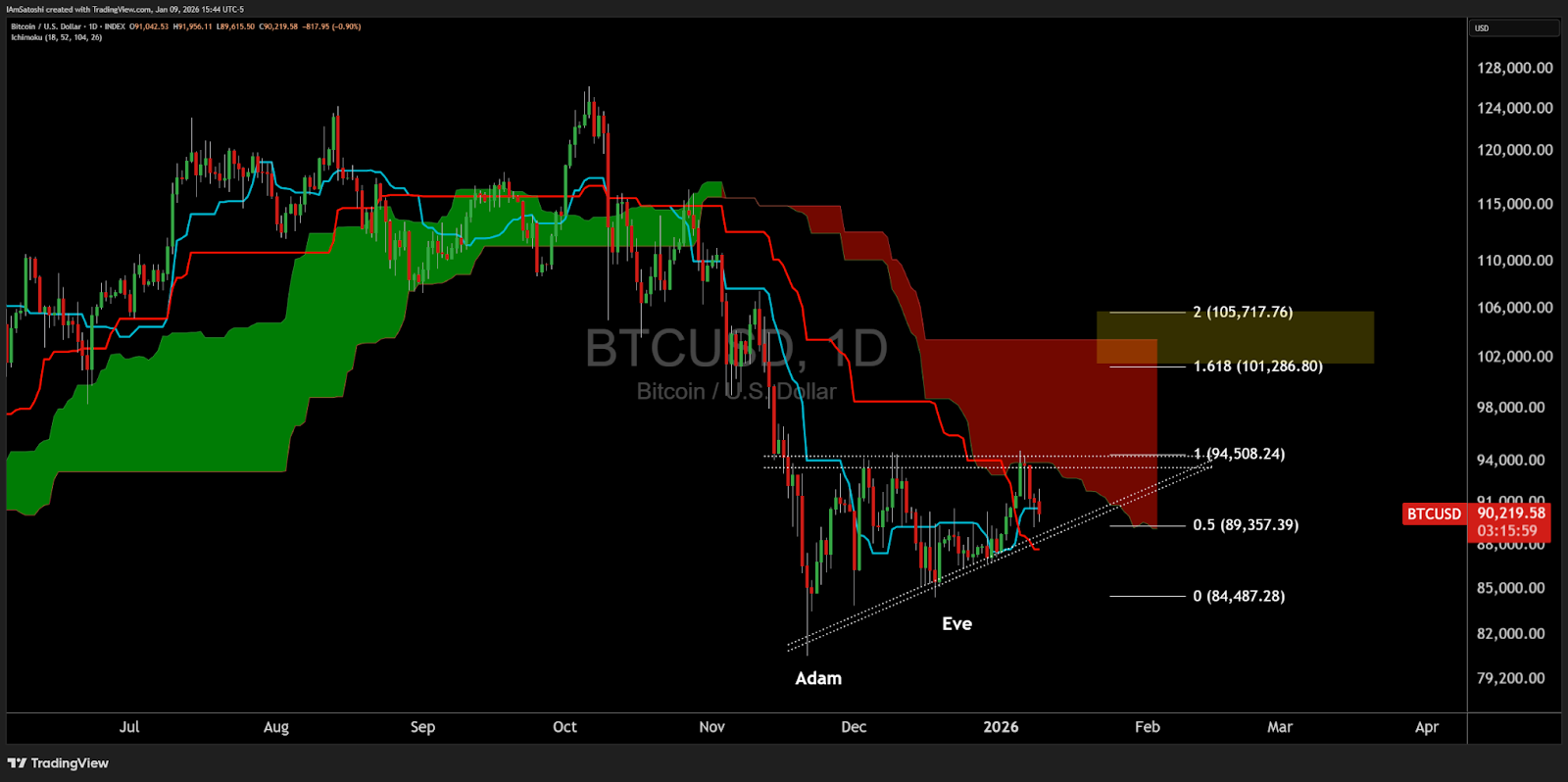

A possible catalyst for a broader crypto restoration is the continuing bearish-to-bullish reversal. BTC. Worth types an Adam (V) & Eve (U) model double backside, which may additionally turn into an inverted head and shoulders or an ascending triangle. Every of those patterns carries a measured shifting goal in direction of the $100,000+ space. Beforehand, the draw back danger centered round the potential for a bear flag breakout on the excessive timeframe, however that menace seems to have light with aggressive tax loss restoration in direction of the top of 2025. BTC ETF flows proceed to be unfavourable, with about $700 million extra in outflows final week.

https://www.tradingview.com/x/3C0H83GB/

Positioning, derivatives and on-chain alerts

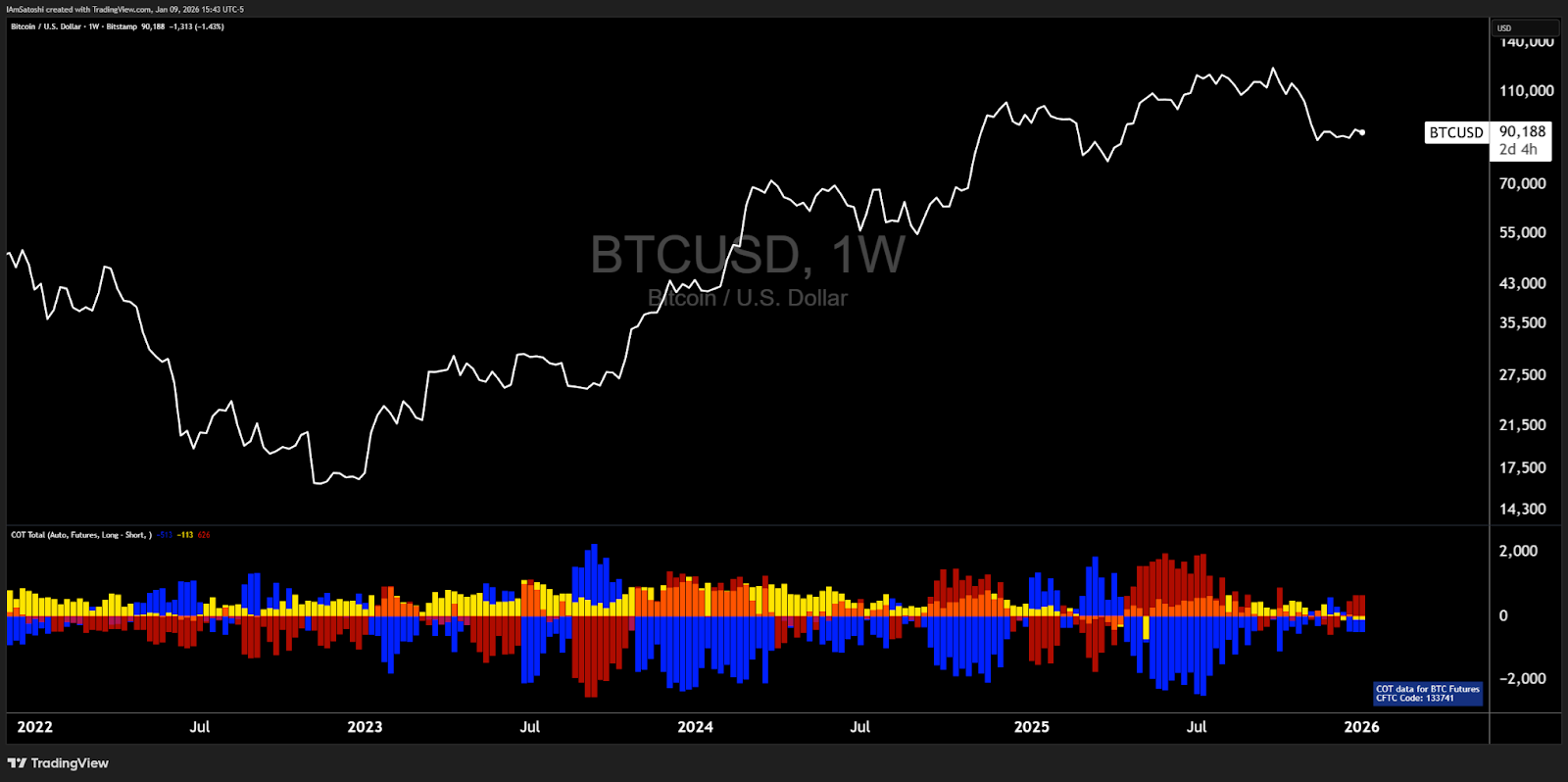

An extra bullish confluence, albeit modest, is rising from the positioning knowledge. Spinoff funding charges throughout crypto exchanges and CME Dedication of Merchants (CoT) knowledge each recommend early indicators of a bullish shift. Merchants stay internet bearish, however industrial members keep a bullish bias, and imbalances may immediate sharp upside if shorts are pressured to cowl.

Industrial mining firms, which have been impartial to bearish in latest weeks, have now turned bullish. Alternatively, the hash price has fallen sharply since mid-October. The hash ribbon (30-day and 60-day shifting common of hashrate) recorded a bearish cross in late November, which is a traditionally related sign. BTC Weak spot. Nonetheless, each hashrate and hashribbon are about to stabilize on the similar time that worth seems to be stabilizing, setting the stage for a possible inflection level within the coming weeks.

https://www.tradingview.com/x/mzLzQpeJ/

this week’s headlines

– Francisco Rodriguez

The “infrastructure stage” of institutional adoption of the crypto market seems to be effectively underway, with main monetary establishments now establishing the mandatory constructing blocks for continued involvement. Cryptocurrencies are lobbying Washington to guard their mannequin as finance intervenes.

- Morgan Stanley Recordsdata Bitcoin, Ether, Solana ETF: Morgan Stanley has filed with the U.S. Securities and Trade Fee (SEC) to launch a Spot Bitcoin, Solana, Ether ETF.

- Lloyds Financial institution completes UK’s first gold foil buy utilizing tokenized deposits: The transaction used blockchain-based financial institution deposits to immediately settle bond purchases and was executed with help from Archax and Canton Community.

- As tokenization infrastructure advances, Barclays invests in stablecoin funds firm: Ubix is constructing a clearing system designed to permit tokenized financial institution deposits and controlled stablecoins to be moved between establishments in equivalence.

- Coinbase pushes again in opposition to banks to maintain rewarding customers who maintain stablecoins: Coinbase has signaled it might oppose the CLARITY Act to take care of stablecoin rewards applications, arguing that it stifles competitors and harms customers.

- Stand With Crypto advocacy group positive factors practically 700,000 new members forward of 2026 election: Stand With Crypto, a corporation based by Coinbase, reported a rise in enrollment of 675,000 folks final 12 months. At present, the variety of members in the USA is roughly 2.6 million.

analysis report

Present state of blockchain in 2025

– Written by Joshua de Vos, Analysis Chief, CoinDesk

The crypto market in 2025 was outlined by the widening hole between exercise and worth efficiency. Most main ecosystems have seen development in token utilization however have struggled to mirror that progress. This sample is constant throughout Bitcoin, Ethereum, and large-scale Layer 1 options, indicating a shift in the place worth is captured.

Knowledge from our “State of the Blockchain 2025” report makes this clear. Seven of the eight ecosystems studied elevated their complete worth locked (TVL) on a local foundation. Every day exercise elevated 4 instances. Throughout the identical interval, base layer prices decreased in all eight. App-level income moved in the wrong way. Complete quarterly app income elevated from roughly $3.9 billion within the first quarter to greater than $6 billion by the fourth quarter. Layer 1 continues to dominate market capitalization, however now represents a a lot smaller share of financial worth.

Ethereum Ether Ethereum$3,370.58 We’re on the middle of this modification. Ethereum Worth efficiency has underperformed in 2025, however ecosystem fundamentals have strengthened. TVL has elevated, stablecoin provide has expanded, and decentralized change (DEX) buying and selling volumes have elevated. Nonetheless, Layer 1 income declined considerably as executions and actions moved to rollups, whereas software income remained roughly secure. Worth didn’t depart the ecosystem. The placement the place it happens has modified. The circulation of institutional traders, particularly via the digital asset treasury, turned a extra necessary driving drive. Ethereum Worth developments worsened as fee-based valuations weakened.

Solana adopted a considerably related trajectory. On-chain utilization continued to develop throughout meme cash, funds, DePIN, and AI-related actions. The market capitalization of stablecoins expanded quickly, with proprietary AMMs accounting for about half of DEX buying and selling quantity by the top of the 12 months. Regardless of continued worth fluctuations, market construction improved. In any case, throughput and exercise alone weren’t sufficient to enhance token efficiency.

BNB Chain stood out final 12 months by translating infrastructure upgrades immediately into execution high quality. Sooner finality and decrease charges have considerably elevated application-level income. Perpetual DEXs dominated quantity, and worth efficiency mirrored application-layer monetization relatively than base-layer charge seize.

Bitcoin has moved alongside a special path. Institutional possession via ETFs and public finance firms continues to extend, with complete possession approaching 13% of provide. Miners’ income continued to be closely depending on block subsidies, with minimal contribution from transaction charges. This has elevated the relevance of BTCFi and Bitcoin Layer 2, creating sustained on-chain exercise and charge demand.

Throughout the ecosystem, incentive-driven development confronted higher scrutiny. In Ether lending, monolithic protocols maintained their dominance whereas the modular market slowed following danger occasions. In different areas, quantity focus has raised questions on sturdiness. Capital allocation has change into extra selective over the previous 12 months.

The route of progress is now clear. At present, application-level monetization, capital effectivity, and institutional utility play a significant position in figuring out the relative efficiency of the general cryptocurrency market.

Learn the complete report for all of the insights.

https://www.coindesk.com/analysis/state-of-the-blockchain-2025

This week’s chart

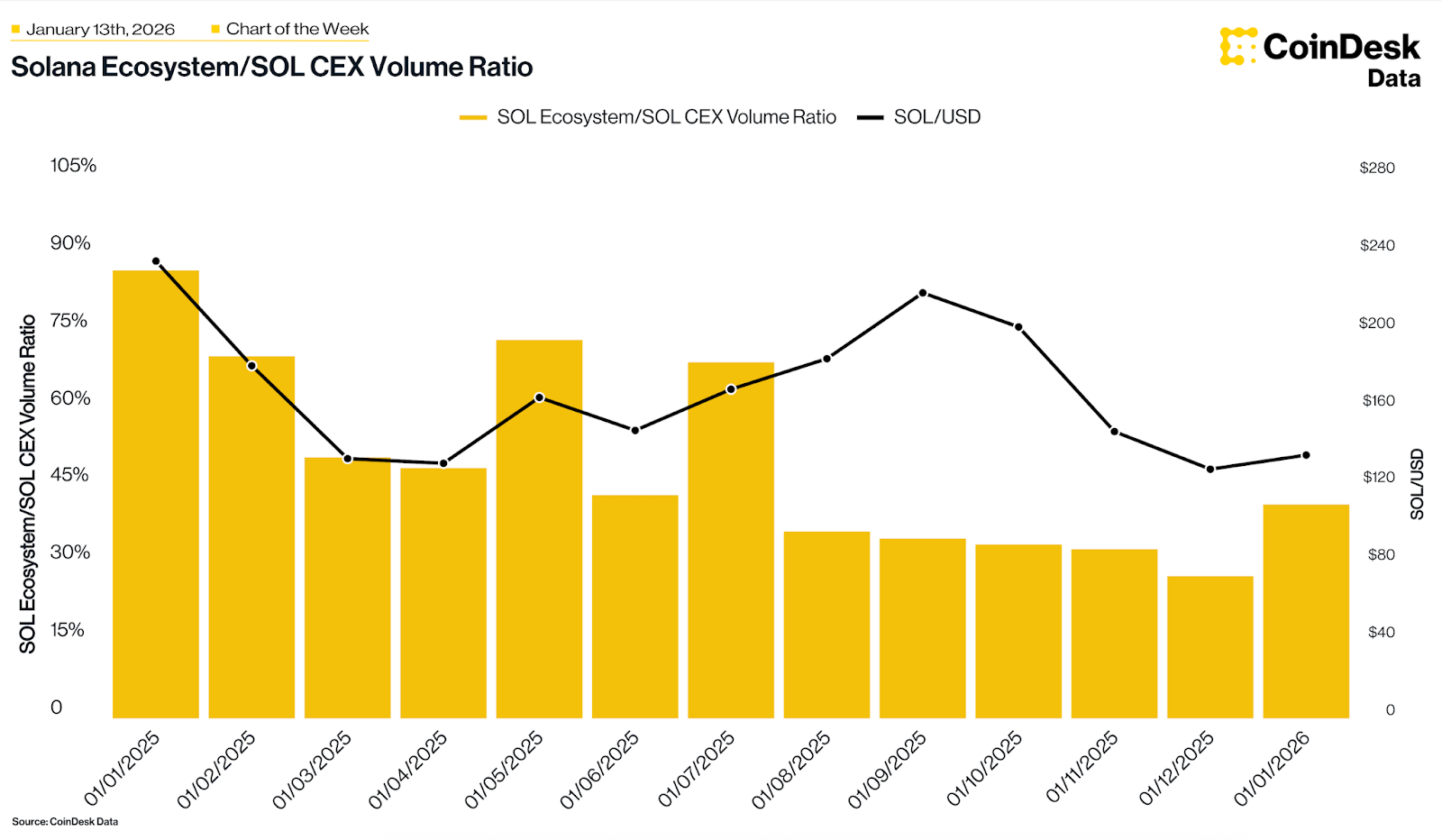

Solana’s danger urge for food returns

Token quantity ratio of solana ecosystem sol Quantity on centralized exchanges surged greater than 40% this month, the very best degree in six months. This exhibits early indicators of curiosity in high-beta belongings on Solana. This alteration displays the month-to-date efficiency of ecosystem leaders similar to PENGU (27%) and RAY (21%). sol (10%), indicating that investor urge for food is beginning to transfer down the chance curve in direction of the interior financial system of the community, the place a “multiplier” comes into play whereas the underlying asset offers a secure decrease certain.

pay attention. learn. clock. interact.

- pay attention: Fairlead Methods’ Katie Stockton explains why Bitcoin behaves extra like a danger asset than a protected haven.

- learn: World Digital Belongings: December ETF and ETP Critiques and 2025 Roundup in partnership with ETF Specific and Trackinsight.

- clock: Polygon Labs acquires Coinme and Sequence for $250 million.

- interact: Chosen CoinDesk indices and charges at the moment are obtainable on TradingView. Discover the cryptocurrency market with CoinDesk Indices.