December was one of many weakest months for cryptocurrency trade buying and selling quantity as the main target shifted to shares and valuable metals. Exchanges have seen an inflow of stablecoins, however commerce has slowed to its lowest degree in a 12 months resulting from dealer issues and the year-end holidays.

Spot market crypto trade exercise slowed in December, a development that has been prolonged because the final quarter of 2025. In accordance with varied accounts, the final month of 2025 was one of many weakest months of the 12 months, with buying and selling volumes starting from $990 million to $1.13 billion.

Many of the visitors went to Binance, which additionally held the most important share of the accessible companies. liquidity. Regardless of this, main belongings equivalent to BTC and ETH skilled an outflow of exercise, whereas altcoins continued to have low buying and selling volumes.

With the slowdown of centralized exchanges, exercise has shifted to prediction markets. What’s new is the platform It recorded a brand new peak in exercise, taking visitors from each centralized and decentralized markets.

Lower in spot trade quantity

Spot buying and selling volumes declined after a short surge following the October 11 liquidation. Spot buying and selling volumes had been unable to compensate for the shrinking derivatives market as each retailers and whalers exited within the last months of 2025.

Over the previous 12 months, January and October have been the most effective months for crypto exercise, coinciding with rising costs and general enthusiasm. The spike in buying and selling quantity is in keeping with optimistic sentiment in the direction of cryptocurrencies, primarily based on the crypto worry and greed index.

Over the previous month, the market feelings Shifting between worry and excessive worry, together with reluctance to commerce.

DEX buying and selling quantity will increase to finish the 12 months

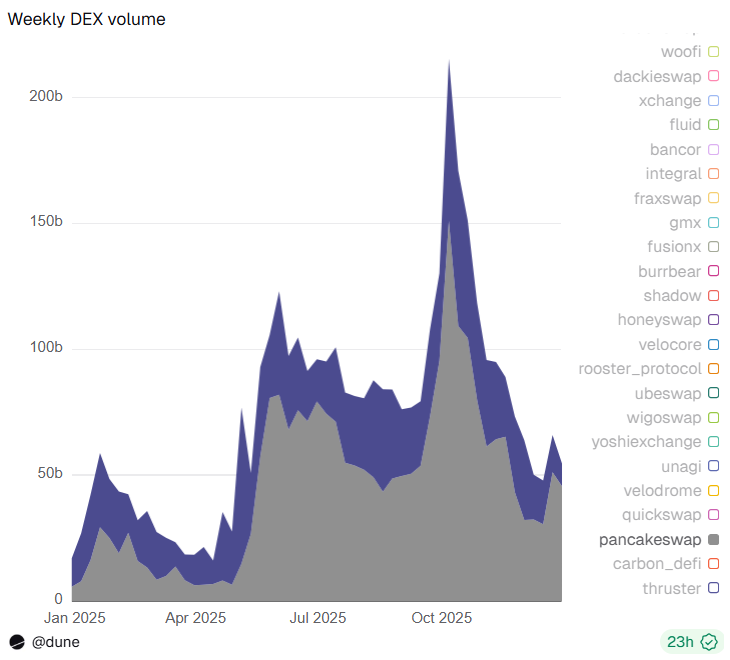

Decentralized exchanges continued to carry out nicely in 2025, with web earnings rising in comparison with January. Decentralized buying and selling developed primarily based on the growth of pockets apps. For many of 2025, DEXs accounted for 17% to 21% of concentrated market exercise.

DEX buying and selling volumes elevated on the finish of the 12 months, however are nonetheless under their October peak. This progress just isn’t solely resulting from elevated use of DeFi and lending; affect of the solana ecosystem.

Looking forward to 2025, PancakeSwap has emerged as one of the crucial energetic DEXs. The market and its multi-chain illustration have overtaken Uniswap to turn out to be the chief in DEX quantity.

PancakeSwap gained market share versus Uniswap in 2025 and ended the 12 months with elevated exercise in comparison with January, though nonetheless down from the height in Q3. |Supply: Dune Analytics

DEX volumes had been additionally extra attentive to developments and incentives, with September seeing document exercise at airfields. In contrast to concentrated markets, DEXs have remained extra strong regardless of indicators of a bear market, permitting for riskier trades with larger upside.

Moreover, general DEX exercise gave method to an all-out season for altcoins, with many smaller belongings producing short-term features. Centralized markets not often supplied related pumps, and actually most led to losses for altcoins and tokens.

DEX exercise additionally displays the latest enhance in stablecoin utilization as on-chain funds and arbitrage prospects turn out to be simpler.