Metaplanet (3350), Asia’s largest Bitcoin holding firm BTC$94,724.39the biggest cryptocurrency rose inside 5% of its value triggering a brand new inventory sale to fund additional purchases.

The Tokyo-based firm’s shares rose 15% on Wednesday to 605 yen ($3.8), near the 637 yen stage that will reactivate its so-called cellular strike warrant (MSW) program after a pause meant to guard shareholders throughout an 80% drop from June highs.

For the reason that firm’s company worth and the ratio of its Bitcoin holdings, or web asset worth a number of (mNAV), have been under 1, promoting the shares at this level would have risked diluting shareholders’ holdings reasonably than growing its worth. The ratio has now risen to 1.36, its highest stage since October. The corporate at present has 35,102 Bitcoins on its stability sheet, making it the world’s fourth-largest holder of publicly traded firms.

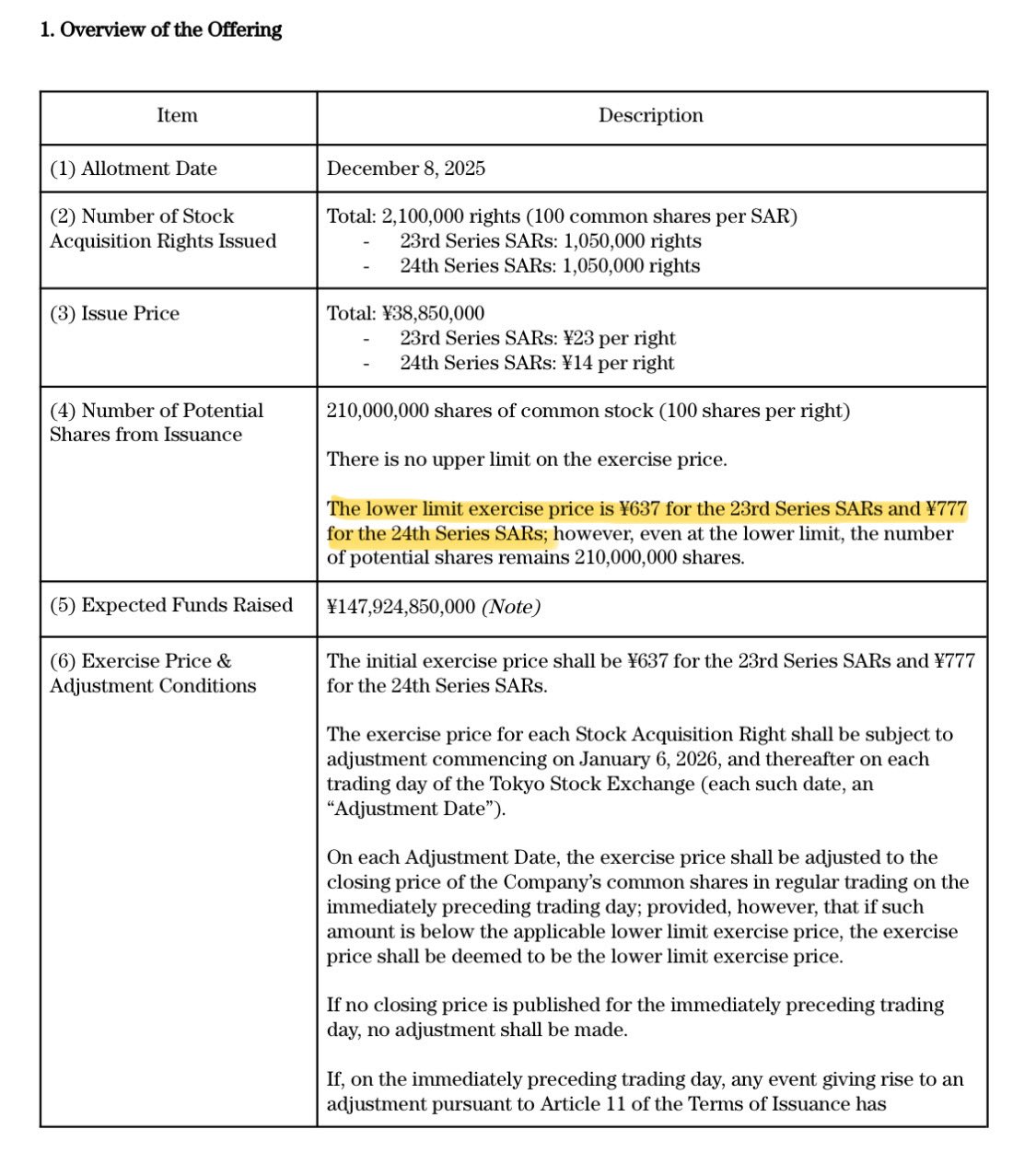

The most recent program has two tranches, the twenty third and twenty fourth Warrants, to be issued to the EVO Fund in December 2025, for a mixed potential of as much as 210 million new shares, divided equally between the 2 sequence.

Metaplanet Service Overview (Metaplanet)

The minimal train value for the twenty third sequence is 637 yen. As soon as the inventory’s adjusted closing value reaches that stage, EVO will probably be allowed to train its inventory choices and promote as much as 105 million newly issued shares. The funding will doubtless be used to buy Bitcoin.

The decrease restrict for the twenty fourth sequence is 777 yen. As soon as this threshold is reached, an extra 105 million shares could possibly be issued, releasing up extra capital.

With the inventory at present up 90% from its December lows, Metaplanet is nearing a stage the place issuance will improve once more.