Metaplanet inventory costs crashed and entered the naked market as demand for Bitcoin treasury firms declined and buyers started reserving earnings.

abstract

- Metaplanet’s inventory worth plummeted 55% from the day gone by.

- Shares fell as Bitcoin finance firms dived.

- Technical evaluation factors to extra downsides within the quick time period.

Metaplanet shares plummeted to 910 yen ($6.18). That is the bottom stage seen since Could twenty third, 55% under this yr’s peak. This decline marked the corporate’s market capitalization from 1.14 trillion yen to 638 billion yen.

Why Metaplanet inventory worth crashed

There are a number of explanation why Metaplanet inventory costs have fallen over the previous few months, regardless of Bitcoin (BTC) being a number of factors under its all-time excessive.

First, there are indicators that demand for Bitcoin Treasury shares is weakening. For instance, the technique, the most important Bitcoin accumulator, has dropped by 30% from an all-time excessive. Different related firms like Mara Holdings and Trump Media have additionally fallen double digits.

Second, Metaplanet’s shares fell as a consequence of earnings from some buyers. At its peak in June, inventory costs rose greater than 15,000% from its 2024 lowest stage.

You may prefer it too: Will the Stellar Protocol 23 improve improve PI community costs?

It’s common for shares to be pulled again after a big gathering. From a technical evaluation perspective, it’s potential that stock has entered the distribution or markdown part of Wyckoff idea.

Third, there’s continued concern about Metaplanet’s evaluation. Regardless of a 55% decline from an all-time excessive, its web asset worth (NAV) is greater than different Bitcoin finance firms, with two a number of stands. The technique has a NAV a number of of 1.47, with Mara being 1.

Moreover, issues about steady dilution stay. In an announcement final week, the corporate introduced plans to boost one other $3.7 billion to purchase Bitcoin. The transfer will improve dilution because it surged from 114 million in January final yr to 460 million.

Metaplanet Inventory Value Know-how Evaluation

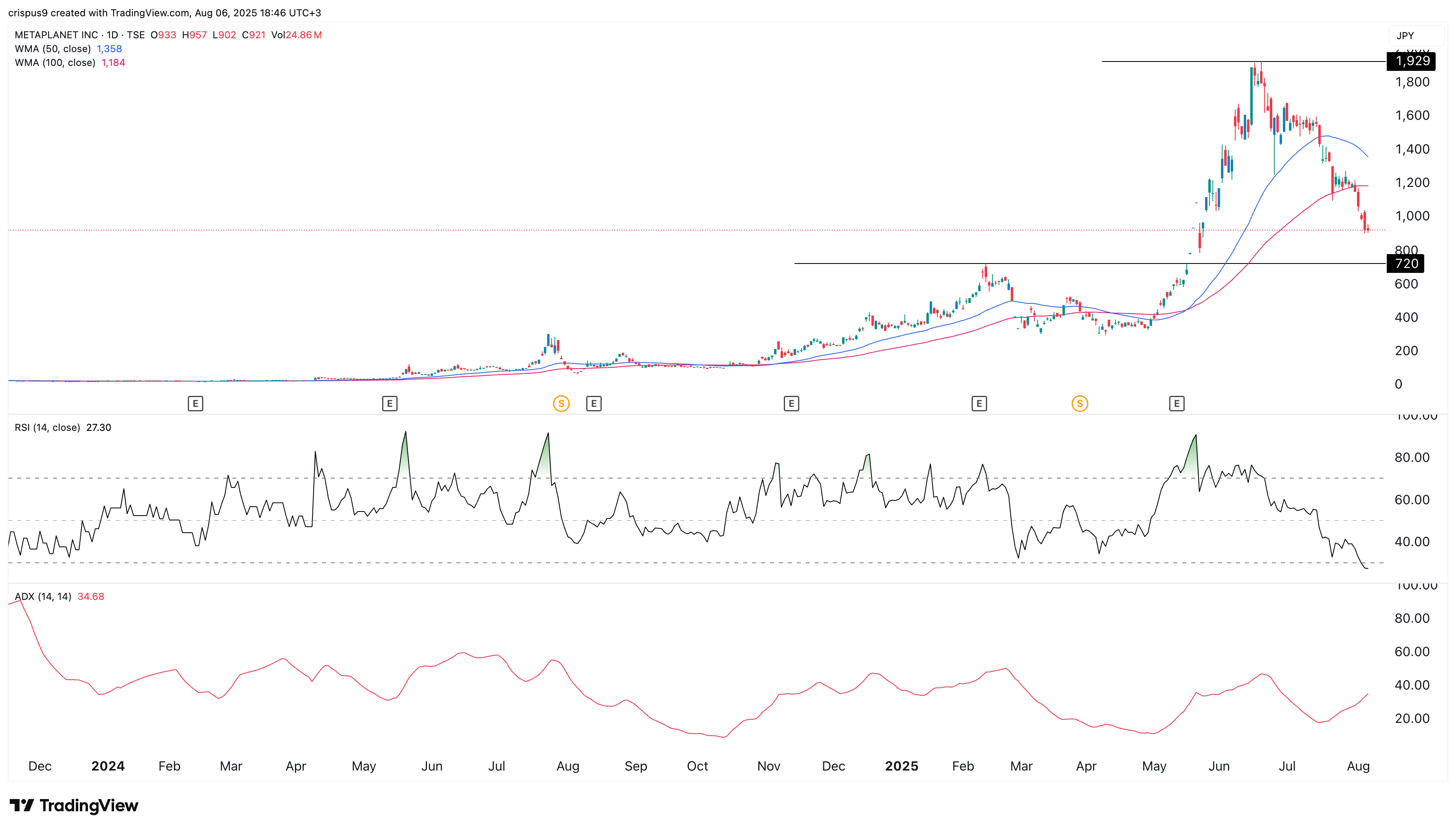

Metaplanet Inventory Chart | Supply: TradingView

Every day charts present Metaplanet shares have been on a robust bearish pattern over the previous few months, falling from a June excessive of 1,929 to 920 yen.

It fell under the weighted transferring averages of fifty and 100 days. In the meantime, the relative power index fell to 27 and the common course index rose to 35. These momentum indicators counsel that bearish tendencies are strengthened.

Subsequently, the trail for the bottom resistance in Metaplanet inventory worth is downwards, with the subsequent goal being 720 yen, the best level in February.

You may prefer it too: The S&P 500 opens greater amongst main company revenues, Bitcoin holds $114K