It has been 36 hours because the crypto market witnessed virtually $20 billion disappear in liquidations. SUI has crashed 80%, XRP is down 53% from its current highs, and Solana value on Binance futures hit $141, whereas spot continues to be buying and selling at $168. This can be a excellent illustration of how the books break down when chain gross sales hit.

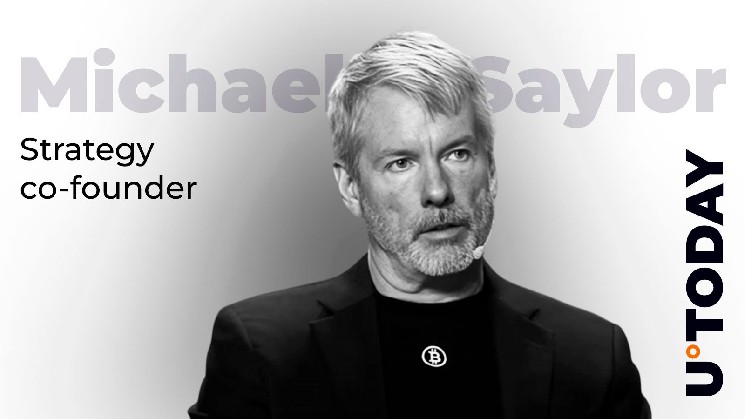

Michael Saylor, an American businessman and one of many world’s largest Bitcoin holders, didn’t react to the crash by displaying one other orange dot on his well-known chart. Which means no new Bitcoin purchases had been made for his technique final week.

Do not cease₿elievin’ pic.twitter.com/LUMroqLSCl

— Michael Saylor (@saylor) October 12, 2025

Nonetheless, he posted a screenshot with 4 phrases written on it: “Do not Cease ₿elievin.” The technique’s present stack is 640,031 BTC with a worth of $71.71 billion and a mean entry value of $73,983. These numbers put Thaler & Firm’s unrealized acquire at 51.44%, or practically $24.35 billion.

$6.4 billion loss

So let’s check out what was misplaced. When Bitcoin traded close to $122,000 earlier this month, that very same stack was value about $78.1 billion. At its present value of practically $112,000, the guide’s paper worth has fallen by about $6.4 billion in just some days. Not a realized loss, however a brutal reduce from the highest.

On the fairness facet, MSTR has a base market capitalization of $87 billion, $97 billion diluted, and an enterprise worth of $101 billion. Greater than 66% of this comes straight from Bitcoin.

Our stance is evident. The market bled $20 billion in at some point and Saylor and Technique misplaced $6.4 billion on paper, however he is nonetheless wanting $24 billion forward and telling everybody to not cease believing in Bitcoin.