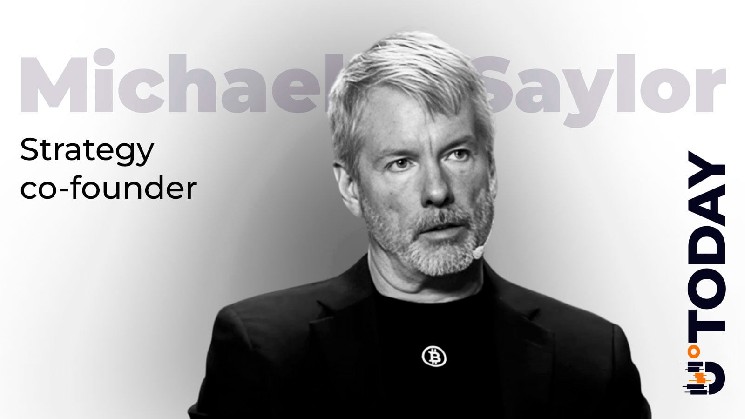

Michael Saylor has taken benefit of the turbulent Bitcoin market to make some of the defining company strikes of the cycle. In a current interview with CNBC, the strategic govt stated that the corporate plans to buy Bitcoin on a quarterly foundation, it doesn’t matter what the short-term value is.

In keeping with Thaler, Bitcoin is sort of a digital capital constructed for increased volatility and better long-term returns than gold, shares, or actual property. For folks like Thaler, who allocate capital over a number of years, the current selloff modifications nothing. That’s the reason considerations about compelled gross sales are invalid. Even when it is 90% or $8,000. $BTC.

“I don’t suppose it should attain zero.”

Michael Saylor didn’t hedge, soften, or change his place on Bitcoin throughout his look on CNBC. However he made it official once more, confirming that the corporate Technique, previously referred to as MicroStrategy, will likely be shopping for Bitcoin on a quarterly foundation and can proceed to take action indefinitely.

Talking dwell on Squawk Field, Saylor described Bitcoin as a digital capital designed to maneuver more durable and carry out over longer intervals of time. That is why he sees Bitcoin’s volatility not as a flaw, however as a property that permits it to outperform gold, shares, and actual property over the long run.

digital capital $BTC Outperform conventional capital. Digital credit $STRC outperform conventional credit. Amplified Bitcoin $MSTR outperforms Bitcoin. pic.twitter.com/Qx2RcSlF4a

— Michael Saylor (@saylor) February 10, 2026

Saylor stated he isn’t apprehensive {that a} extended droop might result in liquidation, regardless that the cryptocurrency’s value is down about 50% from its October excessive. For a method chair, that is a 90% drawdown, or $8,000 per deal, for instance. $BTCis just not a situation to promote something of the corporate’s insane 714,644 $BTC cache.

He stated the technique has multi-year money safety and many years of Bitcoin-related worth in comparison with dividend obligations, and that regardless of all of the disruption in late 2025 and early 2026, refinancing stays a good suggestion and compelled gross sales will solely turn into a problem when the time is true. His monetary studies present the corporate’s leverage is effectively under typical investment-grade requirements.