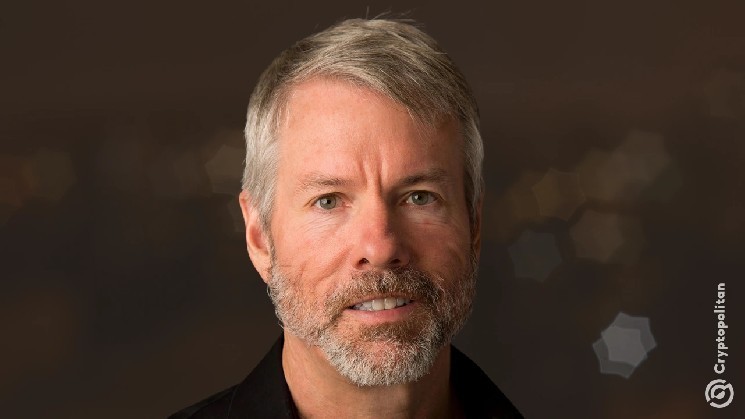

Michael Saylor mentioned he’s not apprehensive about Technique’s credit score threat regardless of Bitcoin’s continued decline. He mentioned the corporate is already planning to answer an unsightly market. Costs may fall considerably or keep low, and the corporate would nonetheless exist. The plan is straightforward:- If Bitcoin collapses for years, the debt will probably be refinanced and promoted.

Saylor spoke as Bitcoin fell 9% in 5 days to commerce round $68,970. The token fell to $60,062, its lowest stage in almost 16 months. At the moment, it was down greater than 50% from its all-time excessive. Regardless of this, Saylor mentioned the corporate will proceed to purchase Bitcoin on a quarterly foundation and won’t promote something it already owns.

Saylor develops refinancing plan as debt stays excessive

Co-founder and govt chairman Michael Saylor instructed CNBC that plans stay the identical, even within the face of a brutal collapse. “If Bitcoin drops 90% over the subsequent 4 years, we’ll refinance the debt. We’ll simply carry it ahead,” Saylor mentioned.

Requested if banks would lend in that state of affairs, he mentioned “sure,” citing Bitcoin’s volatility as a motive lenders would stay . He mentioned volatility does not destroy worth.

Technique has complete debt of greater than $8 billion. Most of that got here from convertible banknotes used to purchase Bitcoin. The corporate presently holds 714,644 Bitcoins value roughly $49 billion, making it the most important company holder of this asset. Saylor mentioned the corporate plans to proceed shopping for Bitcoin on a quarterly foundation eternally and has no intention of promoting its holdings.

He additionally mentioned the corporate has about two and a half years’ value of money on its steadiness sheet to cowl the dividend. He then mentioned Technique wouldn’t face a margin name and had sufficient money, $2.25 billion, to pay curiosity and distributions over two years. Nonetheless, stress is mounting as Bitcoin trades under the corporate’s common value of $76,052.

Losses deepen as volatility falls and buyers turn out to be defensive.

The numbers on paper are getting worse. In its newest earnings launch, Technique reported a fourth-quarter internet lack of $12.4 billion. As reported by Cryptopolitan, this loss was as a result of a decline out there worth of Bitcoin holdings.

This week, additional market stress brought about the worth of Technique’s holdings to fall under its complete buy value for the primary time since 2023, wiping out post-election positive aspects.

The corporate additionally mentioned it doesn’t count on to generate income or income this 12 months or within the close to future. Based mostly on this outlook, Technique mentioned it expects distributions to holders of perpetual most popular inventory to be tax-free in the intervening time. On Tuesday, Bitcoin fell again under $70,000, and the inventory fell about 2%. The inventory value has fallen greater than 40% prior to now three months.

Market alerts are warning. Bitcoin’s implied volatility has fallen from about 83% to almost 60%, indicating a decline in expectations for sharp fluctuations. On the similar time, choices merchants stay defensive. The put skew on the 25 delta name stays tilted in direction of places, indicating demand for draw back safety.

Chief Govt Officer Von Leh instructed current patrons to be affected person throughout an earnings name. “Some individuals purchased Bitcoin or MSTR final 12 months, however that is the primary decline. My recommendation is to carry on,” Fung mentioned. His feedback sparked offended reactions within the livestream chat.

For the previous 4 years, Technique has served as a high-beta company for Bitcoin. The inventory value rose greater than 3,500% between 2020 and 2024.

The rally was pushed by inventory gross sales and debt, however the firm additionally grew to become a goal for critics of its leveraged crypto publicity. Saylor made it clear that the criticism won’t change his plans.