Technique (MSTR) introduced an extra $217 million buy of 1,955 BTC on Monday, bringing the tech firm’s complete holdings as much as 638,460 BTC, in keeping with the SEC.

The latest buy was made at $111,196, growing the common buy value to BET Bitcoin, which is as much as $73,880.

The announcement noticed the value simply go right down to $111,800 after BTC rose from $110,500 to $112,200 on Monday morning, breaking the information.

The transfer is because of MSTR lately going through some criticism from shareholders, notably as a consequence of MNAV’s guarantees. The corporate stated in July that if MNAV falls under 2.5 instances, it will not subject shares simply to take away its promise in a month.

The metric, a ratio that reveals inventory valuations in comparison with Bitcoin Holdings’ worth, has lately been knocked down by about 1.5 instances because the MSTR inventory value plunged. The inventory is at present buying and selling at $335 and has misplaced 26% of its worth since July.

It additionally comes with new purchases as a technique that missed the technique final week concerning the risk that it will be added to the S&P 500 index, damaged by Robin Hood (Hood), regardless of MSTR anticipating it to publish one of many strongest quarters in historical past and embody it after assembly all standards for becoming a member of the index.

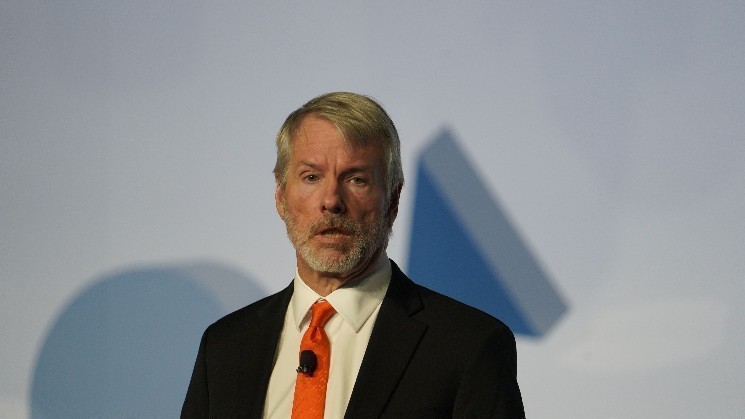

Learn extra: Michael Saylor’s technique snubbed by the S&P 500 amid the Robinhood shock inclusion