Microsoft’s $9.7 billion take care of Texas miners reveals new math driving AI in crypto infrastructure and what it means for marginalized networks.

IREN’s November 3 announcement consolidates two transactions into one strategic axis. The primary is a five-year, $9.7 billion cloud companies settlement with Microsoft, and the second is a $5.8 billion gear settlement with Dell to acquire Nvidia GB300 techniques.

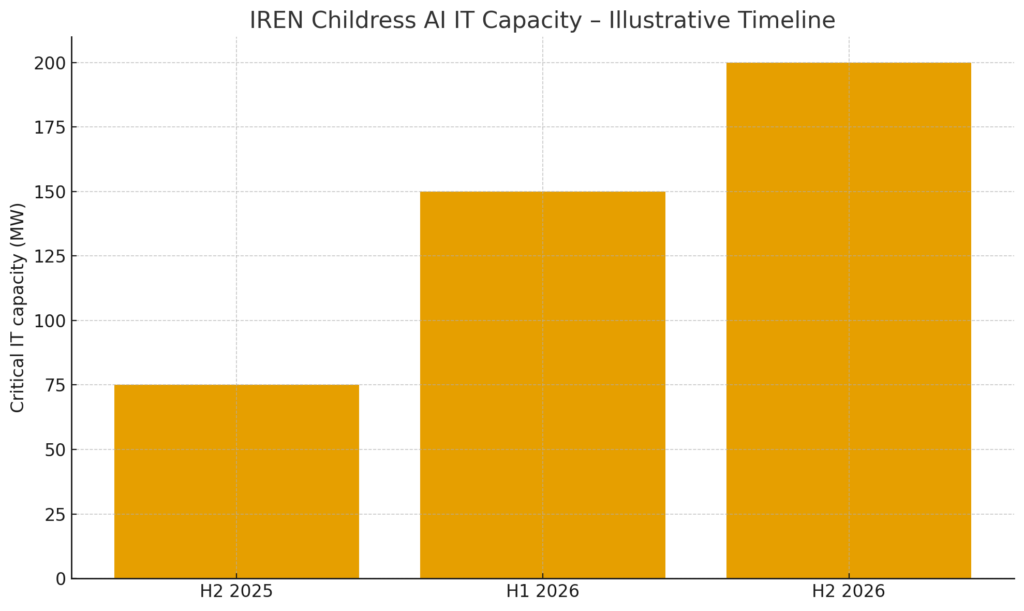

The overall $15.5 billion dedication will convert roughly 200 megawatts of essential IT capability at IREN’s Childress, Texas campus from potential Bitcoin mining infrastructure to contracted GPU internet hosting for Microsoft’s AI workloads.

Microsoft included a 20% upfront fee, or about $1.9 billion, to exhibit urgency over capability constraints that the corporate’s CFO warned would prolong by means of not less than mid-2026.

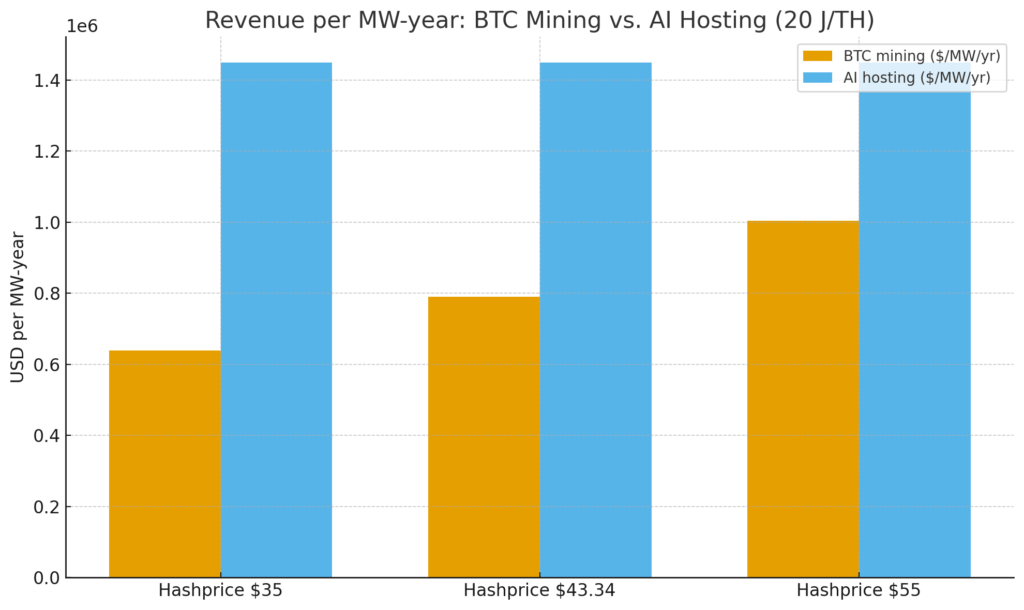

The construction of this transaction reveals that the miners have been secretly calculating. At present ahead hash costs, every megawatt devoted to AI internet hosting generates roughly $500,000 to $600,000 extra in whole annual income than the identical megawatt of hashed Bitcoin.

This margin, a rise of roughly 80%, creates the financial logic driving essentially the most important infrastructure reallocation within the historical past of cryptocurrencies.

damaged income calculation

Mining Bitcoin at an effectivity of 20 joules per terahash would generate roughly $790,000 per megawatt hour at a hash worth of $43.34 per petahash per day.

Even at $55 per Petahash, which might require continued will increase in Bitcoin costs or greater charges, mining income would solely enhance to $1 million per megawatt yr.

In distinction, the AI internet hosting benchmark is roughly $1.45 million per megawatt yr, based mostly on Core Scientific’s disclosed contract with CoreWeave. This equates to roughly 500 megawatts of cumulative income of $8.7 billion over 12 years.

The crossover level the place Bitcoin mining matches the economics of AI internet hosting is between $60 and $70 per day per petahash for a fleet of 20 joules per terahash.

For a lot of the mining business working 20-25 Joule gear, hash costs would wish to rise 40%-60% from present ranges to make Bitcoin mining as worthwhile as contracted GPU internet hosting.

That state of affairs would require both a pointy rise in Bitcoin costs, sustained price stress, or a major drop in community hashrate, however when Microsoft presents on the spot assured dollar-denominated returns, no operator can depend on it.

Why Texas received the bid

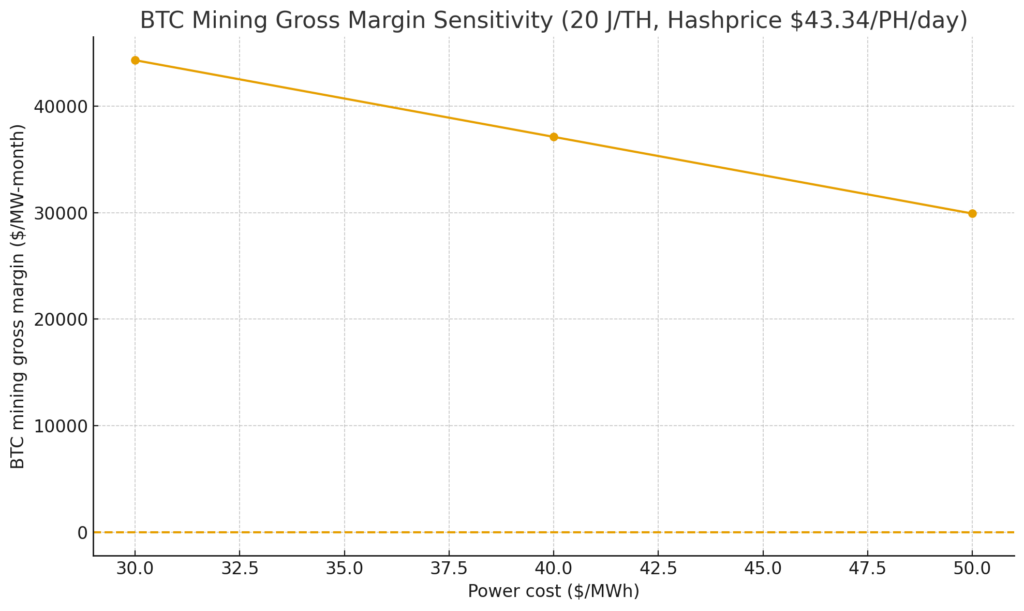

IREN’s Childress campus is positioned on ERCOT’s energy grid, the place wholesale electrical energy costs averaged $27 to $34 per megawatt hour in 2025.

These numbers are decrease than the U.S. nationwide common of about $40, and considerably decrease than these for PJM and different japanese grids the place knowledge middle demand has pushed capability public sale costs to regulatory limits.

Texas has benefited from speedy enlargement of photo voltaic and wind energy era, conserving base electrical energy prices aggressive. Nonetheless, ERCOT’s volatility creates extra income streams that reach the financial case for versatile computing infrastructure.

Riot Platforms demonstrated this dynamic in August 2023, accumulating $31.7 million in demand response and suppression credit by halting mining operations throughout peak worth occasions.

The identical flexibility applies to AI internet hosting if the contract construction is structured as a pass-through. Operators can scale back operations throughout excessive pricing occasions, gather funds for ancillary companies, and resume operations when costs normalize.

PJM’s capability market tells the opposite facet of the story. Knowledge middle demand is driving capability costs as much as administrative ceilings for future supply years, indicating provide constraints and interconnection queues extending into a number of years.

ERCOT operates an energy-only market with no capability construction. This implies quicker interconnection timelines and fewer regulatory hurdles for operators.

IREN’s 750-megawatt campus already has energy infrastructure in place. Changing from mining to AI internet hosting requires changing ASICs with GPUs and upgrading cooling techniques somewhat than buying new transmission capability.

Deployment timeline and what occurs to miners

Knowledge Heart Dynamics flagged IREN’s “Horizon 1” module in late 2025. This can be a 75-megawatt direct-to-chip water cooler designed for Blackwell class GPUs.

In response to the report, the phase-in will likely be prolonged to 2026 and important IT hundreds will likely be expanded to roughly 200 megawatts.

This timeline exactly aligns with Microsoft’s mid-2026 capability scarcity, making third-party capability rapidly worthwhile even when hyperscale ramp-up ultimately catches up.

The 20% down fee acts as insurance coverage on the schedule. Microsoft has locked down supply milestones and shares among the provide chain dangers inherent in procuring Nvidia’s GB300 techniques, which stay supply-constrained.

The upfront construction suggests Microsoft values certainty over ready for probably cheaper capability in 2027 or 2028.

If IREN’s 200 megawatts represents the vanguard of a broader reallocation, community hashrate progress will gradual as capability is withdrawn from Bitcoin mining. The community just lately surpassed 1 zettahash per second, reflecting a gentle enhance in issue.

Eradicating even 500 to 1,000 megawatts from the world’s mining base, if Core Scientific’s 500 megawatts mixed with IREN’s pivot and comparable strikes by different miners, could be a believable state of affairs, slowing hashrate progress and barely mitigating hash costs for remaining operators.

The issue is adjusted each 2,016 blocks based mostly on the precise hashrate. If the entire community capability decreases or rapidly stops rising, you’re going to get barely extra Bitcoins for every remaining petahash.

Excessive-efficiency fleets with hash charges lower than 20 joules per terahash profit essentially the most as a result of their value buildings permit them to take care of decrease hash fee ranges than older {hardware}.

For miners that efficiently convert their capability to multi-year dollar-denominated internet hosting contracts, the stress on the Treasury will likely be alleviated.

Bitcoin mining returns fluctuate based mostly on worth, issue, and price exercise. Operators with skinny stability sheets typically face pressured gross sales to cowl mounted prices throughout downturns.

Core Scientific’s 12-year settlement with CoreWeave decouples money move from the Bitcoin spot market and converts risky revenues into predictable service charges.

IREN’s Microsoft contract achieves the identical consequence. In different phrases, monetary efficiency depends upon uptime and operational effectivity, not whether or not Bitcoin trades at $60,000 or $30,000.

This delinking has a secondary impact on the Bitcoin spot market. Miners are required to transform a portion of the mined cash into fiat forex to cowl electrical energy and debt repayments, making a structural supply of promoting stress.

Decreasing the mining base eliminates that incremental sale, barely tightening the stability of Bitcoin provide and demand. As this development scales to a number of gigawatts over the subsequent 18 months, the cumulative influence on miner-driven gross sales will likely be important.

Danger situations to reverse trades

Hash costs don’t stay static. If the value of Bitcoin spikes whereas reallocation of capability slows the expansion of the community’s hash fee, hash costs might exceed $60 per petahash per day and method a degree the place mining can match the economics of AI internet hosting.

While you add in greater costs on account of community congestion, the income hole narrows even additional. Miners with locked-in capability in multi-year internet hosting contracts can’t pivot simply as a result of they’re dedicated to buyer SLAs round {hardware} acquisition budgets, web site design, and GPU infrastructure.

Provide chain dangers are on the opposite facet. Nvidia’s GB300 techniques stay constrained, with liquid cooling elements dealing with quarterly lead instances and substation work probably delaying web site readiness.

If IREN’s Childress deployment extends past mid-2026, the income assure from Microsoft will lose a few of its fast worth.

Microsoft wants capability when inner constraints are at their most extreme, not six months later when their extensions go dwell.

Contract construction introduces one other variable. The $1.45 million per megawatt yr determine represents service income, with margins decided by efficiency SLAs, availability ensures, and clear passage of energy prices.

Some internet hosting contracts embrace take-or-pay energy contracts that shield operators from curtailment losses whereas limiting income from ancillary companies.

Others additionally make operators extra vulnerable to ERCOT worth fluctuations, creating margin threat if excessive climate occasions trigger electrical energy prices to exceed pass-through thresholds.

What Microsoft really purchased

IREN and Core Scientific are usually not outliers, however somewhat seen edges of the reoptimization unfolding throughout the listed mining sector.

Miners with entry to low-cost energy, ERCOT or comparable versatile grids, and present infrastructure can promote capability to hyperscalers that may be activated quicker and cheaper than constructing greenfield knowledge facilities.

The limiting components are cooling capability, direct liquid cooling to the chip requires a distinct infrastructure than air-cooled ASICs, and the provision of GPU provides.

Microsoft did not simply purchase 200 megawatts of GPU capability from IREN. We ensured supply throughout constraint durations when all opponents confronted the identical bottlenecks.

The upfront fee and five-year time period point out that hyperscalers worth velocity and reliability sufficient to pay a premium over the price of future capability.

For miners, this premium means arbitrage alternatives. Reallocate megawatts to worthwhile use instances whereas hash costs are suppressed, and reevaluate when Bitcoin’s subsequent bull cycle or price setting modifications the calculus.

Offers work till they fail, and the timing of that reversal will decide which operators seize the most effective of the AI infrastructure scarcity and which lock in simply earlier than the mining economic system recovers.