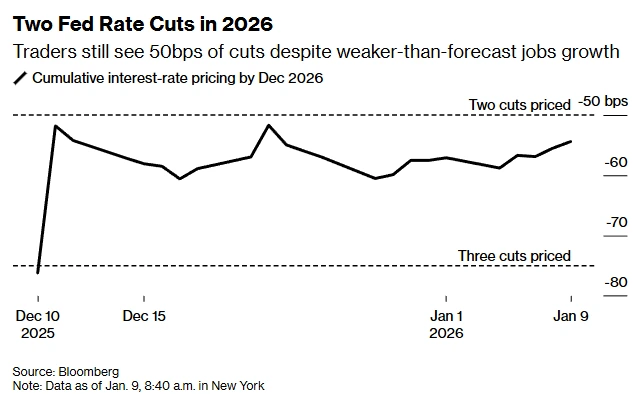

The percentages of the Fed slicing charges in January are extraordinarily slim, however merchants expect no less than two price cuts in 2026.

Morgan Stanley and Citigroup have revised their expectations for a 2026 Fed price reduce forward of the appointment of the brand new Fed chairman.

Bitcoin and crypto markets will profit from risk-on mode attributable to elevated international cash provide.

The Fed is anticipated to proceed reducing rates of interest in 2026 amid robust stress from the administration. Wall Avenue analysts now anticipate a price reduce of no less than 50 bps in 2026, as President Donald Trump prepares to call a nominee to switch Jerome Powell as Fed chair.

Morgan Stanley and Citigroup anticipate additional Fed price cuts in 2026

The Federal Reserve plans to start slicing rates of interest by no less than two 25 foundation factors in 2026, based on consumer notes from Morgan Stanley (NYSE: MS) and Citigroup (NYSE: C). Morgan Stanley revised its forecast for 25 foundation level price cuts in January and April 2026 to June and September 2026.

Citigroup modified its forecast for 2026 Fed price cuts from January, March, and September to March, July, and September. In consequence, Citigroup expects the Fed to start slicing rates of interest by as a lot as 75 bps in 2026, bringing the speed cuts beneath 3%.

Why is Wall Avenue anticipating extra rate of interest cuts?

Wall Avenue expects the Fed to proceed reducing charges in 2026 after slicing charges thrice in 2025. With President Trump anticipated to call a brand new Fed chair quickly, Wall Avenue is assured of no less than two rate of interest cuts within the coming months.

Supply: X

Regardless of weaker-than-expected job progress, Treasury Secretary Scott Bessent confused the necessity for decrease rates of interest to spur financial progress.

What affect do you anticipate on Bitcoin and cryptocurrencies?

The Fed’s anticipated price cuts coincided with an ongoing liquidity injection beneath President Trump. The Fed will start quantitative easing (QE) in early December 2025, and President Trump plans to inject $200 billion by means of the housing trade.

These occasions are extraordinarily dovish for the crypto market. Furthermore, Wall Avenue traders are regularly switching to risk-on mode. Because the inventory market bull market continues, Bitcoin and the broader altcoin trade will finally put up a robust bull run in 2026, with capital anticipated to movement from the valuable metals trade.