MSTR inventory continued its current downward pattern on Monday as volatility within the cryptocurrency market stays.

abstract

- MSTR inventory continued its robust downward pattern this week.

- MicroStrategy continued its Bitcoin accumulation technique.

- Based on technical evaluation, MSTR may crash to $100 quickly.

MicroStrategy has fallen 75% from its all-time excessive to $136. It then stabilized at $145 as Bitcoin ($BTC) reduce a few of its earlier losses to greater than $78,000.

The technique additionally stabilized as the corporate revealed final week that it had acquired 8,555 cash value over $75 million. This was the smallest buy up to now three weeks.

Technique scored 855 $BTC Roughly $75.3 million at about $87,974 per Bitcoin. As of February 1, 2026, it has 713,502 individuals. $BTC It was acquired for about $54.26 billion at roughly $76,052 per Bitcoin. $MSTR $STRC https://t.co/tYTGMwPPUF

— Michael Saylor (@saylor) February 2, 2026

The corporate at the moment has 713,502 cash, which have been bought at a median value of $76,052. At Monday’s low level, Technique’s unrealized losses soared to greater than $900 million.

You may additionally like: Bitcoin insider faces fallout from Epstein-era emails over Ripple and Stellar feud

The technique now has entry to more money to proceed shopping for up Bitcoin. The corporate has entry to $8 billion value of MSTR inventory that it will possibly promote to boost capital, in response to its buying report. It additionally owns $20 billion value of STRK most well-liked inventory, $4 billion value of STRD inventory, $3.6 billion value of STRC inventory, and $1.6 billion value of STRD inventory.

Due to this fact, Saylor could proceed to build up by benefiting from the drop in Bitcoin costs. His view is that Bitcoin will finally rebound and hit new all-time highs.

Historical past reveals that each time Bitcoin enters a bear market, it all the time rebounds. for instance, $BTC The inventory has plunged greater than 35% between its excessive in January and its low in April final yr. It then hit a document excessive in Might.

Bitcoin additionally fell by greater than 70% between its 2021 excessive and 2022 low. After that, it skyrocketed from lower than $16,000 in 2022 to $126,200 in 2025. Due to this fact, the most certainly situation is that Bitcoin rebounds later this yr.

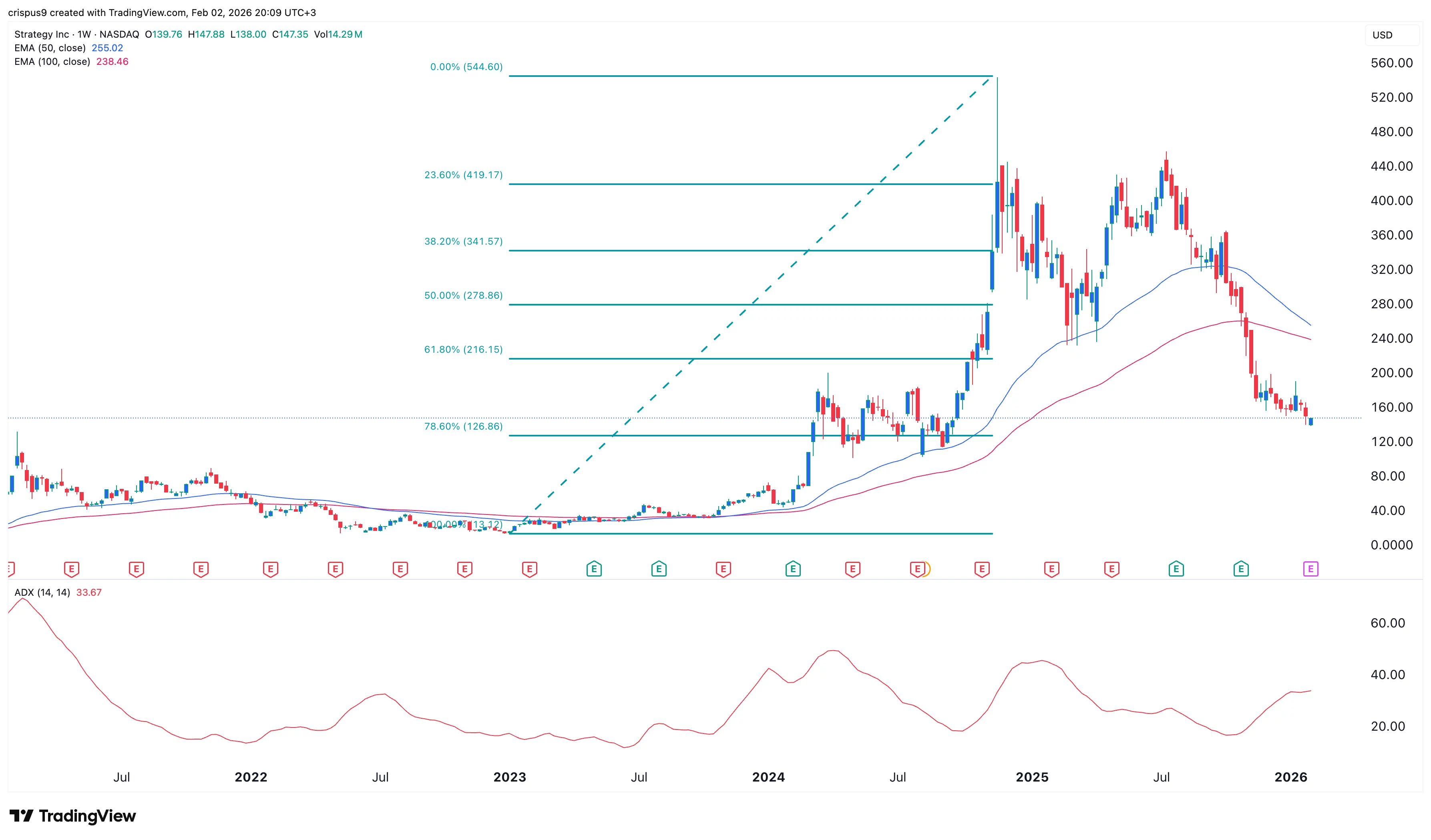

MSTR inventory value technical evaluation

Technique Inventory Chart |Supply: TradingView

The weekly chart reveals that the MicroStrategy inventory value is in a big downtrend. It’s at the moment under the 61.8% Fibonacci retracement degree, confirming a downtrend.

The typical directional index rose to 33, the very best degree since March final yr. A pointy rise within the ADX indicator signifies that the downtrend is gaining momentum.

The inventory value fell under all shifting averages and supertrend indicators. Due to this fact, the most certainly situation is a 35% decline to $100 after which a return to the downtrend.

learn extra: Regardless of constructive fourth-quarter forecast, Palantir inventory types an alarming sample