Social media was abuzz this week after Bitcoin blocks 932129 and 932167 have been mined with none instantly seen pool tags. This led to hypothesis {that a} lone miner had made a fortune, resulting in a well-known “Bitcoin lottery” story that briefly captured the market’s consideration.

However the pleasure had much less to do with the block itself and extra to do with what the block’s apparently mislabeled label revealed about how Bitcoin mining attribution works. It additionally reveals how rapidly beliefs turn into entrenched.

sauce: bitcoin archive

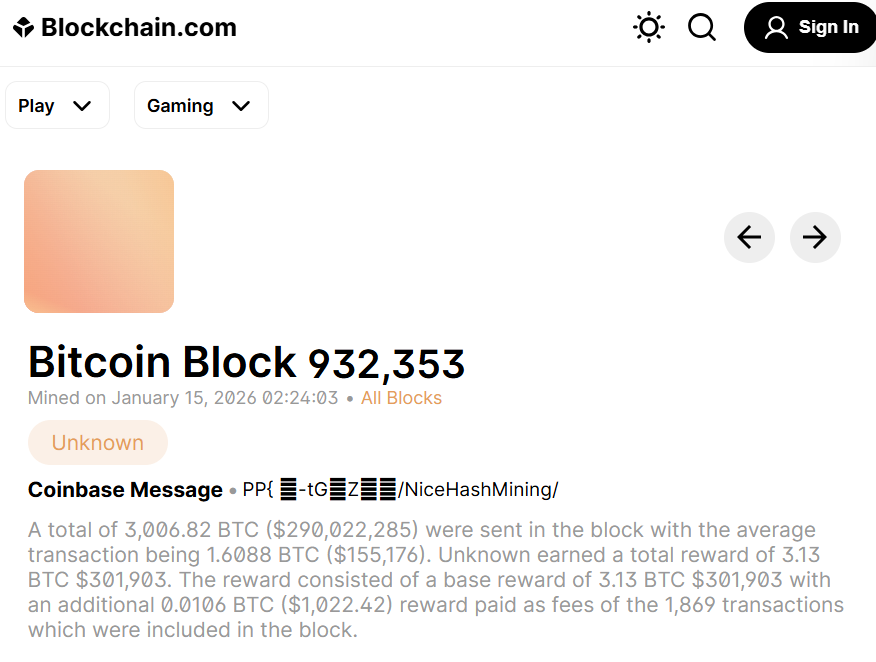

Amidst the hypothesis, NiceHash emerged because the miner behind each blocks. Moderately than working a standard mining pool, NiceHash operates a hashrate market that connects miners with consumers of computing energy.

The blocks initially appeared untagged within the mempool explorer, main many observers to imagine that they had been mined independently by a single miner. In truth, the corporate confirmed that each blocks have been mined by NiceHash as a part of inner testing for its upcoming product.

In unique feedback to Cointelegraph, NiceHash AG CEO Sasa Ko mentioned this misunderstanding stems from the best way block metadata is displayed, relatively than an try to obscure attribution.

“The one misunderstanding right here is that the block was tagged with NiceHashMining however not labeled by mempool,” Koh mentioned. “We did not need to trigger any hypothesis.”

Koh confirmed that the blocks have been mined throughout inner testing associated to the brand new product, however declined to share technical particulars forward of launch.

“Whereas we can not reveal the small print but, we’re engaged on a brand new set of merchandise that may present full performance along with our current markets,” he mentioned.

NiceHash mined two extra blocks on Thursday. sauce: Blockchain.com

Block tags are metadata and don’t assure any protocol. If a well-known tag just isn’t seen, the market can rapidly leap to the improper conclusion. This episode highlights how a lot Bitcoin narrative formation nonetheless depends on assumptions relatively than verifiable on-chain alerts.

Associated: Bitcoin Mining 2026 Prediction: AI Turnabout, Margin Stress, and Combat for Survival

Solo mining continues to be attainable, however much less frequent

This quick “fortunate miner” story additionally reignited the controversy about solo mining, a setup through which particular person miners work independently relatively than contributing hashing energy to a pool. Solo miners obtain rewards for all the block if profitable, however as a result of stochastic nature of mining, payouts are extremely unpredictable.

“Solo mining is feasible and plenty of enjoyable,” says Ko. “Nicehash’s Simple Mining was accountable for 17 of the 36 whole solo blocks mined in 2025.”

sauce: Bitcoin documentation

However institutional mining operations can not depend on probability, he added. These corporations sometimes function giant infrastructures and make use of subtle methods designed to cut back variance and generate extra predictable income streams.

Bitcoin mining for institutional buyers has turn into more and more troublesome with every halving, squeezing margins and squeezing profitability, whereas forcing operators to diversify their income streams into areas equivalent to synthetic intelligence and high-performance computing.

Associated: Bitcoin is presently 56.7% inexperienced: This is learn how to make it even cleaner