The NIGHT token outperformed the broader cryptocurrency market on Monday, December 29, after Charles Hoskinson prompt it might assist develop decentralized finance (DeFi) throughout the blockchain ecosystem, together with XRP.

Cardano’s companion chain, Midnight, is a privacy-focused blockchain constructed for confidential transactions and personal DeFi, with NIGHT serving because the native token. Hoskinson is the co-founder of Ethereum and the founding father of Cardano.

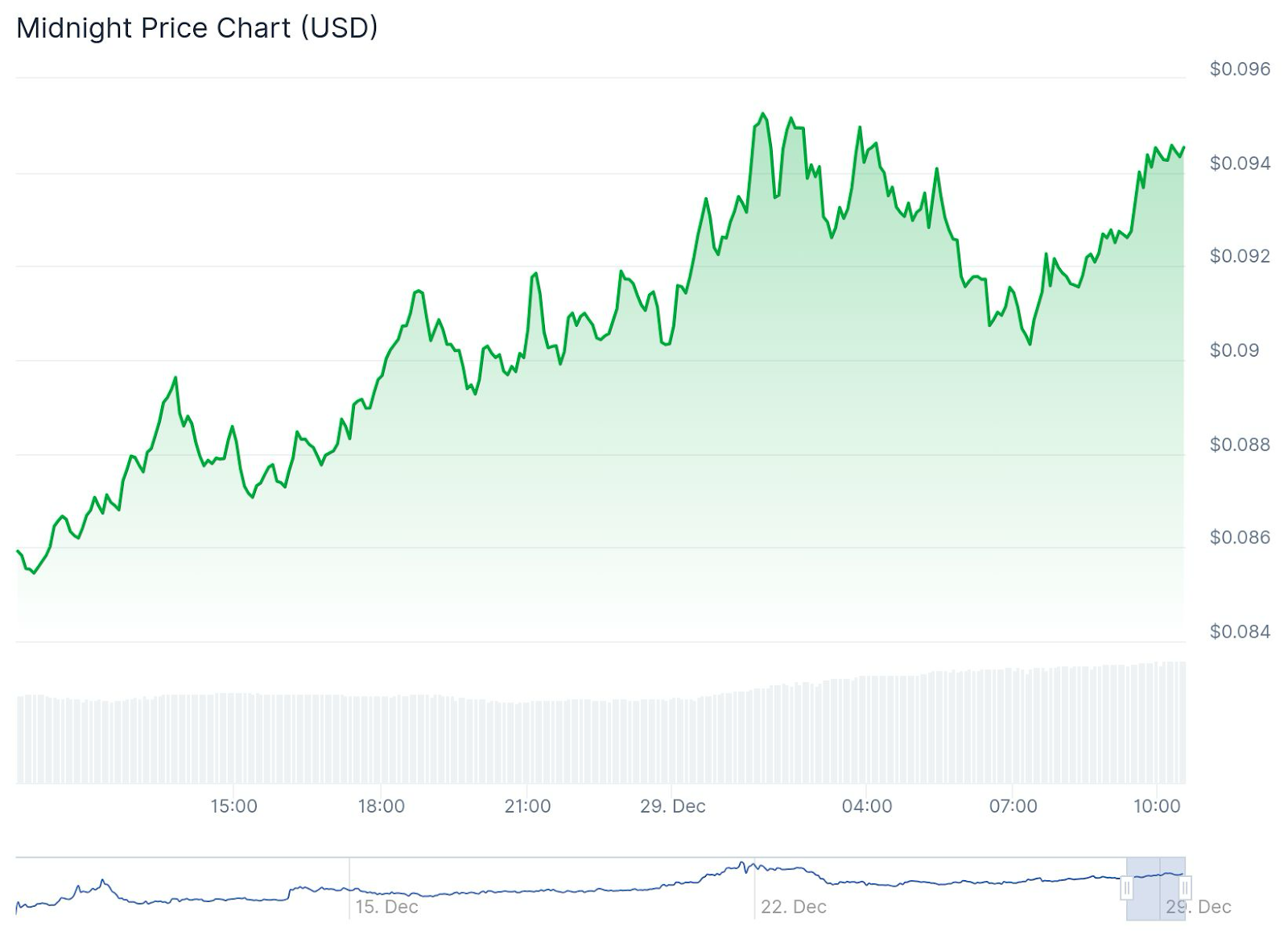

Based on CoinGecko, NIGHT has risen over 11% up to now 24 hours. The rally got here after Hoskinson stated in a publish on X that including Midnight to the XRP ecosystem would “blow conventional banks out of the water.”

“Including Midnight to Bitcoin will allow the world Satoshi envisioned. Including Midnight to Cardano will considerably strengthen our DeFi ecosystem, growing our MAUs, transactions, and TVL by 10x as we’re the primary to convey personal DeFi to market at scale,” Hoskinson stated in the identical publish.

NIGHT’s rise comes amid a broader market decline right now, with BTC presently down 1% to $86,000. XRP additionally fell 0.6% up to now 24 hours to $1.85, whereas Cardano’s native token ADA additionally fell 3.4% to round $0.35.

Concentrate on privateness

NIGHT’s transfer comes amid a latest uptick in privacy-focused crypto property and infrastructure. Tokens like Zcash have soared in latest months as merchants migrated to property that provide on-chain confidentiality.

In the meantime, regulators and trade leaders have develop into more and more vocal about confidentiality and the way it’s key to growing the adoption of cryptocurrencies. Earlier this month, U.S. Securities and Trade Fee (SEC) Commissioner Hester Peirce stated throughout the SEC’s Cryptocurrency Roundtable that privateness ought to be handled as a traditional a part of monetary exercise, moderately than an indication of wrongdoing.

“Defending privateness ought to be the norm and never a sign of legal intent,” Peirce stated in his speech. “Governments ought to resist the temptation to coercively intervene to supply a regulatory beachhead or facilitate monetary oversight.”

In the meantime, the Roman Storm case earlier this 12 months, during which Storm was discovered responsible of working an unauthorized cash switch operation associated to the Twister Money mixer, highlighted the authorized dangers going through privacy-focused crypto builders.