Whereas many corporations now maintain Bitcoin as a reserve asset, the market is worried about how it is going to be held, Nansen’s report reveals.

Bitcoin (BTC) is quickly changing into a core a part of the normal monetary system. A latest report by Nansen reveals that new regulatory requirements and macroeconomic components have modified how corporations view Bitcoin publicity. This has created the biggest firm with over 700,000 BTC.

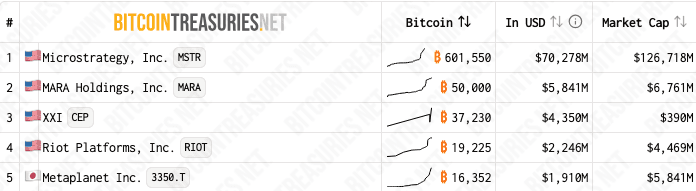

Collectively, Technique, Marathon Digital, 21 capitals, riot platforms, and Metaplanet personal roughly $81.9 billion value of Bitcoin. The earlier micro-tactics controls the share of those holdings of lions at 601,550 BTC.

Nonetheless, not all of those corporations see the identical influence on inventory costs. Particularly, the technique trades virtually twice the valuation of BTC holdings. In distinction, Marathon Digital, the place BTC accounts for 85% of its market capitalization, trades on par with Bitcoin Reserve.

The 5 largest company Bitcoin holders’ BTC holdings and market capitalization | Supply: Bitcointreasuries

Methods leverage debt to outweigh BTC

This means that the market cares about how corporations construction their BTC holdings. The technique makes use of debt to will let you persistently accumulate Bitcoin and act successfully as a leveraged guess on its worth.

You would possibly prefer it too: Bitcoin vs Technique Inventory: Which is the higher buy?

This may present each larger volatility than Bitcoin, offering each larger extremes. For instance, in December 2024, Strategic shares fell 21%, whereas Bitcoin fell simply 2%. Nonetheless, strategic shares are higher than Bitcoin in the long term.

“Buyers take care of micro-tactics much like leveraged Bitcoin ETFs to amplify their publicity to Bitcoin worth actions. Consequently, the inventory often displays volatility of 2-3 x Bitcoin,” stories Nansen.

Japanese firm Metaplanet trades the worth of its BTC holdings at a a number of of three.5 instances. Nansen factors out that merchants assist the benefit of their first look in Asia. Like its technique, Metaplanet additionally points debt to purchase Bitcoin.

learn extra: Michael Saylor boasts the “indestructible steadiness sheet” of technique