Nvidia (NASDAQ: NVDA) will proceed its lengthy historical past of paying its subsequent quarterly dividend on October 2, 2025 to reward buyers looking for revenue.

Future dividend funds come when NVDA inventory goals to succeed in $200, the very best ever, after spectacular runs over the previous few years. On the finish of the ultimate buying and selling session, NVDA inventory fell by greater than 3%, however shares for the reason that begin of the 12 months rose 25%.

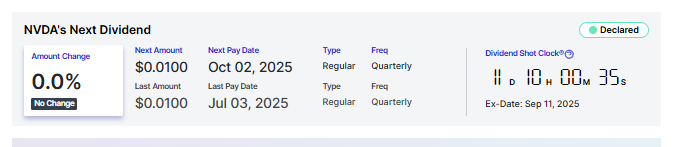

For future funds, the American semiconductor large can pay a dividend of $0.01 per share on October 2, 2025. Buyers should maintain shares previous to the unique supply date of September 11, 2025.

Specifically, this fee has not modified for the reason that earlier quarter, indicating the corporate’s second consecutive 12 months of dividend improve.

For shareholders, possession of 100 NVIDIA shares will generate a dividend revenue of $1 this quarter, producing $4 per 12 months on the present fee. With a ahead yield of simply 0.02%, dividends stay token returns for buyers in corporations that prioritize reinvestment in revenue distributions.

Nvidia Inventory Fundamentals

In truth, dividend funds proceed to dominate within the synthetic intelligence sector, supported by a number of basic elements, leading to dividend funds.

For instance, within the second quarter of 2025, NVIDIA reported quarterly income of $46.7 billion, up 56% year-on-year and induced $54 billion this quarter, barely exceeding expectations.

The outcomes highlighted sturdy demand for AI chips, but in addition mirror challenges associated to US export restrictions on gross sales to China.

On Wall Road, corporations like Morgan Stanley and Benchmark have raised their worth targets to $210 and $220 respectively, with a mixture of responses citing Nvidia’s AI benefit.

Featured Photos by way of ShutterStock