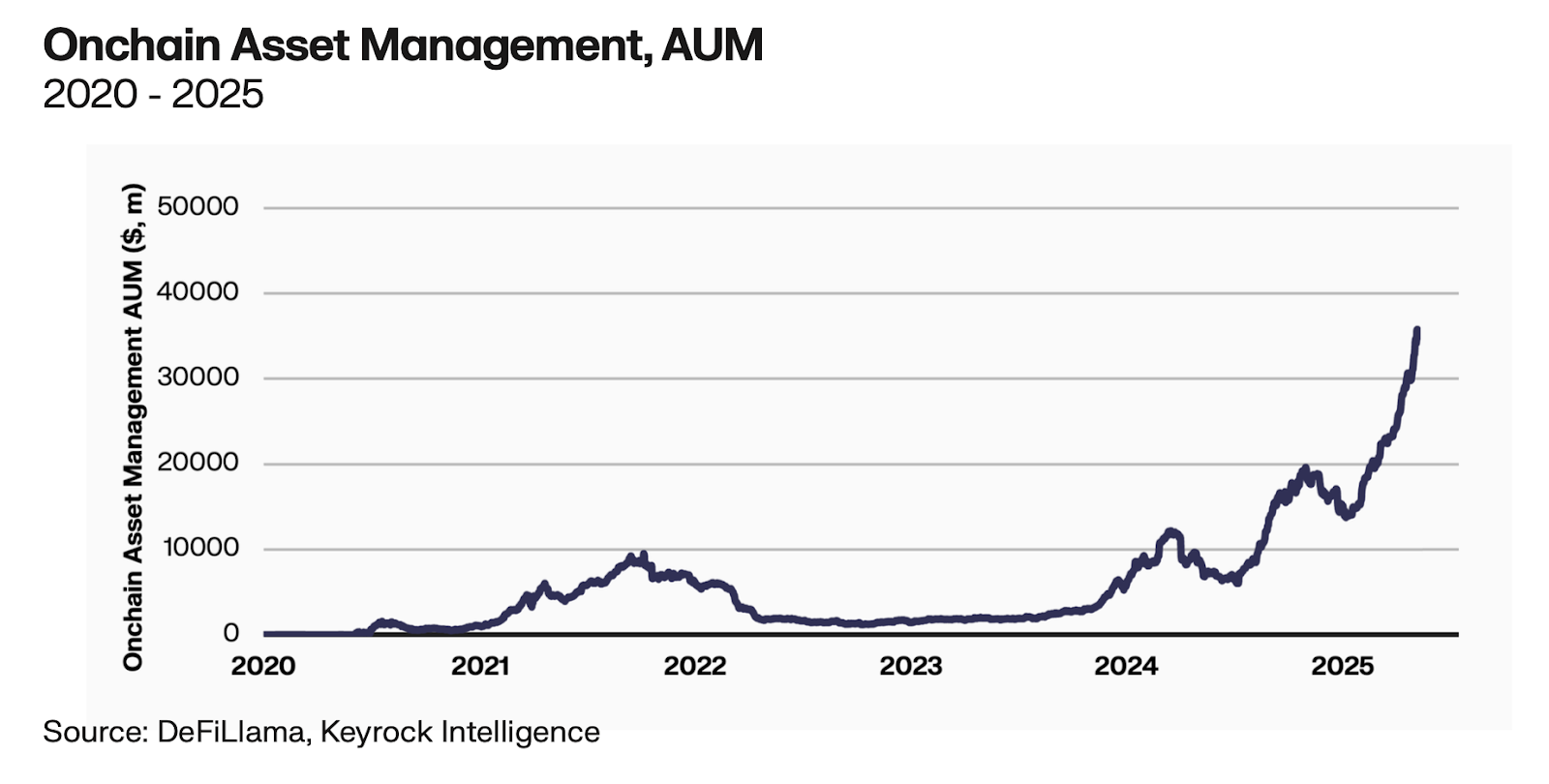

In line with a brand new report from funding firm Keylock and Chain asset supervisor Maple Finance, the funding firm’s Keylock and Chain asset supervisor, on-chain asset administration has been having a powerful yr, doubling it in 2025 (AUM).

The report discovered that complete AUM throughout automated assortment methods, discretionary methods, structured merchandise and chain credit has grown by 118% to $35 billion thus far this yr.

The three protocols, Morpho, Pendle and Maple themselves, account for 31% of the full. Morpho boasts a complete of $7.14 billion in locked (TVL)-on-chain, Pendle’s TVL is $8.3 billion, and Maple’s TVL is $2.7 billion per defilama information.

On-chain AUM from 2020 to 2025. Supply: Keylock, Maple

Most depositors are small traders, referred to as “shrimps,” and maintain below $10,000 on on-chain protocols. Nevertheless, nearly all of capital comes from massive traders, together with “dolfines” (over $100,000) and “whales” (over $1 million).

Moreover, the report recognized automated yields as the principle entry level for allocators, marking the biggest share of AUM at $18 billion.

On-Chain vs. cordfi

The findings present that on-chain methods are now not experimental. As a substitute, they provide aggressive returns and are sometimes extra clear and accessible than conventional monetary merchandise.

Nevertheless, the findings highlighted some dangers of on-chain methods, together with good contract exploits, restricted market capability capabilities, and variable returns.

“The evolution of on-chain asset administration in 2025 demonstrates that on-chain methods are a viable and scalable part of the worldwide monetary atmosphere,” the report states.

“Onchain Asset Administration is a blueprint for the following technology of capital markets, in that it’s programmable, clear and configurable by default.”

Particularly, computerized yield safes outweigh conventional passive investments of round 186bps after charges, the report notes. Then again, discretionary methods provide comparable returns to TradFi.

Structured merchandise and on-chain credit are barely much less after the price, however nonetheless carry out higher. APY of 10.3%, discretionary technique is 9.7% APY, automated technique 8%, and on-chain credit score 7.5%.

Progress is coming

Wanting forward, the report authors state that the following part of on-chain asset administration shall be formed by the “interactions of innovation, complexity and institutional adoption.”

They predict that AUM might develop from $35 billion to $64 billion within the subsequent cycle, finally turning into a “built-in infrastructure for world allocators”, pushed by stronger governance, deeper liquidity and a rise in institutional traders.

Keyrock is a world crypto funding firm specializing in market manufacturing, OTC and choices buying and selling, and Maple is the $4 billion on-chain asset supervisor at AUM.

Final week, immediately, Syrupusd’s Maple’s $200 million pre-deposit deposit deposit, Stablecoin blockchain plasma, which simply launched its mainnet beta, was nearly immediately stuffed.