Fabian Dori, chief funding officer at Digital Asset Financial institution Sygnum, mentioned banks that present crypto loans desire crypto collateral within the type of on-chain belongings relatively than trade gross sales funds (ETFs).

Dori mentioned that as a result of on-chain belongings are extra liquid, lenders can liquidate collateral in actual time, permitting lenders to demand margin requires crypto-assisted loans and supply debtors with the next mortgage and worth (LTV) ratio. Dori advised the Cointelegraph:

“In actuality, it is fascinating to have a direct token as collateral. It may be completed 24/7, so if it’s essential to carry out margin calls on the ETF late at night time on a Friday, it is much more troublesome if the market closes.

The crypto loan-value ratio refers back to the complete quantity of loans with collateral that helps the mortgage, akin to Bitcoin (BTC), Ethereum (ETH), or different tokens accepted by the lender.

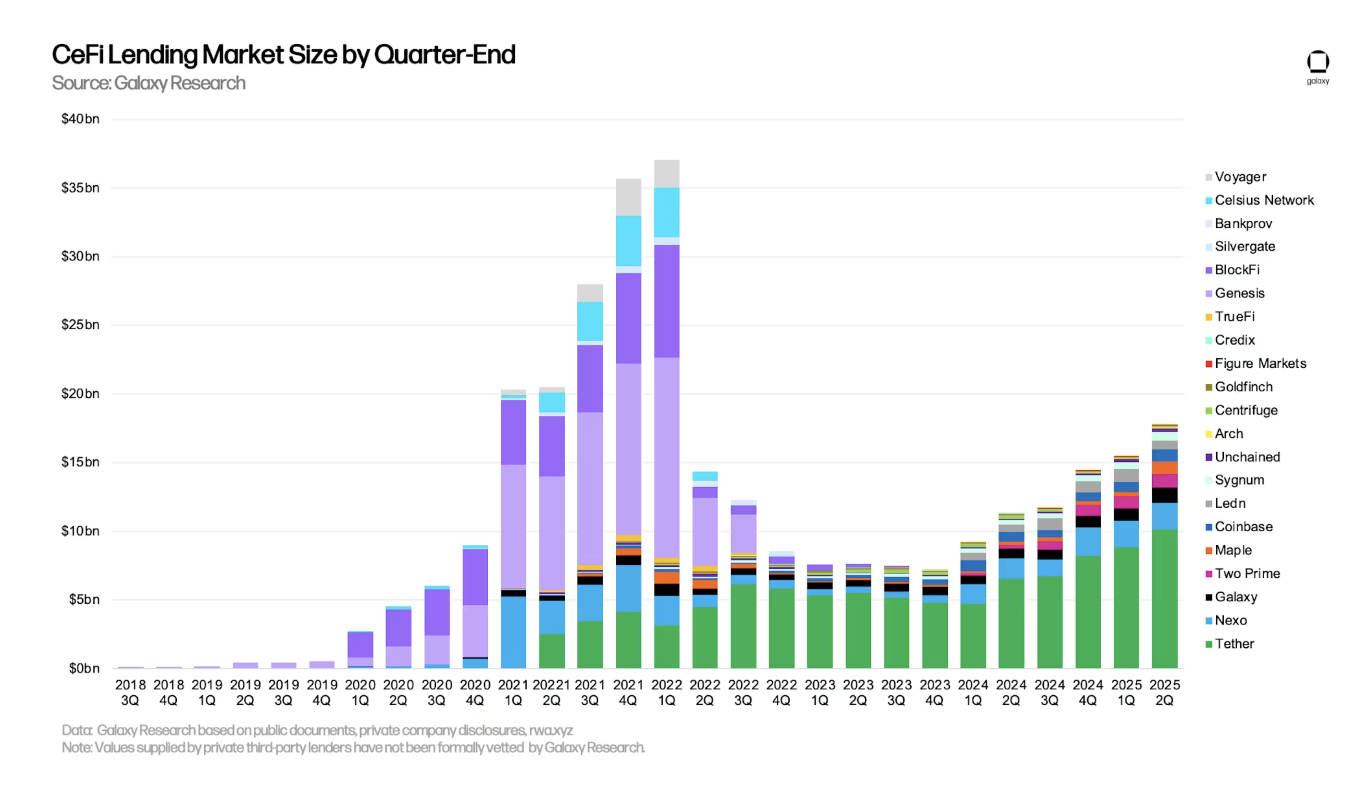

Cryptocurrency loans from centralized establishments have declined considerably within the Bear market in 2022, with a number of crypto lending firms exploding, however once more rising. sauce: Galaxy

A excessive LTV ratio signifies that debtors have entry to extra credit by way of the collateral posted crypto, whereas a low LTV signifies that they get fewer loans for a similar quantity of collateral.

Crypto-backed loans are nonetheless of their early phases, Dori mentioned, however he was satisfied that the sector would proceed to develop as Crypto features widespread adoption.

Monetary establishments are steadily accepting crypto-protected loans in keeping with the concept crypto lenders are open to US inventory exchanges and conventional monetary (Tradfi) firms settle for them as collateral for his or her loans.

Associated: South Korea will restrict crypto mortgage rates of interest to twenty% and reap the benefits of prohibited loans

Crypto Lending will debut on Wall Avenue as Tradfi warms as much as crypto-support lending

Crypto-aid lender Determine Expertise debuted on Thursday on the NASDAQ Change, a high-tech-focused U.S. inventory trade.

https://www.youtube.com/watch?v=ly-sjgrakrs

In response to Yahoo Finance, our shares have skyrocketed by over 24% in the course of the first day buying and selling and now have a market capitalization of over $6.8 billion.

JP Morgan of Monetary Companies Firm can be contemplating providing purchasers Crypto-backed loans. It is a improvement that may happen in 2026 if the Legacy Monetary giants advance their concepts.

journal: Mortgages utilizing Crypto as collateral: Are dangers outweighing compensation?