The subsequent wave of stablecoin adoption will not be pushed by folks. Paxos Labs co-founder says AI brokers might change into the “X-factor”, immediately shifting liquidity to probably the most environment friendly issuers and turning market fragmentation into a bonus.

With the passage of clearer rules relating to stablecoins within the US, the stablecoin market has soared previous $300 billion and has change into one of many central tales of cryptocurrencies. Nevertheless, fragmentation throughout issuers and jurisdictions stays a problem.

As new entrants enter the more and more numerous area, from dollar-backed giants like Tether and Circle to artificial belongings like Athena and PayPal’s PYUSD aimed toward client funds, questions are being raised about whether or not fragmentation might trigger issues for the business.

“Fragmentation is a double-edged sword,” Bhau Kotecha, co-founder and director of Paxos Labs, instructed Cointelegraph. With varied competing fashions issuing stablecoins tailor-made to their companies, there’s a threat that “liquidity silos and consumer confusion will consequence, hindering adoption.”

However he believes AI brokers – autonomous applications that may make selections and carry out duties resembling buying and selling and transferring funds with out human enter – might clear up the issue.

He stated the AI brokers will “immediately change” to the stablecoin that provides the very best economics.

“Which means fragmentation isn’t essentially a deterrent; it could actually truly be a market-level optimization measure, with AI guaranteeing that liquidity flows to probably the most environment friendly issuers. Over time, this might compress charges and drive issuers to compete on fundamentals.”

The rise of AI brokers in cryptocurrencies

Kotecha isn’t alone in highlighting the significance of AI brokers in stablecoin adoption.

In a Sept. 2 Bloomberg interview on the Goldman Sachs Asia Leaders Convention in Hong Kong, Galaxy Digital CEO Mike Novogratz stated AI brokers would be the main customers of stablecoins, driving a surge in buying and selling volumes.

Within the “not-too-distant future,” AI brokers shall be utilizing stablecoins to deal with on a regular basis purchases, he stated, pointing to grocery shops that perceive your eating regimen, preferences and price range and mechanically fill your cart.

He added that these brokers are more likely to depend on stablecoins reasonably than wire transfers or cost apps like Venmo, and that he expects an “explosion of stablecoin transactions” within the coming years.

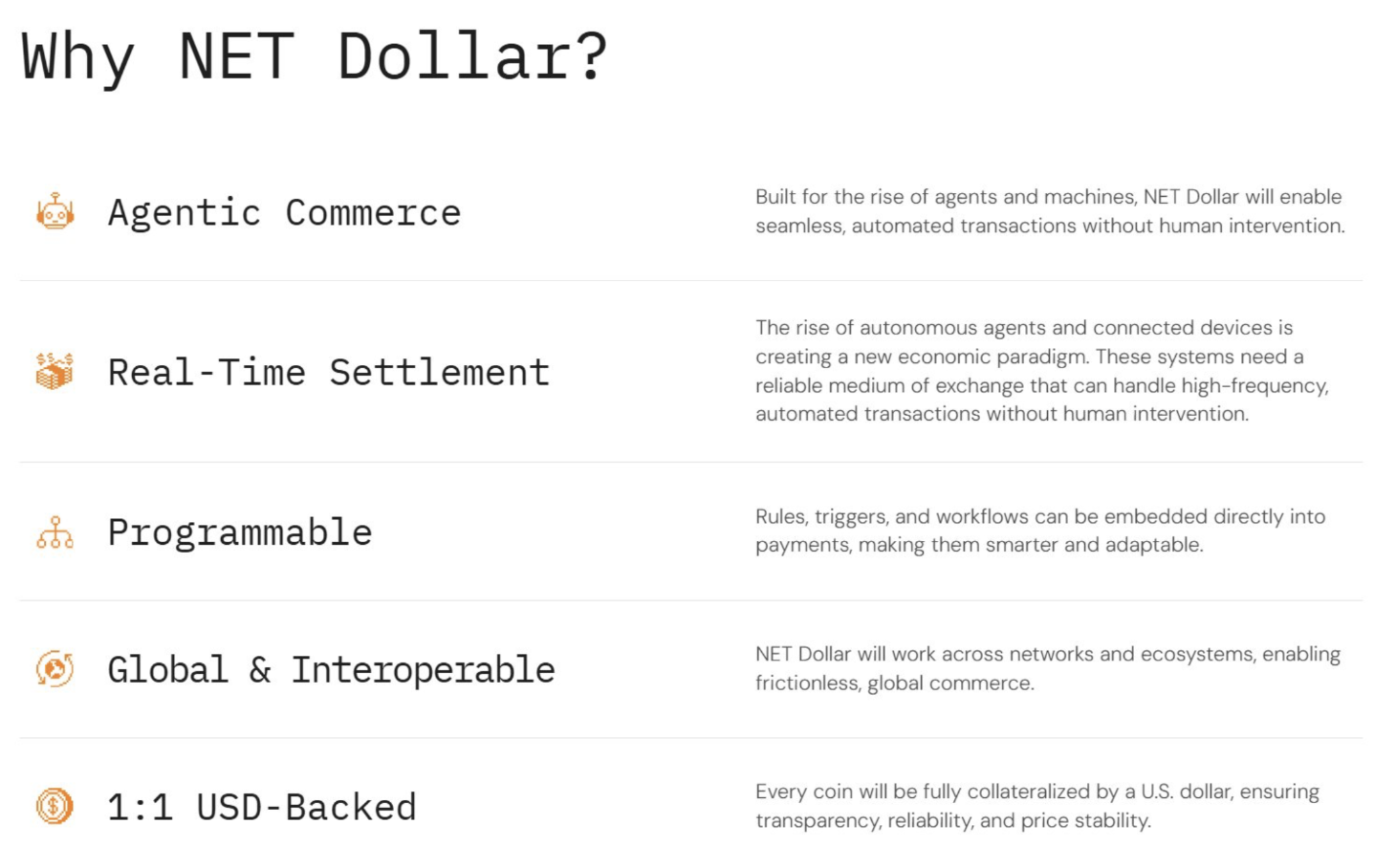

One firm already pursuing this imaginative and prescient is Cloudflare, a worldwide cloud infrastructure firm. On September twenty fifth, Cloudflare introduced that it’s engaged on creating NET$, a stablecoin that helps on the spot transactions by AI brokers.

Cloudflare stated its imaginative and prescient for the stablecoin features a private AI agent who can take rapid motion and ebook the most affordable flight tickets or purchase merchandise as quickly as they go on sale.

Options of NET greenback stablecoin. sauce: cloudflare

The information from Cloudflare comes after a number of cryptocurrency thought leaders expressed their ideas on the significance of AI brokers and their impression on cryptocurrencies.

On August 13, members of Coinbase’s X growth staff wrote that AI brokers are poised to change into “Ethereum’s greatest energy customers,” due to the little-used net customary HTTP 402 “Cost Required” that was first launched 30 years in the past.

sauce: Ethereum Basis

Anoma co-founder Adrian Brink wrote in late August that the rise of AI agent programs is inevitable. Nevertheless, to make sure customers have management over their knowledge and belongings, an intent-based blockchain infrastructure is required.