necessary notes

- Brandt mentioned previous violations of comparable constructions led to declines of practically 80%.

- Bitcoin continues to battle under the important thing resistance stage at $93,000, primarily on account of promoting strain from retail traders.

- Traders stay nervous as necessary macro occasions are developing this week, together with the US Shopper Value Index in November and the Financial institution of Japan’s choice to lift rates of interest.

Regardless of the Fed’s rate of interest cuts and the tip of quantitative tightening (QT), Bitcoin stays BTC $89,866 24 hour volatility: 0.3% Market capitalization: $1.79 trillion Vol. 24 hours: $3.509 billion The worth is beneath sturdy promoting strain and is as soon as once more buying and selling under $90,000.

This week can be an necessary week with the discharge of the US client worth index for November and the Financial institution of Japan’s choice to lift rates of interest.

Peter Brandt predicts Bitcoin worth crash

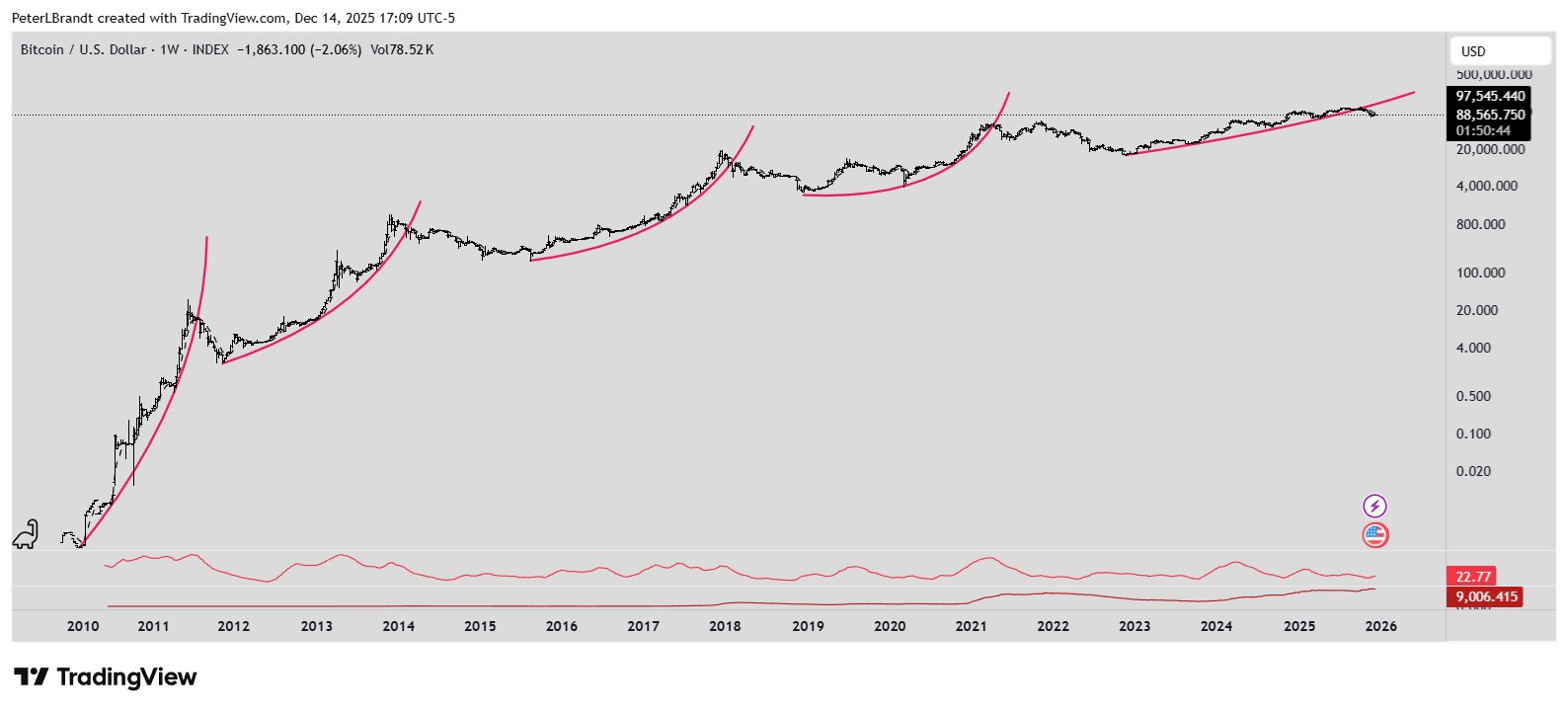

Veteran dealer Peter Brandt has warned that Bitcoin could also be coming into a deeper correction primarily based on previous market cycles. Brandt identified that Bitcoin bull cycles usually observe a parabolic development. Nonetheless, as soon as BTC broke the parabolic pattern, Bitcoin worth crashed practically 80% from its peak.

Bitcoin breaks under parabolic pattern | Supply: Peter Brandt

In line with Brandt, the present parabolic construction has been violated, as proven within the picture above. This additional will increase the chance of serious drawdowns. Brandt urged that primarily based on historic traits, Bitcoin’s roughly 80% decline from its all-time excessive would counsel a worth stage nearer to $25,240.

Many of the promoting strain on BTC is coming from retail traders. Bitcoin worth is going through a powerful rebound at $93,000, and the bulls haven’t been in a position to escape of it.

Over the previous week, BTC has as soon as once more fallen under the $90,000 stage and is testing the $88,000 assist. However, some market specialists stay bullish on BTC.

Market analyst Captain Fybic mentioned a breakout in Bitcoin costs could possibly be on the horizon. Nonetheless, he pressured that bulls have to regain resistance at $93,000 to regain upside momentum.

Associated article: Binance Whale inflows collapse as retail traders proceed to promote Bitcoin

Fibig famous that whereas patrons are struggling to interrupt above $93,000, resistance is regularly weakening on account of repeated retests.

$BTC breakout is only a matter of time.. 📈🔥

The bulls have to reclaim the $93,000 resistance to completely regain bullish momentum.

The bulls are nonetheless struggling to regain the $93,000 resistance, however this resistance has gotten weaker with every retest.

If the wedge breaks upward… pic.twitter.com/vRDZdqpBYP

— Captain Faibik🐺 (@CryptoFaibik) December 15, 2025

In the meantime, Technique CEO Michael Saylor hinted that extra BTC purchases can be made sooner or later. The biggest Bitcoin treasury firm already holds 660,524 BTC price $58.5 billion.

US CPI and Financial institution of Japan fee hike choice looms

Previous to this, on Thursday, December 18th, the US will launch the CPI (Shopper Value Inflation) figures for November. Current forecasts for U.S. client worth inflation in November 2025 point out a rise of roughly 3.1% year-over-year and roughly 0.4% month-over-month. These numbers may affect the Fed’s choice to chop rates of interest sooner or later.

In the meantime, the Financial institution of Japan’s rate of interest choice is developing on December nineteenth.

The final 3 times Japan has raised rates of interest, the BTC greenback has fallen by 20% to 30%.

The Financial institution of Japan is predicted to lift rates of interest once more on December nineteenth.

Will or not it’s completely different this time? pic.twitter.com/2Glf0U9jQd

— Ted (@TedPillows) December 14, 2025

In style market analyst Ted Pillows identified that the final 3 times the Financial institution of Japan introduced rate of interest hikes, Bitcoin costs fell by 20-30%. If historical past repeats itself, we can not rule out the chance that it may drop to $70,000.

Disclaimer: Coinspeaker is dedicated to offering honest and clear reporting. This text is meant to offer correct and well timed data however shouldn’t be taken as monetary or funding recommendation. Market situations can change quickly, so we advocate that you simply confirm the knowledge your self and seek the advice of an expert earlier than making any choices primarily based on this content material.