Current feedback from US Federal Reserve Chairman Jerome Powell have sparked a heated debate over whether or not the crypto market may quickly enter a brand new bullish cycle fueled by quantitative easing (QE).

What do analysts say about this chance? Let’s take a more in-depth look right here.

Might the Fed resume quantitative easing within the coming months?

In a speech on the Nationwide Affiliation for Enterprise Economics (NABE) convention on October 14, 2025, Chairman Powell introduced that the Fed is contemplating ending its quantitative tightening (QT) program.

He emphasised that financial institution reserves are approaching applicable ranges. Powell stated QT may finish quickly to keep away from extreme liquidity tightening that would damage financial progress.

Analysts famous that suspending QT may pave the best way for QE, that means the Fed may inject liquidity into the market, much like what it did throughout the COVID-19 pandemic.

As soon as QE begins, Bitcoin could possibly be the most important beneficiary. Traditionally, QE has pushed danger property increased, as seen in Bitcoin’s leap from lower than $10,000 to greater than $60,000 from 2020 to 2021.

The Fed might resume quantitative easing within the coming months https://t.co/VVBpQsd1GY pic.twitter.com/Y2sBpa5E1v

— Zero Hedge (@zerohedge) October 14, 2025

This alteration will even have an effect on altcoins. BitMEX co-founder Arthur Hayes declared QT successfully over and stated it is a nice shopping for alternative.

“It is over, QT is over. Again the vans and purchase every little thing,” stated BitMEX co-founder Arthur Hayes.

Some analysts imagine that the market will begin to notice the influence of this choice.inside the subsequent six months.

What is going to occur to Bitcoin if QT ends however QE doesn’t begin?

Not everybody shares the identical optimism.

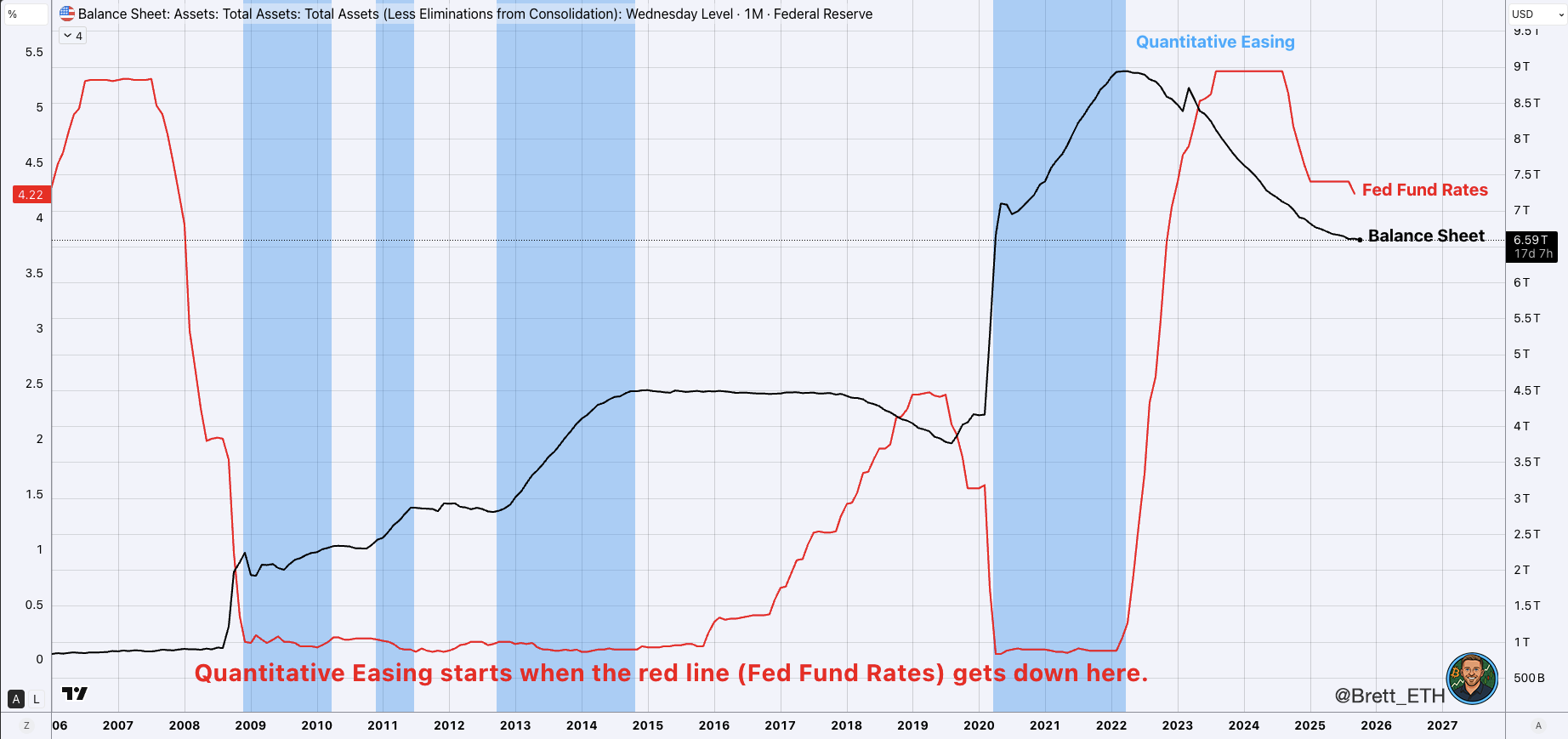

For instance, analyst Brett argued that many interpretations of Powell’s remarks have gone too far. He famous that quantitative easing is usually solely applied when the federal funds fee is close to zero, however presently the federal funds fee is sitting at 4.2%.

Chairman Powell merely hinted that the Fed might quickly end shrinking its steadiness sheet. Even when QT ends, QE doesn’t routinely begin.

quantitative easing interval. Supply: ₿let

“Discover that QE (blue shaded space) would not begin till the federal funds fee is near zero. We’re nonetheless at 4.2. It might take an financial catastrophe and maybe 12 months of fee cuts to get to that degree by the point QE is launched,” Brett defined.

Concerning Bitcoin’s response, Brett believes that Bitcoin tends to maneuver in cycles moderately than straight reacting to QE and QT. In his view, Bitcoin’s long-term developments function considerably independently of financial coverage.

Bitcoin tends to be extra cyclical than QE or QT.

🟪 = Fed ends QT or QE (Powell says it can enter this stage inside a couple of months)

🟥 = QT

🟦 = QEDiscover how Bitcoin rises and falls on each QT and QE. Bitcoin is far more cyclical than individuals are keen to confess.

QE is… pic.twitter.com/cZIJ8LcSLu

— ₿rett (@brett_eth) October 14, 2025

Nonetheless, historic information since 2011 exhibits that Bitcoin usually declines for a number of months after every QE or QT section ends. The query then arises: Is one thing totally different this time?

In different phrases, if the Fed resumes quantitative easing, liquidity may flood the market and Bitcoin may skyrocket. But when the Fed merely ends QT with out introducing new funds, the outlook turns into much more dangerous.

The market is presently awaiting upcoming information on the Producer Value Index (PPI) and unemployment fee, which may present clearer clues in regards to the future.

The put up Powell hints at the potential for QT ending — is that this the liquidity enhance cryptocurrencies want?The put up appeared first on BeInCrypto.