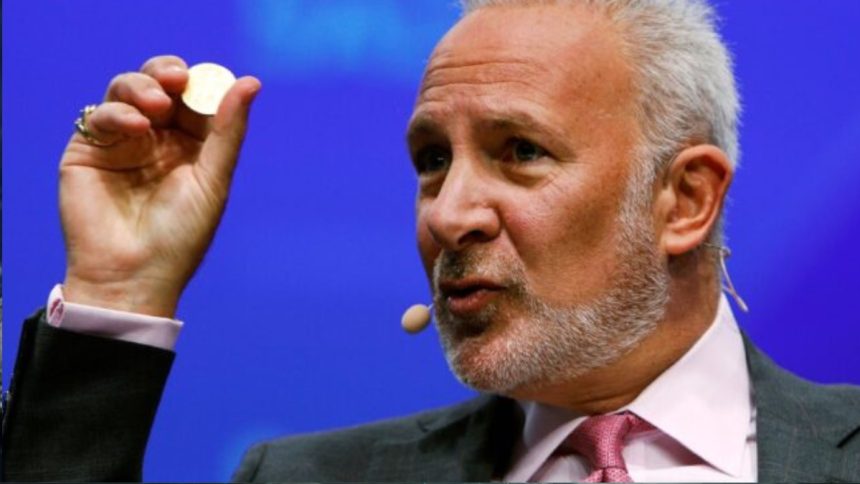

American economist Peter Schiff argues that America is headed for an financial collapse of historic proportions. In his view, the world is witnessing an finish to the greenback’s “exorbitant privileges” and a altering period through which gold, somewhat than Bitcoin (BTC), cements its place as central banks’ undisputed reserve asset.

“Put together for a historic financial collapse,” Schiff mentioned. His phrases coincided with an uncommon finish to the 12 months for valuable metals. cash is over the wall $4,500 per ounce, a rise of 70% in 2025 alone, bringing silver to $75.

This metals growth happens within the context of a weak US forex. The greenback index (DXY) remained near 98 factors, down 9.7% for the 12 months, its worst efficiency since 2017. Schiff attributes this development to persistent inflation above the Federal Reserve’s 2% aim. He mentioned this might slowly erode the greenback’s worth and trigger “disagreeable surprises” for conventional buyers in shares, bonds and greenback deposits, who would see a lack of buying energy. Because of this, many individuals use valuable metals as a refuge.

The economist doesn’t see Bitcoin as an asset that may change the greenback or gold as a retailer of worth. Quite the opposite, new criticism of the forex created by Satoshi Nakamoto is as soon as once more stirring up controversy. Based on Schiff, the funding alternative for BTC has already ended and he expects it to proceed. regularly reducing in the direction of absolute zero For individuals who nonetheless keep their belongings.

Nevertheless, its credibility within the digital world has been questioned. Social media shortly reminded him of the historical past of his predictions failing. “Is it the identical as telling everybody to not purchase Bitcoin if you mentioned it will collapse when it hit $3,500?” one person chided him.

Criticism of Schiff has turn into a style in itself below the banner of “reverse Schiff.” The ironic principle is that his detrimental predictions for Bitcoin are normally bullish alerts.

“Peter Schiff predicting financial collapse is essentially the most dependable bullish sign Bitcoin has,” mentioned one other person. “Like a clock.” The time period “Schiff sign” has additionally emerged as a recurring reenactment of his feedback about X, and has turn into a recurring meme.

Bitcoin: secure or dangerous asset?

On this dialectical debate, Schiff discovered an surprising ally within the macroeconomic analyst Henrik Seberg, however for various causes. Seberg agrees that Bitcoin wouldn’t function a lifeline in an actual disaster. “Bitcoin just isn’t a particular asset. It’s a danger asset. In reality, it’s a very dangerous asset,” Zeberg mentioned as not too long ago reported by CriptoNoticias.

Based on analysts, Bitcoin solely thrives with considerable liquidity. “Fairly than performing as a secure asset, Bitcoin will fall together with danger belongings,” Seberg warned. suggests a digital forex Could possibly be lower than $10,000 What if “all bubbles” finally burst and we find yourself behaving extra like speculative tech shares than the “digital gold” that so many champion?

In his evaluation, Seberg doesn’t dismiss Bitcoin as an asset per se, however sees it as half of a bigger macro cycle, through which a “blow-off prime” (the ultimate stage of a parabolic rally) essentially precedes the collapse of a bearish/recession section.

In a local weather of world uncertainty, Mr. Schiff’s warning displays the view shared by some analysts that the worldwide monetary system as we all know it might bear important structural modifications.