desk of contents

What’s the Chainlink Reserve? How has the Reserve grown since its inception? Technical Construction and Transparency Connection to Chainlink Community Actions Conclusion Supply FAQ

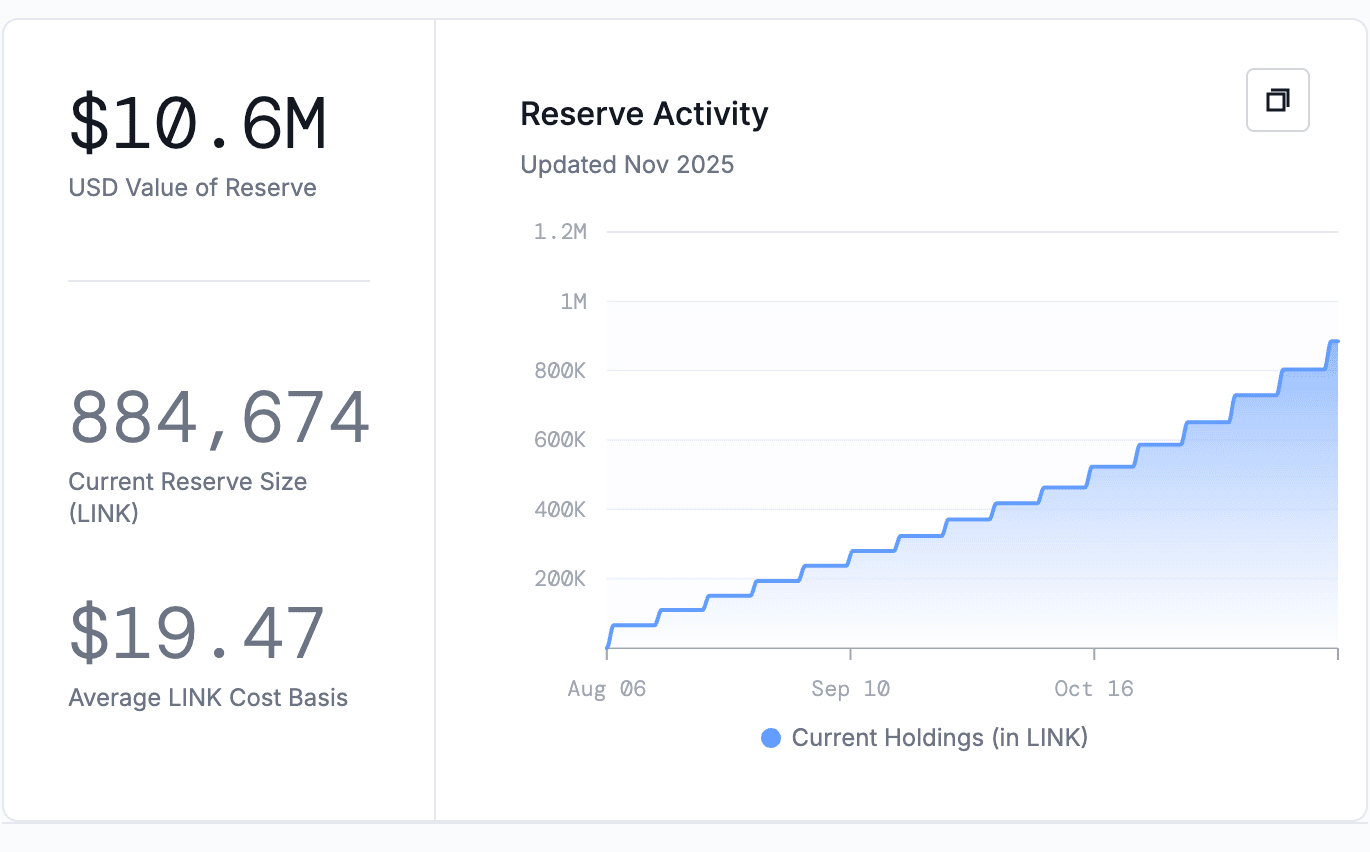

Since its launch in August 2025, chain hyperlink reserve There have been no down weeks. On-chain treasury contracts that accumulate robotically hyperlink token Community income reached 884,673.64 LINK on November twentieth, with sixteenth consecutive week of deposits reaching 81,285.98 LINK.

This reserve converts each off-chain company funds and on-chain service charges into LINK via decentralized exchanges, primarily Uniswap V3, locking the tokens beneath a multi-year no-withdrawal coverage enforced by time-locked sensible contracts.

We check out the present standing and up to date exercise of the reserve, which on the time of writing is approaching $11 million, following a gentle accumulation regardless of market fluctuations.

What’s Chainlink Reserve?

Chainlink Reserve is an on-chain reserve designed to retailer LINK tokens funded by each firms and on-chain royalties. The purpose is to strengthen the long-term sustainability of the community by funneling income from massive establishments and decentralized functions immediately into LINK. This platform will likely be launched on August 7, 2025, on August 7, 2025. Just lately concluded SmartCon 2025.

This reserve works via a function referred to as Cost Abstraction. How does this work? Institutional prospects and companies utilizing chain hyperlink Companies equivalent to Cross-Chain Interoperability Protocol (CCIP), information feeds, and verifiable random features (VRF) can settle invoices in fiat forex or stablecoins (mostly USDC).

These funds will likely be routed via a decentralized liquidity pool the place a portion of the deposited funds will likely be exchanged to LINK on Uniswap V3, and the remaining proportion will come from on-chain charges paid immediately on LINK. As soon as acquired, the tokens are transferred to a reserve contract and have a built-in multi-day timelock, in order that they can’t be eliminated for a number of years.

All holdings and transactions are official dashboard and might be impartial Verified with Etherscan.

How has the reserve elevated since launch?

Chainlink deposits new LINK into the reserve each Thursday. The primary public accumulation exceeded $1 million in LINK worth inside days of launch in August 2025. Since then, this reserve has recorded 16 weekly inflows and no withdrawals.

Current deposits for November 2025 present constant development.

- November 6, 2025: 78,252.51 LINKs added for a complete of 729,338.41 LINKs.

- November 13, 2025: 74,049.24 LINKs added for a complete of 803,387.65 LINKs.

- November 20, 2025: 81,285.98 LINKs added for a complete of 884,673.64 LINKs.

The Reserve at present holds 884,674 hyperlinks, valued at roughly $10.6 million.

The Nov. 20 deposit was value roughly $1.06 million on the time of buy. The month-to-month financial savings quantity has elevated visibly. In late October 2025, this reserve added a mean of roughly 63,500 LINK per week, in comparison with roughly 77,900 LINK per week within the three November deposits reported thus far.

Technical construction and transparency

The preliminary settlement contains a number of safeguards. Timelocks forestall withdrawals for a number of years, and governance authority is entrusted to a multi-signature pockets managed by the Chainlink staff. Future makes use of of amassed tokens, equivalent to staking reward funding, node operator incentives, and ecosystem subsidies, will likely be decided via group discussions by way of present Chainlink governance channels.

As well as, real-time information reveals present balances, previous inflows, acquisition value foundation, and proportion of complete LINK provide held.

Connecting to Chainlink community exercise

The income flowing into Reserve comes from a number of Chainlink merchandise. The most important components embrace CCIP charges as a result of cross-chain token transfers, information feed subscriptions utilized in DeFi protocols, and company integration with conventional monetary establishments.

Notable developments supporting income development in November 2025 embrace:

- Chainlink Runtime Surroundings (CRE) launches for institutional tokenization workflows on November 4, 2025

- Announcement of cross-border funds pilot utilizing CCIP between Brazilian digital forex Drex and Hong Kong Financial Authority

- On-chain FTSE Russell index integration by way of Chainlink information feed

- UBS continues piloting tokenized funds

- Chainlink Rewards Season 1 will begin on November 11, 2025, and third-party undertaking tokens will likely be distributed to LINK stakers.

Chainlink continues to carry an estimated 70% share of the blockchain oracle market, with over $100 billion in complete locked up throughout DeFi and real-world asset protocols.

Vital future milestones embrace: Swift SR2025 This replace permits greater than 11,000 member banks to ship authenticated directions to Chainlink CCIP, probably rising payment-related charges to cowl reserves.

conclusion

Chainlink Reserve offers a clear and verifiable mechanism to transform actual income from oracle companies and cross-chain infrastructure into perpetual LINK holdings. Since its launch in August 2025, it has amassed tokens at an accelerated tempo, reaching 884,674 hyperlinks by November 20, 2025, via 16 consecutive weekly deposits, primarily funded by company adoption and on-chain charges.

Mixed with high-value staking participation and future institutional integrations equivalent to SWIFT’s SR 2025 rollout, this reserve establishes a direct on-chain report of LINK token worth accrual based mostly on precise community utilization slightly than speculative narratives.

supply of knowledge

- chain hyperlink reserve: Monitor reserving metrics with real-time updates.

- ether scan: Chainlink reserve confirmed on Etherscan.

- chain hyperlink weblog: Asserting the discharge of Chainlink Reserve

- chain hyperlink x: Cumulative complete variety of LINKs as of November twentieth.