Bitcoin’s hashrate fell 4% within the month to December 15, however analysts at VanEck mentioned this may very well be a constructive signal for crypto costs within the coming months, as miners’ capitulation is a “traditionally bullish contrarian sign.”

“When hashrate compression continues over an prolonged time frame, constructive ahead returns are likely to happen extra steadily and to a higher magnitude,” VanEck crypto analysis chief Matt Siegel and senior funding analyst Patrick Busch mentioned in a report on Monday.

They identified that since 2014, Bitcoin’s 90-day ahead return has been constructive 65% of the time when the community’s hashrate was declining prior to now 30 days, in comparison with 54% when the hashrate was rising.

This sample additionally holds true when wanting additional forward, with 90 days of unfavorable hashrate development adopted by a constructive 180-day Bitcoin return 77% of the time, with a mean return of 72%, outpacing the 61% constructive return when the hashrate will increase over the identical interval.

This pattern is optimistic for Bitcoin (BTC) miners, as rising costs might broaden revenue margins for some miners or convey beforehand unprofitable miners again on-line.

Bitcoin is at the moment buying and selling at $88,400, down almost 30% from its all-time excessive of $126,080 on October 6, based on knowledge from CoinGecko.

Break-even worth for Bitcoin miners is over 35%

Siegel and Busch famous that the break-even electrical energy worth for the 2022 Bitmain S19 XP miner, one of the vital well-liked Bitcoin mining rigs, has fallen almost 36% from $0.12 per kilowatt hour (kWh) in December 2024 to $0.077/kWh as of mid-December, highlighting how troublesome the state of affairs is for miners.

S19 XP miner break-even worth change since January 2020. supply: Van Eck

Analysts at VanEck mentioned the numerous 4% decline in Bitcoin hashrate since April 2024 is probably going because of the latest shutdown of roughly 1.3 gigawatts of mining capability in China.

The pair mentioned a lot of that energy might shift to fulfill the rising demand for AI, a pattern they estimate might wipe out 10% of Bitcoin’s hashrate.

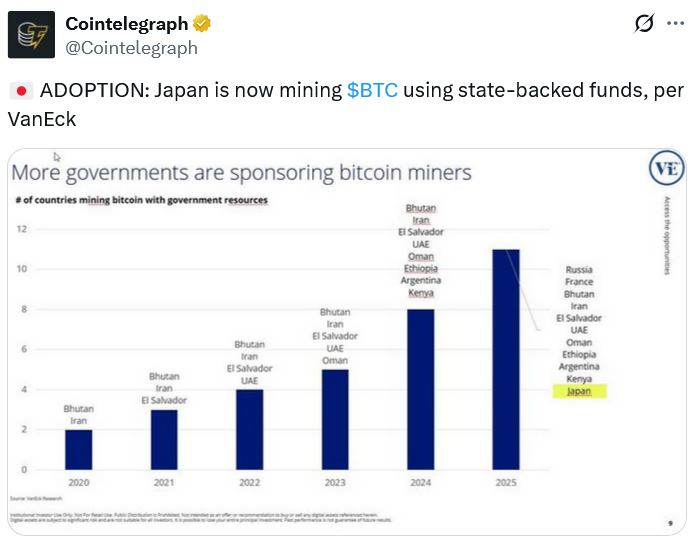

Nation-states nonetheless assist firms mining Bitcoin

Not all international locations are withdrawing from the Bitcoin mining business, with Siegel and Bush estimating that as much as 13 international locations at the moment assist Bitcoin mining actions.

These embrace Russia, France, Bhutan, Iran, El Salvador, UAE, Oman, Ethiopia, Argentina, Kenya, and most lately Japan.

sauce: cointelegraph