The newly relaunched Ethereum DAO was funded by way of TornadoCash, reiterating Ethereum’s privateness mission. The DAO will put aside $220 million in reserves to fund safety analysis.

The brand new Ethereum DAO reserves will undergo Twister Money, which is able to taint all subsequent transactions. The primary objective is to make sure that personal transactions are nonetheless accepted because the norm, slightly than an indication of hacking.

Griff Inexperienced, one of many co-founders of the brand new DAO, introduced a deliberate deposit of $69,420. $ETH Take part in beacon contract. Mr. Inexperienced additionally set stakes by way of his actions. Griffes self-importance handle.

.@thedaofund’s 69,420 $ETH Staking is for safety. https://t.co/5kEKRmo0V5

— griff.eth – $GIV Maxi (@griffgreen) February 1, 2026

The pockets tagged Deploy DAO funds was initially funded by Twister Money and included Etherscan. tag. Right now, rules relating to using funds tainted by Twister Money are variable, and exchanges don’t essentially evaluation earlier commingling.

Nonetheless, in case you hyperlink Ethereum, dao The formal joint assertion with Twister Money is one other assertion in assist of privateness. Beforehand, Ethereum supporters proposed creating a personal validator pool that would not be linked to depositor addresses.

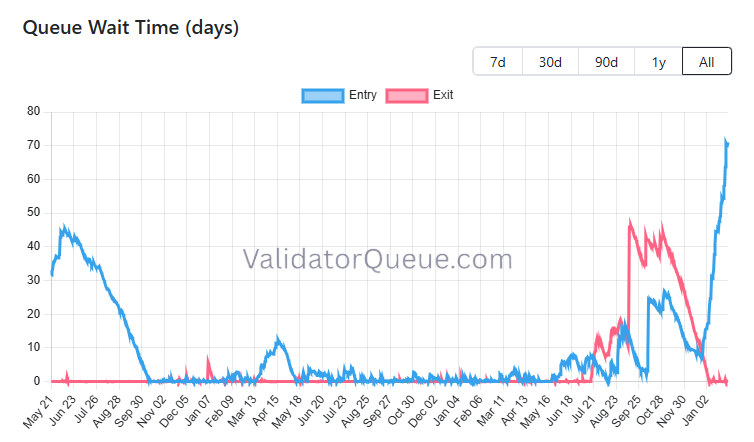

DAO funds want to attend greater than 70 days

DAO’s potential passive revenue could also be delayed as funds should first be accepted into the beacon chain contract.

On account of elevated demand for deposits, DAO reserves might have to attend greater than 70 days.

DAO funds have a ready interval of 70 days or extra earlier than producing passive revenue. |Supply: Validator Queue.

Validator queue is stored longer than 4M $ETH All it’s important to do is await deposits to the contract and infrequently await withdrawals. Wait instances have accelerated to an all-time excessive and at the moment are nearing 71 days.

The DAO holds the funds as potential passive revenue and is used for grants and analysis. The DAO might be a part of the Ethereum Basis’s new spending schedule, with the Ethereum Basis aiming to spend its reserves extra conservatively within the coming years.

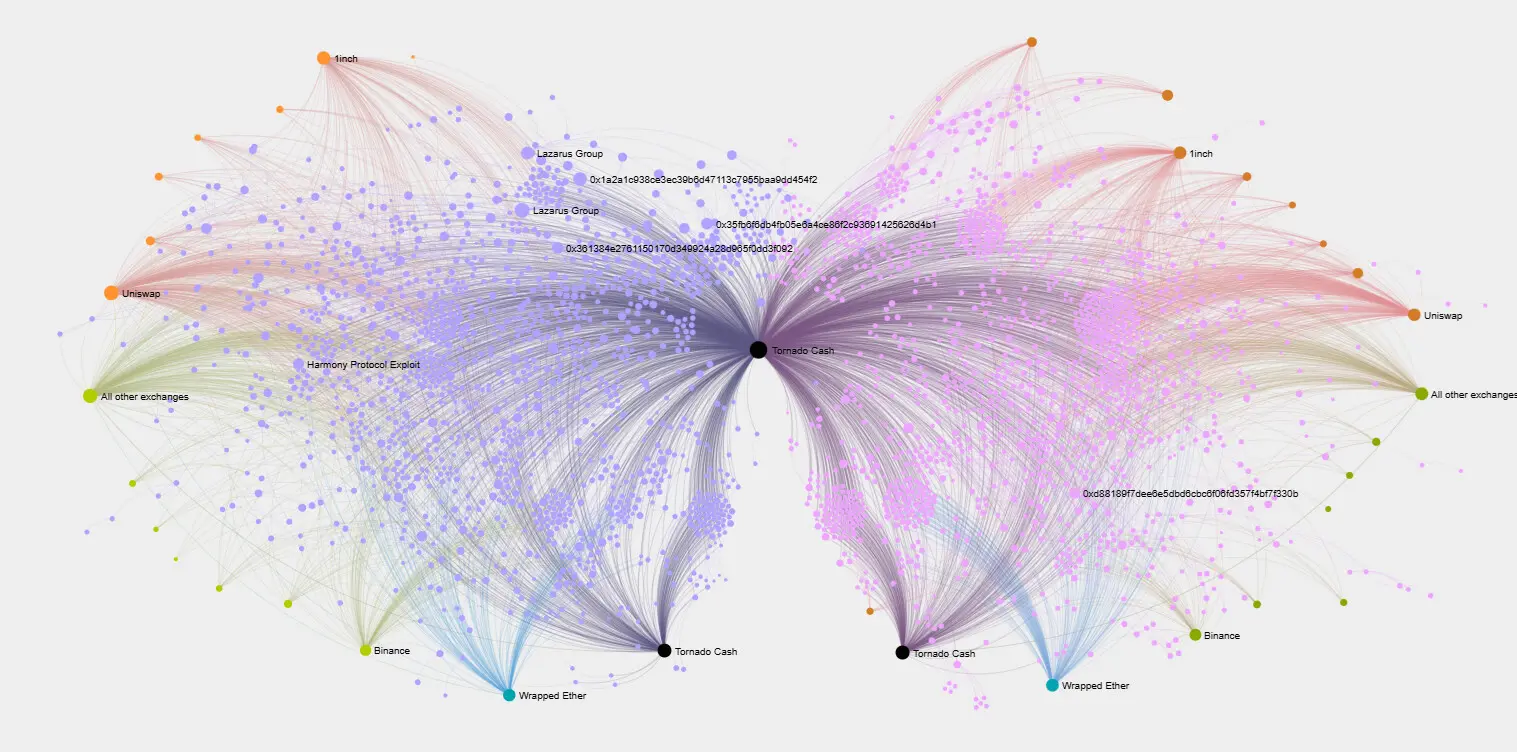

Twister Money spreads throughout Ethereum

Twister Money has been flagged for carrying visitors from North Korean exploits and hacks. Nonetheless, mixers have already unfold to giant components of the Ethereum ecosystem by way of common use and “dusting” from devoted wallets.

This mixer pulled in visitors from throughout the crypto ecosystem, together with centralized and decentralized exchanges, routers, and apps.

Twister Money is turning into an necessary a part of the decentralized Ethereum ecosystem and infrequently receives transfers from prime DEXs. |Supply: Twister Community.

Twister Money additionally obtained peak quantity $ETH And stablecoins have reached an all-time excessive in whole worth. Mixer accommodates over 361K $ETHwhereas exercise has rebounded to ranges not seen since 2021.

Over the previous 12 months, Twister Money has step by step recovered from low baseline exercise. Mixers pulled in visitors from decentralized exchanges for an extra layer of privateness. Vitalik Buterin helps veiled buying and selling as a supply of safety and never exposing whales or outstanding merchants.