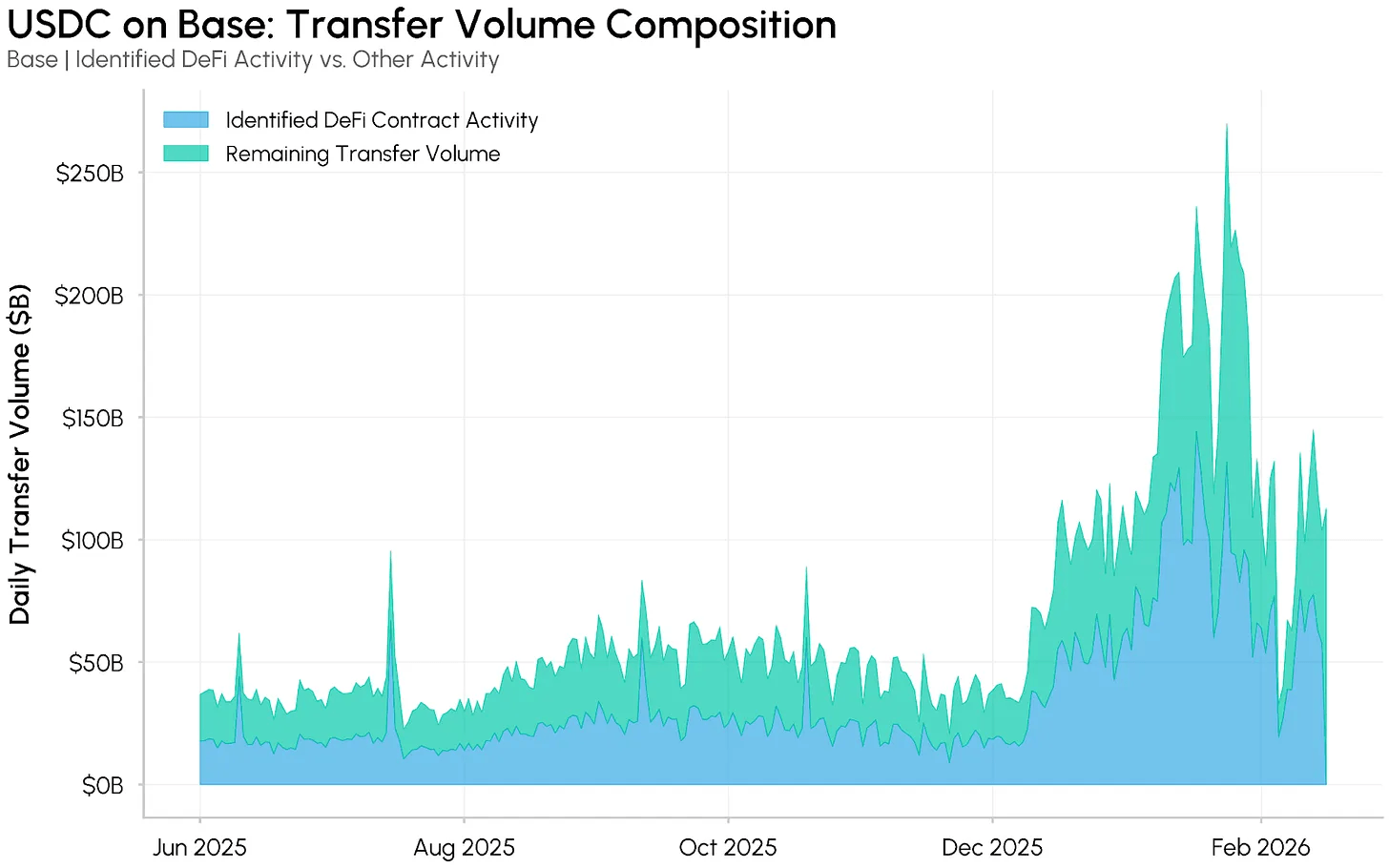

A brand new Coinmetrics evaluation written by Senior Analysis Affiliate Tanai Ved finds that January’s file $8 trillion in adjusted stablecoin remittances was primarily as a result of: $USDC Base exercise, and far of the surge is expounded to decentralized finance (DeFi) mechanics quite than funds.

Coin index Tanay Ved collapses $USDC$5.3 trillion on a month-to-month foundation

Coin Metrics reported that adjusted stablecoin switch quantity reached a file $8 trillion in January 2026, with nearly all of that development concentrated within the following areas: $USDC on the bottom. The report isunusual case of $USDC on the bottomThe paper, written by Tanay Ved, Senior Analysis Affiliate at Coin Metrics, attributes a lot of the enlargement to a mixture of single property and community exercise.

In line with Coin Metrics Community Knowledge Professional: $USDC on Base has a provide of roughly $4.1 billion and generated roughly $5.3 trillion in buying and selling quantity in January alone. Senior researchers on the firm word that this results in unusually excessive speeds in comparison with different chains, prompting a more in-depth take a look at the underlying dynamics.

In line with Coinmetrics knowledge, the rise was dominated by large-scale transfers. day-after-day $USDC Transactions over $100,000 on Base rose from lower than 50,000 in mid-2025 to greater than 450,000 at its peak in January 2026. In line with the report, remittances between $100,000 and $10 million accounted for about 90% of whole remittances, whereas the most important band above $10 million noticed intermittent spikes.

To find out the reason for this exercise, Coin Metrics analysts analyzed it utilizing ATLAS knowledge. $USDC We are going to give attention to updating the Base steadiness throughout 10 days in January. The highest 5 addresses have been associated to DeFi infrastructure, particularly liquidity provision on Aerodrome and lending and flash mortgage exercise on Morpho.

Coin Metrics ATLAS knowledge is out there for airfield WETH/$USDC Centralized liquidity swimming pools alone account for an estimated 32% of the whole, or $6.4 trillion. $USDC Adjusted switch quantity in Base for the previous 12 months. Mixed with Aerodrome’s cbBTC/$USDC In pool and Morpho exercise, these contracts accounted for a good portion of flows associated to DeFi mechanisms quite than conventional funds.

This evaluation explains how centralized liquidity fashions or suppliers encourage frequent rebalancing. Liquidity suppliers (LPs) exit and redeploy as worth ranges change. $USDCgiant inflows and outflows happen with restricted web adjustments to the pool steadiness. On the January peak degree, WETH/$USDC Pool recorded greater than $100 billion day by day $USDC Remittance volumes usually stayed inside $20 million, whereas web day by day flows usually stayed inside $20 million.

Coin Metrics additionally recognized flash mortgage exercise on Morpho as one of many key elements. Single flash mortgage transaction involving $114 million $USDC reveals how a bot borrows and repays giant quantities inside a single atomic transaction, producing giant volumes of switch with out representing any pure financial motion.

Supply: Coin Metrics ATLAS & Community Knowledge Professional Newest report from Coin Metrics.

Coin Metrics estimates that it’s going to break down about 50% of January’s $5.3 trillion. $USDCThe adjusted switch quantity at Base is probably going because of the prime three DeFi contracts. The remaining exercise nonetheless reveals development, however not on the scale urged by the day by day peak of over $200 billion.

The researchers conclude that whereas stablecoin adoption continues to develop, switch quantity metrics can conflate essentially several types of exercise. Coin Metrics highlights the necessity for extra granular classification to differentiate between liquidity administration, arbitrage, and real cost or settlement flows. It may be deceptive to lump all the pieces collectively into one particular kind of classification.

Often requested questions ❓

- What did Coin Metrics report on stablecoin quantity in January 2026?

Coin Metrics discovered that adjusted stablecoin switch quantity reached a file $8 trillion in January 2026. $USDC on the bottom. - how a lot $USDC Did you expertise any switch quantity on Base in January?

coin metrics knowledge present $USDC on Base generated roughly $5.3 trillion in adjusted switch quantity through the month. - What drove the rise? $USDC What are your base actions?

In line with Tanay Ved and Coin Metrics, a lot of the expansion is because of DeFi exercise at Aerodrome and Morpho, reminiscent of liquidity rebalancing and flash loans. - Why does Coin Metrics say that switch quantities could be deceptive?

Coin Metrics factors out that headline volumes can confuse DeFi mechanics and cost exercise, and detailed classification is important for correct interpretation.