Cryptocurrency markets have had a yr stuffed with ups and downs, with a lot of the massive digital belongings turning out for combined efficiency in 2025. After a tricky begin to the yr, Bitcoin costs began to choose up within the second and third quarters, with Bitcoin costs hitting a number of all-time highs in a six-month interval.

Nonetheless, the flagship cryptocurrency has struggled for a lot of the closing months of 2025 and is more likely to finish the yr within the pink. Curiously, the most recent on-chain information and historic patterns counsel that Bitcoin value may very well be set for a a lot stronger year-end shut than anticipated.

There aren’t any destructive days left in 2025, however a severe correction might happen in 2026.

On Saturday, December sixth, AlphaRactal CEO and Founder Joan Wesson took to the X Platform to share what she expects for Bitcoin value on the finish of 2025. In keeping with on-chain specialists, market leaders are more likely to finish the yr in a flat value vary.

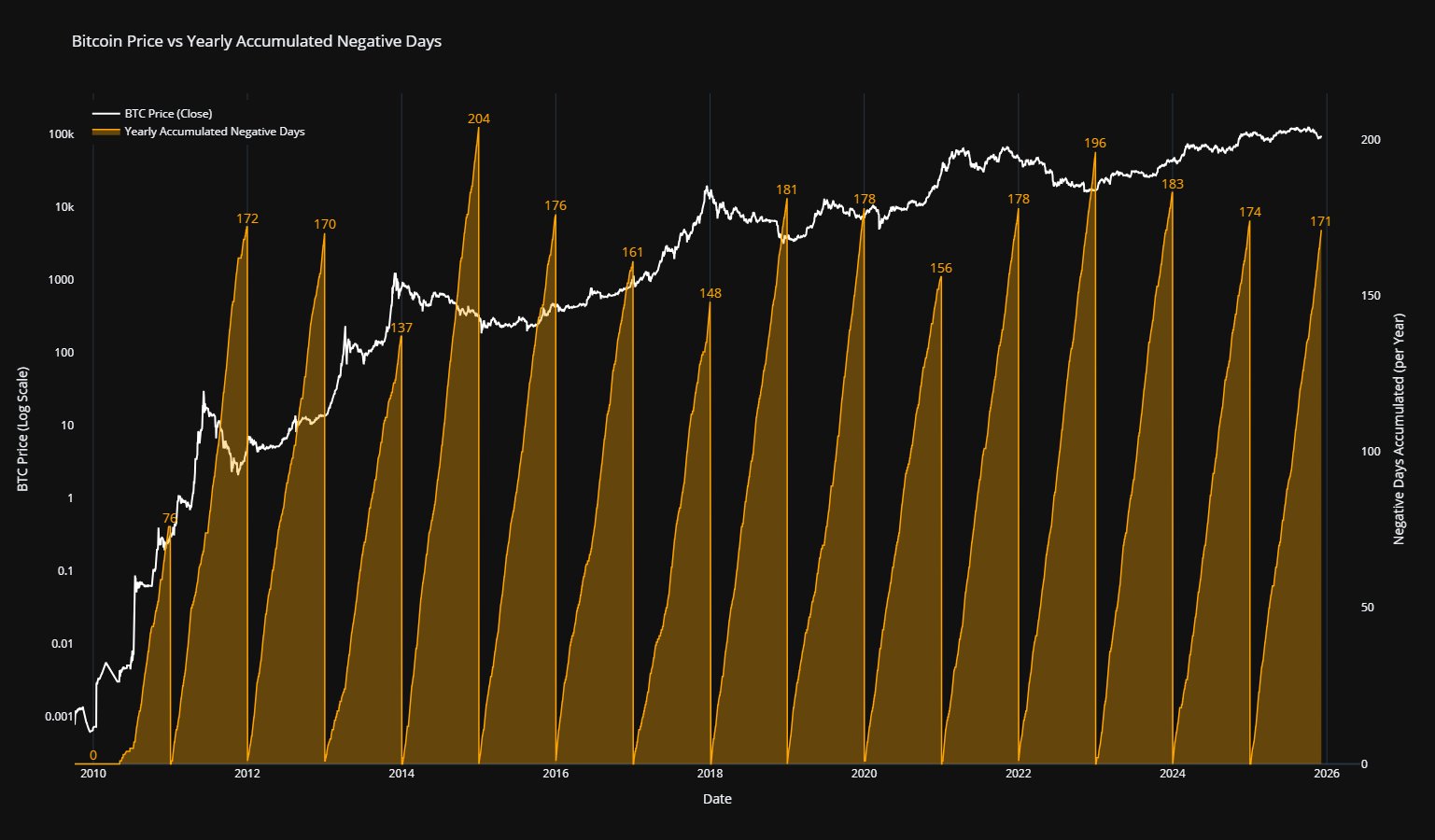

The related metric right here is the cumulative variety of destructive days per yr. It tracks market resilience by measuring the variety of days in a yr that an asset’s each day value candlestick ends within the pink.

Historic information and patterns present that Bitcoin usually experiences a mean of 170 days of destructive value fluctuations per yr. This common worth or stage gives perception into the stress threshold of the world’s largest cryptocurrency by market capitalization.

Supply: @joao_wedson on X

When the variety of destructive days approaches or exceeds this threshold of 170 days, as Bitcoin already did in 2025, fatigue units in among the many bears and promoting stress available in the market tends to subside. Wesson revealed that the main cryptocurrency has already amassed 171 destructive days by 2025.

On-chain specialists famous that crossing this threshold “strongly suggests” that Bitcoin value won’t see any extra destructive days within the closing weeks of 2025. Wesson mentioned if a deeper correction is imminent for market leaders, it’ll possible occur subsequent yr.

Nonetheless, because the Alpharactal founder emphasised, Bitcoin costs are more likely to finish the yr in a consolidated vary. Including additional credence to this assumption is the shortage of market demand, as seen within the decline in capital inflows to identify Bitcoin exchange-traded funds.

Bitcoin value overview

As of this writing, the value of BTC is round $89,397, reflecting a decline of simply 0.3% over the previous 24 hours.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView