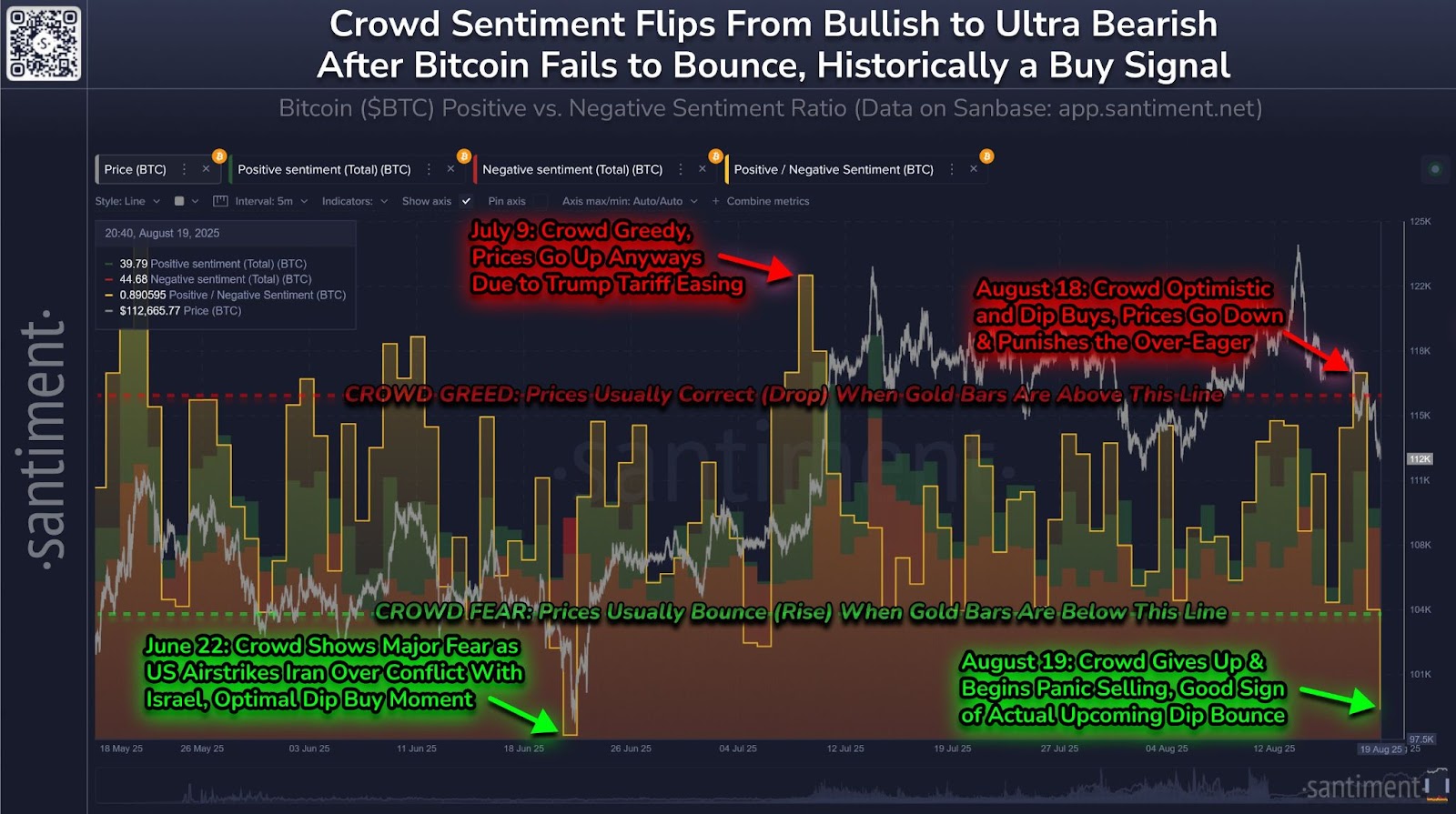

It seems that Retail Crypto merchants have hit a 17-day low and have turned one thing horrible the other way up as Bitcoin could not choose up themselves from a drop beneath $113,000 from their latest DIP.

“After Bitcoin failed to fulfill and fell beneath $113,000, the retailer went 180,” an analyst at blockchain analytics agency Santiment stated Wednesday.

Santiment additionally reported that the previous 24 hours marked “probably the most bearish emotions seen on social media” since June 22, when the concern of battle within the Center East brought about a cascade of panic promoting.

Nevertheless, Santimento stated unfavorable social feelings are good for dip patrons, particularly when “blood on the streets and concern is maximized.”

Additionally, short-term retailers usually tend to panic about promoting or scalp income than their Diamond Hand counterparts, who view their asset class as a long-term funding.

Santimento stated the panic sale is “a very good signal of dip bounce sooner or later.”

The group’s feelings became “Extremely Beash.” sauce: single

Bitcoin drops to assist zones

Bitcoin (BTC) fell to $112,656 in late buying and selling on Tuesday at Coinbase. Based on TradingView, the bottom value since August third fell to assist ranges at round $112,000.

BTC is presently 8.5% down from final week’s all-time excessive, exceeding $124,000, however Crypto’s complete market capitalization fell beneath $4 trillion, dropping to a two-week low.

Associated: Why does Bitcoin crash and $112K on the backside of the final?

In the meantime, Bitcoin’s Worry & Greed Index fell into “terror” with a ranking of 44 out of 100, the bottom stage since late June.

“The market strikes in the wrong way of crowd expectations,” Santimento stated.

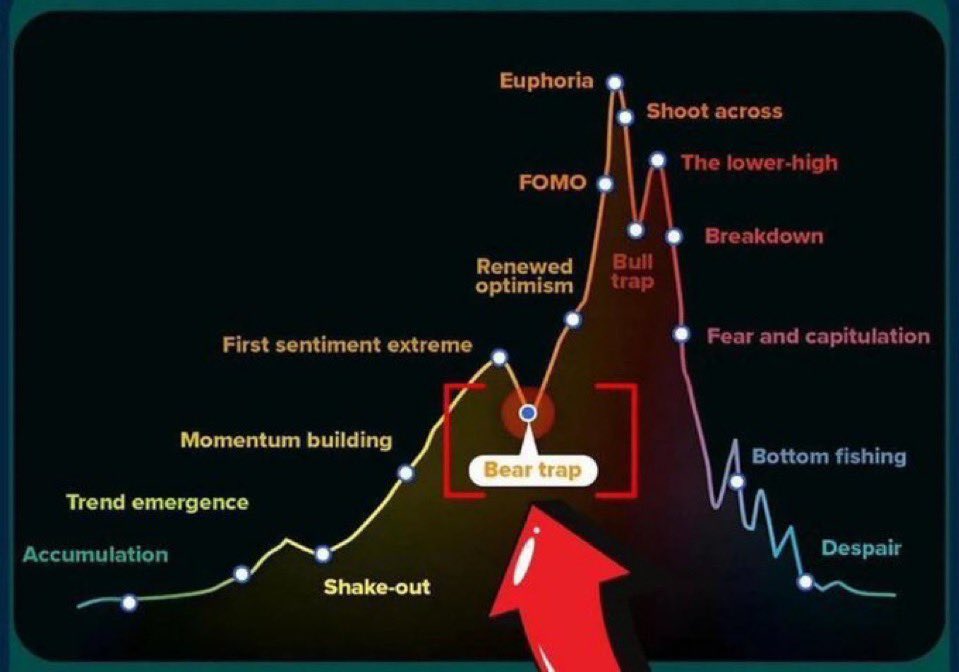

Does the historical past of the Bull Cycle rhyme?

Market revisions in the course of the bull cycle should not new, however slightly wholesome components of the bigger cycle. Comparable pullbacks, also known as “bear traps,” have occurred on the similar stage up to now few years of cycles.

Analysts share the chart extensively, displaying the “bear lure” revision on the similar stage in Bull Market Yr. sauce: Cyclop

Within the 2017 bull market 12 months, BTC was compensated 36% in September and reached a brand new peak three months later.

The same situation befell in September 2021, when BTC revised 23% earlier than it delivered the very best energy ever later that 12 months.

If historical past rhymes and there’s a related correction depth in 2025, BTC may pull again $90,000 subsequent month, as little as $90,000, if it follows the identical sample, earlier than recovering to a brand new historical past excessive.

journal: Coinbase is in search of “full-scale” Alt season, Ether Eyes $6K: Hodler’s Digest