Neobank Revolut launched a 1:1 trade between USD and stablecoins, permitting its 65 million customers to trade as much as $578,630 each 30 rolling days with out incurring charges or spreads.

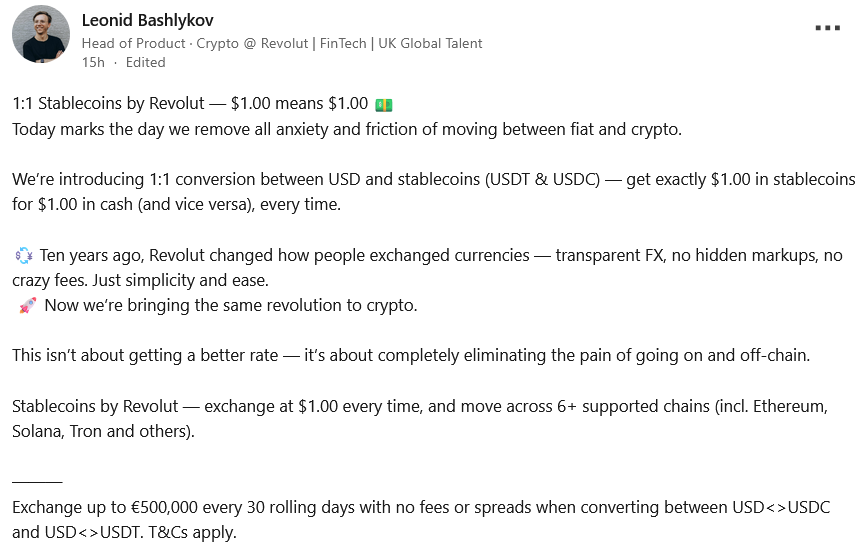

“At this time is the day to take away all of the nervousness and friction when transferring between fiat and cryptocurrencies,” Leonid Vasilikov, head of crypto merchandise at Revolut, posted on LinkedIn on Thursday.

“Revolut’s 1:1 stablecoin — $1 means $1.”

Revolut reported holding $35 billion price of property on behalf of its prospects in 2024, a rise of 66% from 2023, with month-to-month transactions on the platform additionally growing considerably.

Revolut’s providers will apply to Circle’s USDC (USDC) and Tether (USDT) throughout six blockchains, together with Ethereum, Solana, and Tron, Vasilikov stated.

This comes a couple of week after Revolut acquired a crypto asset market regulation license from the Cyprus Securities and Change Fee, permitting it to supply regulated cryptocurrency providers in 30 international locations which can be a part of the European Financial Space.

Vasilikov stated that one-to-one conversions usually are not meant to enhance charges, however to “fully take away the ache of transferring on-chain and off-chain.”

sauce: Leonid Vasilikov

In response to Vasilikov’s submit, Elbruz Yilmaz, managing associate at enterprise capital agency Outran, stated a one-to-one conversion would have a significant affect on small and medium-sized enterprises in international locations going through financial challenges, comparable to Turkey.

He famous that small and medium-sized companies lose vital worth once they should convert currencies such because the Turkish lira into US {dollars}, and losses are compounded by SWIFT charges and slippage when transferring funds throughout borders.

“Clear 1:1 ramps rework stablecoins from speculative property to working capital infrastructure. Quicker cycles. Much less trade hemorrhage. Higher monetary administration.”

Vasilikov stated that so long as the stablecoin stays pegged, Revolut will cowl the unfold internally to make sure prospects obtain a 1:1 price.

The UK-based financial institution has been providing cryptocurrency buying and selling since 2017 and at present helps over 200 tokens, in addition to the choice to pay with cryptocurrencies for on a regular basis purchases.

Western Union introduced its personal stablecoin plans this week

Earlier this week, cash switch platform Western Union introduced that it’ll introduce a stablecoin cost system on the Solana blockchain someday within the first half of 2026.

Associated: Ondo tokenizes over 100 US shares and ETFs on BNB Chain

The answer consists of the US Greenback Cost Token (USDPT), which Western Union plans to concern on associate cryptocurrency exchanges, and a digital asset community.

Zelle and MoneyGram are additionally making related strikes.

Final Friday, the father or mother firm of funds platform Zelle introduced it might introduce stablecoins to facilitate sooner cross-border funds, whereas MoneyGram introduced in mid-September that it might combine its crypto app in Colombia and provide a USDC pockets for native residents.

SWIFT (Society for World Interbank Monetary Telecommunication) can also be constructing a blockchain funds platform to assist the switch of stablecoins and tokenized property.

journal: Bitcoin OG Kyle Chasse is one shot away from being completely banned from YouTube