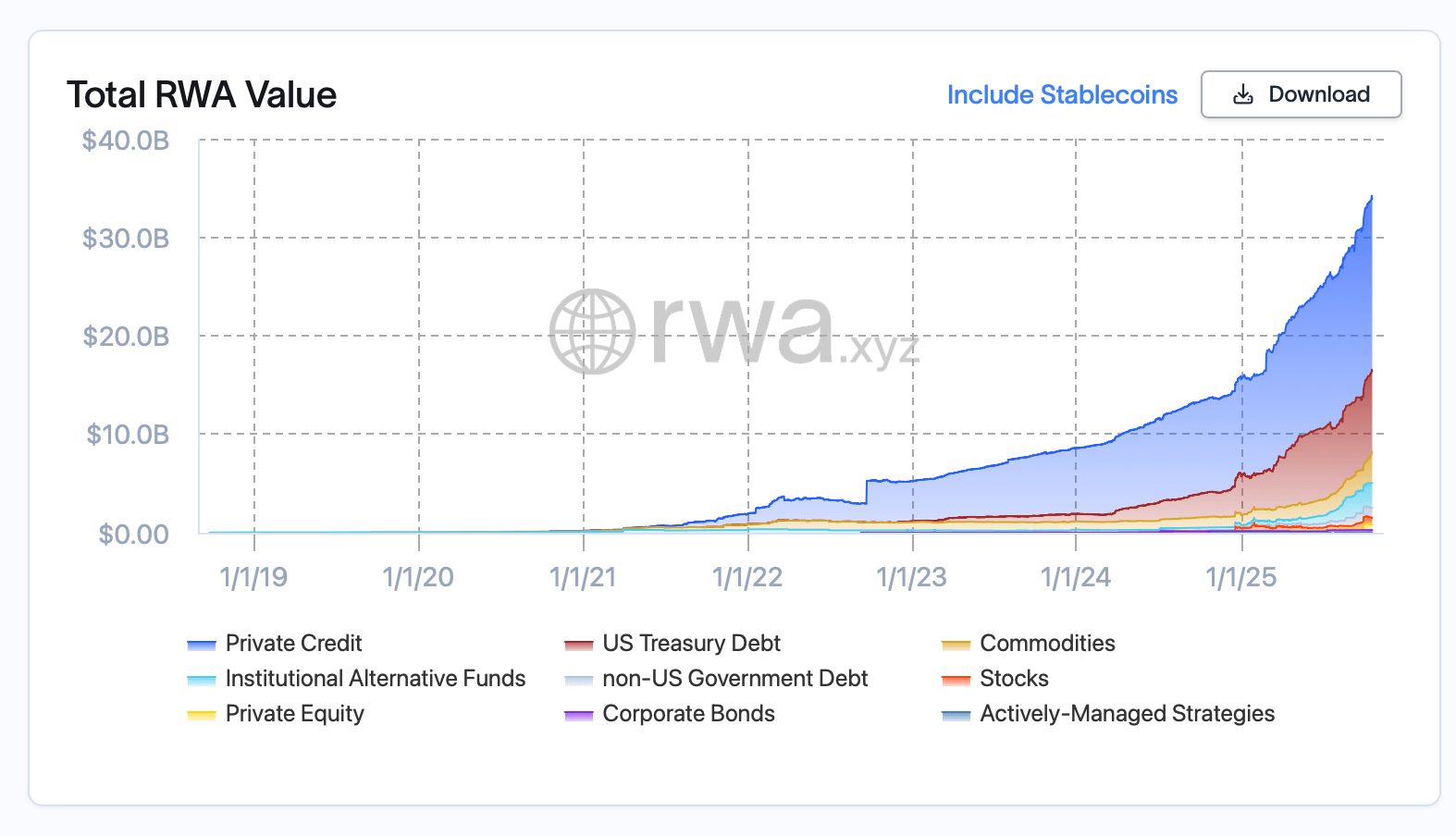

Based on rwa.xyz, tokenized actual world belongings (RWA) on public blockchains now complete $34.14 billion, a rise of 10.58% prior to now 30 days, and the area is on observe to succeed in the $35 billion mark.

BUIDL, XAUT, PAXG High RWA Belongings Headline Resulting from On-Chain Worth Development

RWA tokenization points blockchain tokens that characterize claims for off-chain merchandise (reminiscent of U.S. authorities bonds, commodities reminiscent of gold, institutional funds, non-public credit score, and equities) and permits them to be transferred and settled on public networks. Demand is pushed by 24/7 transferability, quicker funds, combinability with on-chain purposes, and entry to frictionless world liquidity with legacy rails.

Based on statistics from rwa.xyz, the variety of contributors within the present continues to develop. RWA has 489,037 asset holders, a rise of 6.71% in 30 days, and has a complete of 225 energetic issuers. In rwa.xyz’s multi-year breakdown, U.S. Treasuries and institutional merchandise lead by complete worth, with extra depth in commodities, company bonds, non-U.S. sovereign debt, and energetic administration methods.

Whole worth of tokenized actual world belongings (RWA) as of Sunday, October 19, 2025.

By blockchain, Ethereum was the main venue with a tokenized worth of $12.476 billion, a rise of 20.73% in 30 days and holding a market share of 58.24%. Zksync Period adopted with $2.365 billion (-2.46%, 11.04% share), adopted by Polygon with $1.138 billion (-3.74%, 5.31%). Arbitrum is up 122.3% (4.08% share) for the month and holds $874 million.

Avalanche $745.7 million (-0.56%, 3.48%), Aptos $724.8 million (+0.19%, 3.38%), Solana $699 million, $5.9 million (+5.04%, 3.25%), Stellar $636.4 million (+23.28%, 2.97%), and BNB Chain $515.4 million. (+14.99%, 2.41%), and XRP Ledger $362.1 million (+3.45%, 1.69%). The highest 20 shares by market capitalization of RWA belongings present that U.S. Treasuries proceed to be dragged together with gold-backed merchandise and institutional funds.

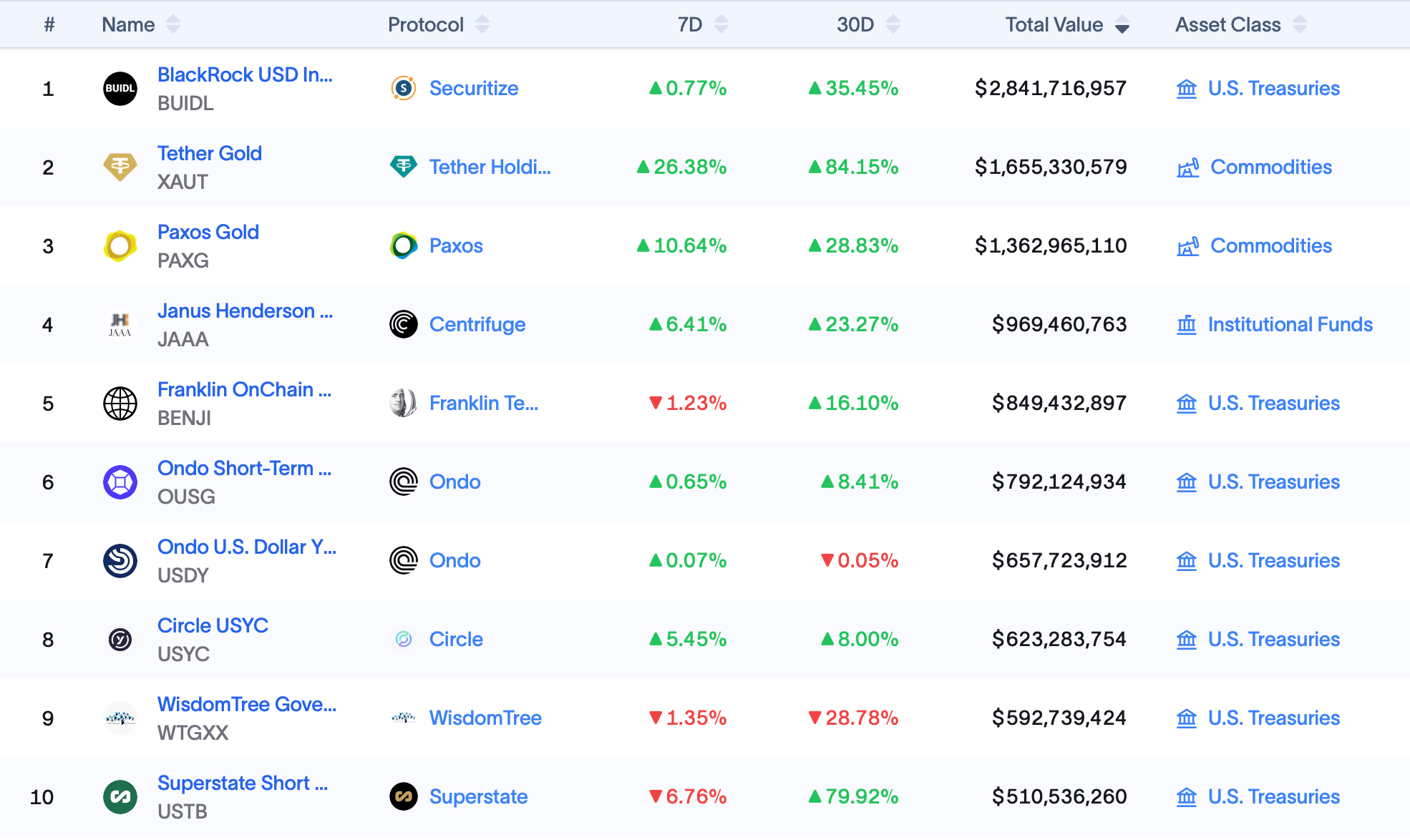

In authorities bonds, the BlackRock USD Institutional Digital Liquidity (BUIDL) Fund rose 0.77% in 7 days and 35.45% in 30 days to $2.84 billion. Franklin Templeton’s Franklin Onchain U.S. Authorities Cash Fund (BENJI) fell 1.23% for the week and rose 16.10% for the month to $849.43 million. Ondo Brief-Time period US Authorities Bond Fund (OUSG) rose 0.65% (7D) or 8.41% (30D) to $792.12 million. And the Ondo greenback yield (USDY) was virtually flat at $657.72 million at +0.07% (7D) and -0.05% (30D).

High 10 RWA belongings by market capitalization excluding stablecoins as of October 19, 2025.

Circle USYC (USYC) rose 5.45% (7D), 8.00% (30D) to $623.28 million. Superstate short-term US Treasuries (USTB) rose 6.76% (7D), 79.92% (30D) to $510.54 million. Janus Henderson US Treasuries (JTRSY) fell 14.67% (7D), 14.51% (30D) to $295.2 million. Constancy Digital Intermediate Treasury Bonds (FDIT) have been flat this week, rising 9.21% month-over-month to $222.45 million.

In Commodities, Tether Gold (XAUT) rose 26.38% (7D) and 84.15% (30D) to $1.66 billion, Paxos Gold (PAXG) rose 10.64% (7D) and 28.83% (30D) to $1.36 billion, JSOY OIL rose 2.00% (7D) and remained flat for 30 days. 313.34 million {dollars}. Authorities and non-US sovereign merchandise included China AMC USD (CUMIU) up 0.20% (7D, 30D) to $503.1 million, Spico EU Treasury Invoice (EUTBL) up 0.57% (7D), down 0.85% (30D) to $324.58 million.

Amongst institutional funds, Janus Henderson AAA (JAAA) is up 6.41% (7D) and 23.27% (30D) to $969.46 million, Blockchain Capital (BCAP) is flat this week and up 11.49% month-over-month to $404.96 million, and Superstate Crypto Money (USCC) is down 6.87% (7D) or extra. 10.81% (30D) to $253.64M, Legion Methods (LS) was flat on each time frames at $217.93M.

Fairness and personal market entries embody Exodus Motion EXODB, down 12.77% (7D) and flat month-over-month, to $480.97 million (Non-public Fairness), and Exodus Motion EXOD, down 12.77% (7D) and 14.80% (30D), to $223.37 million (Fairness). Taken collectively, these 20 devices exhibit how authorities bonds, gold, and institutional funds anchor the class, whereas area of interest exposures widen its breadth.

Structurally, RWA development follows a easy sample. Issuers wrap acquainted high-yield or reserve-style merchandise into tokens, custodians and trustees handle off-chain collateral, and protocols deal with main issuance and secondary funds. On-chain traders are in search of predictable yields (treasury bonds and institutional funds), inflation hedges (gold), and operational advantages reminiscent of quicker maturities, automated funds, and integration with decentralized finance (DeFi) primitives.

Though RWA spans many chains, liquidity remains to be concentrated the place institutional wrappers are mature and custody flows are established. This month’s vital progress, together with a rise within the variety of holders and a rise in issuer measurement, signifies a gradual, gradual uptake fairly than a short lived spike, with the $35 billion threshold now inside attain.

Ceaselessly requested questions 🧭

- What’s RWA tokenization? That is the issuance of blockchain tokens that characterize claims on off-chain belongings reminiscent of authorities bonds, gold, funds, and credit.

- Why is demand growing? Buyers are in search of 24/7 remittance availability, quicker funds, and integration with DeFi whereas sustaining publicity to the monetary merchandise they’re accustomed to.

- Which chain will lead? Ethereum leads in RWA worth with $12.48 billion and market share of 58.24%.

- What’s the present market measurement? Based on rwa.xyz, the overall quantity of on-chain RWA was price $34.14 billion, a rise of 10.58% in 30 days.