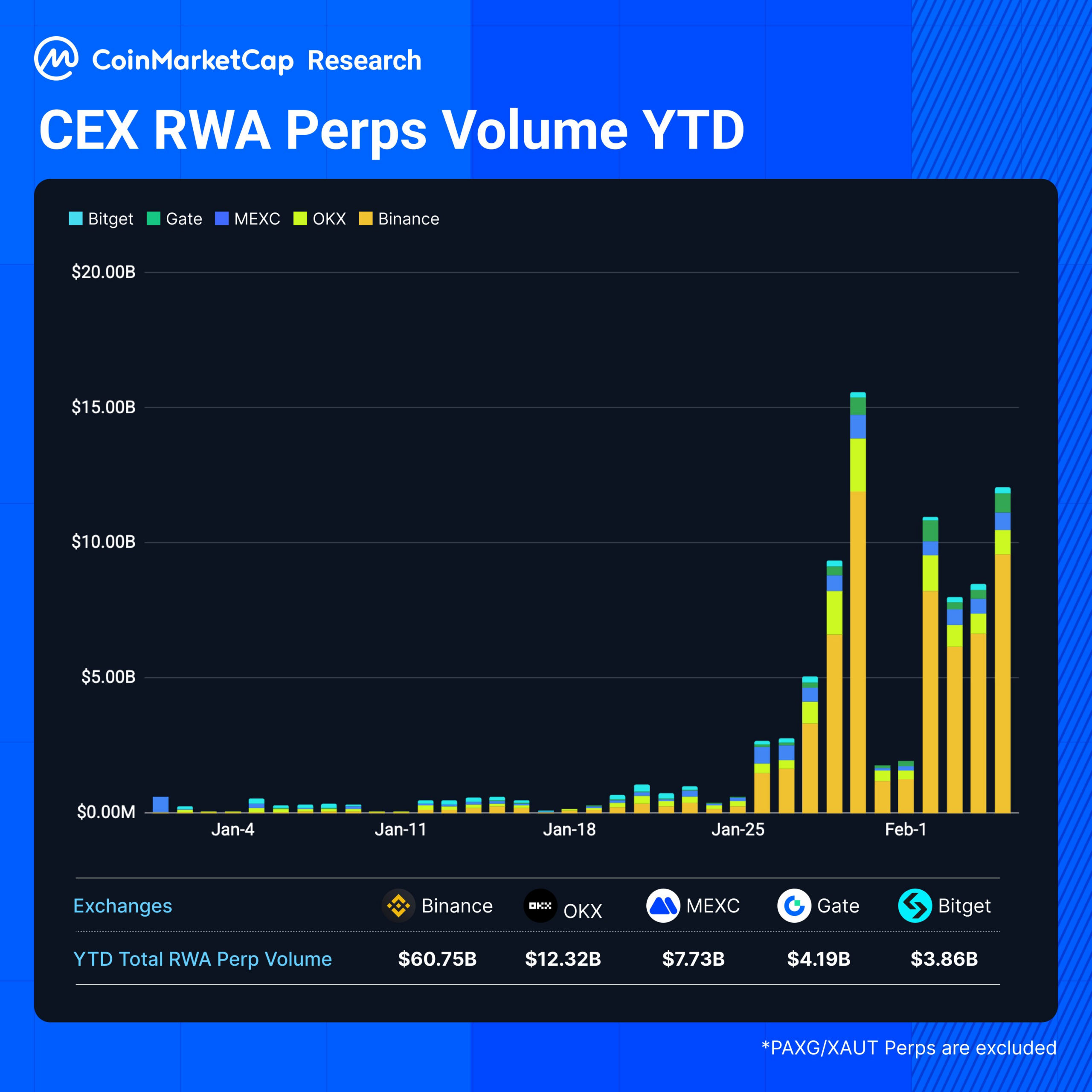

In accordance with a latest X publish on CoinMarketCap, there’s a mission that the RWA perpetual market is carving out a brand new sector within the wake of rising gold and silver costs. Over the previous two weeks, there was a major improve in bets on real-world items comparable to gold and silver utilizing crypto derivatives.

Supply: CoinMarketCap

Purps buying and selling quantity in RWA reportedly exceeded $15 billion as gold and silver reached an ATH of $5,500, or $121.64 per ounce, indicating that merchants are usually not solely testing these markets, however actively exploiting them.

RWA Perpetual is a crypto contract that permits customers to guess on the value of RWA comparable to gold and silver 24/7 with no expiry date. Not like shopping for digital tokens that symbolize actual property, merchants merely commerce based mostly on value actions, just like buying and selling Bitcoin perpetual swaps.

On some crypto exchanges, the day by day buying and selling worth of silver perpetual swaps is sort of as excessive as conventional COMEX silver futures. This exhibits that blockchain-based derivatives for real-world items are gaining mainstream acceptance.

Associated: Brazil leads international RWA revolution: reaching $100 million milestone in 2026

Increasing RWA with Gold and Silver

On January fifth and January seventh, Binance started permitting merchants to invest with gold and silver (XAU, XAG) perpetual contracts in opposition to USDT by way of approved regulated entities on the Abu Dhabi International Market. It’s now the popular platform for merchants who use perpetual contracts to guess on gold and silver value actions.

Alongside Binance, a number of different crypto buying and selling platforms additionally supply related companies. MEXC began providing gold and silver futures buying and selling with no buying and selling charges, HyperLiquid noticed a surge in gold and silver buying and selling exercise, and Aster DEX had already listed steel perpetual buying and selling and in addition had a rewards program incentivizing customers to commerce gold-silver perpetual swaps.

On Hyperliquid, the day by day buying and selling quantity of the valuable steel PERP exceeds $1.3 billion, making silver probably the most traded property after Bitcoin.

International financial components prompted important fluctuations in gold and silver costs in early 2026. Not like conventional markets that shut in a single day or on weekends, crypto perpetual buying and selling permits merchants to guess on and hedge in opposition to these value actions across the clock, making it enticing to a variety of market individuals.

Estimates recommend that the tokenized asset market might finally attain trillions of {dollars} by the tip of the last decade. In one among its older stories, international consulting agency McKinsey predicted that the market capitalization of tokenized property might attain $2 trillion by the tip of 2030.

Associated: What are RWA’s efficiency and future prospects in 2026?

Disclaimer: The knowledge contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version is just not accountable for any losses incurred because of the usage of the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.