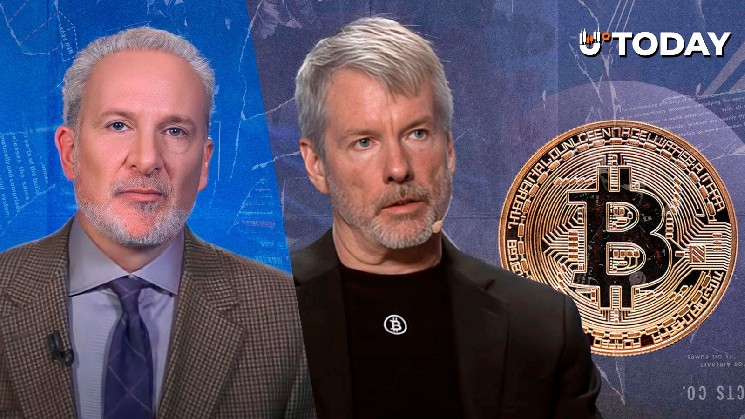

Peter Schiff is slammed In Michael Saylor’s Bitcoin MENA keynote, he declared that Technique (previously MicroStrategy) will purchase up each out there Bitcoin.

This comes after the corporate not too long ago introduced its largest Bitcoin buy. in just a few months.

purchase all

In his keynote deal with on the Bitcoin MENA convention, Thaler mentioned MicroStrategy’s purpose is to purchase as a lot Bitcoin as doable: “We’ll purchase every thing.”

The speech lasted roughly 45 minutes and was attended by greater than 10,000 individuals, together with Center Japanese sovereign wealth fund representatives, bankers, household workplaces, and hedge fund managers.

Saylor’s presentation was imagined to be a blueprint for reworking the area into a world hub for monetary infrastructure “backed by Bitcoin.” He described Bitcoin as digital vitality, a “scarce programmable asset that may energy a brand new period of financial sovereignty.”

additional criticism

In one other social media put up, Schiff additionally criticized Michael Saylor’s framework for changing Bitcoin as “digital capital” into “digital credit score” by way of MicroStrategy’s most well-liked inventory.

The inventory is backed by the corporate’s 650,000 BTC holdings, acquired at a mean price of $74,000 per coin, and generates an 8% perpetual dividend.

Schiff argues that Saylor’s 8% yield Bitcoin financial institution solely works within the head.

Yield comes from the everlasting rise within the value of Bitcoin. If Bitcoin stops rising in worth, your complete technique might collapse. So behind the “yield” there are not any belongings that produce precise money flows, which reinforces Schiff’s criticism.