Securitize, a real-world asset tokenization platform, has introduced a tokenization fund designed to present buyers on-chain entry to AAA-rated loan-backed mortgage obligations.

The fund is being developed in partnership with world funding financial institution BNY Mellon. In line with Wednesday’s announcement, BNY will safeguard the fund’s underlying property and a subsidiary of the financial institution will handle the fund’s portfolio.

As world loan-backed securities issuance exceeds $1.3 trillion, Securitize and BNY goal to carry AAA-rated floating fee credit score on-chain, the corporate mentioned.

Pending governance approvals throughout the Sky ecosystem, Grove, an institutional grade credit score protocol, plans to anchor the fund with a $100 million allocation.

Tokenization is the method of changing real-world property, resembling shares, actual property, and debt, into digital tokens recorded on a blockchain.

Securitize CEO Carlos Domingo mentioned the launch is “a serious step in direction of making high-quality credit score extra accessible, environment friendly and clear by way of digital infrastructure.”

The announcement follows Domingo’s Oct. 28 feedback to CNBC through which he revealed Securitize’s plans to go public by way of a merger with clean verify agency Cantor Fairness Companions II.

Associated: Tokenization platform tZero is eyeing an IPO in 2026 amid a surge in cryptocurrency listings

Tokenization of monetary merchandise is quickly growing

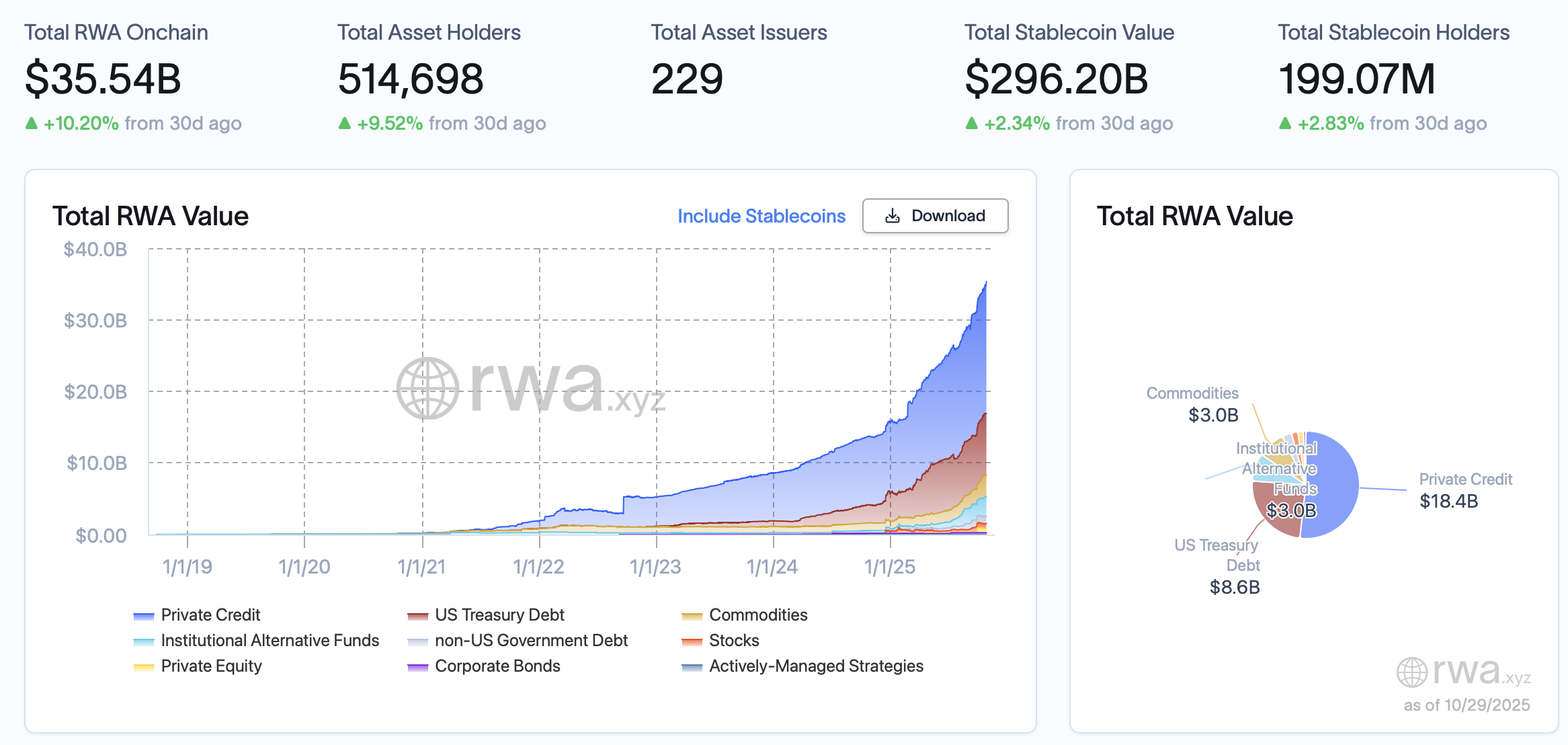

Because the tokenization of real-world property accelerates, with greater than $35.5 billion at the moment represented on-chain, in line with RWA.xyz, the method is quickly increasing to incorporate a wider vary of conventional monetary devices.

Whole on-chain RWA. sauce: RWA.xyz

Ondo Finance introduced in January that it could launch a tokenized US Treasury fund on the XRP ledger, permitting buyers to realize publicity to institutional authorities bonds with the choice to redeem their holdings utilizing stablecoins. The fund started operations in June.

In July, Grove partnered with blockchain infrastructure platform Centrifuge to launch two Janus Henderson tokenized funds on Avalanche.

That very same month, Centrifuge partnered with S&P Dow Jones Indices to tokenize the S&P 500 index, bringing the benchmark on-chain for the primary time.

journal: Solana vs. Ethereum ETF, Influence on Fb’s Bitwise: Hunter Horsley