Sharplink is making a daring transfer to strengthen the Ethereum Treasury Division. In response to LookonChain information, Sharplink has transferred $145 million in USDC to Galaxy Digital’s OTC pockets.

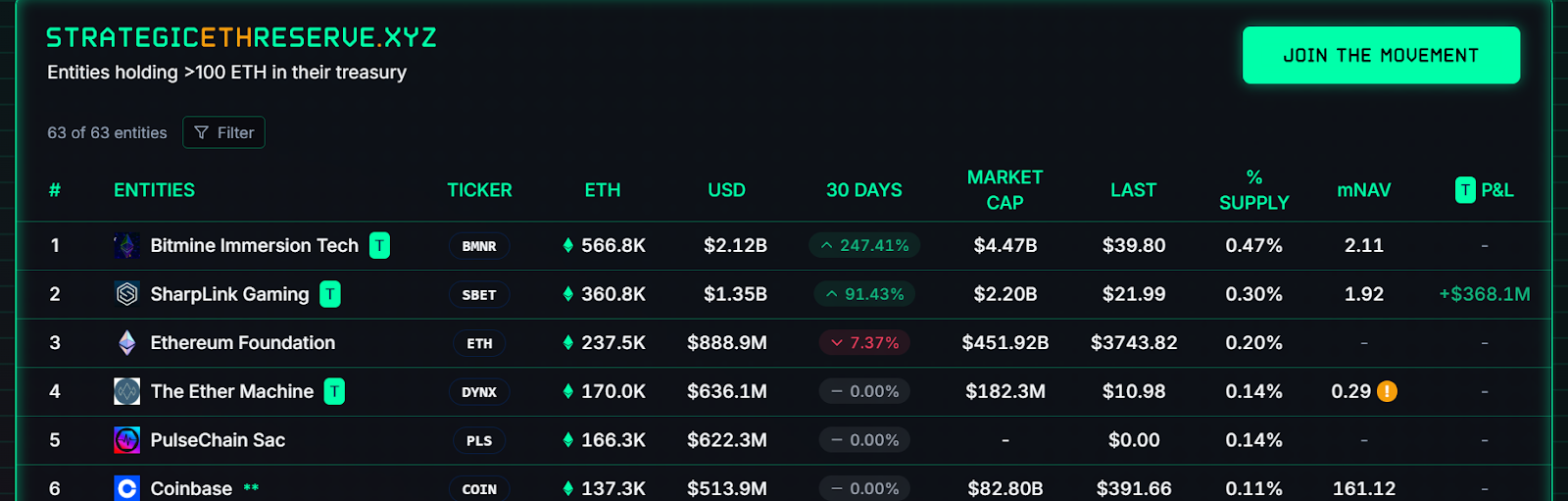

Bitmine Immersion not too long ago introduced a large buy of 566,776 ETH, over $2 billion. Presently, it has surpassed Sharplink’s ETH stash and has achieved the best place amongst company ETH homeowners.

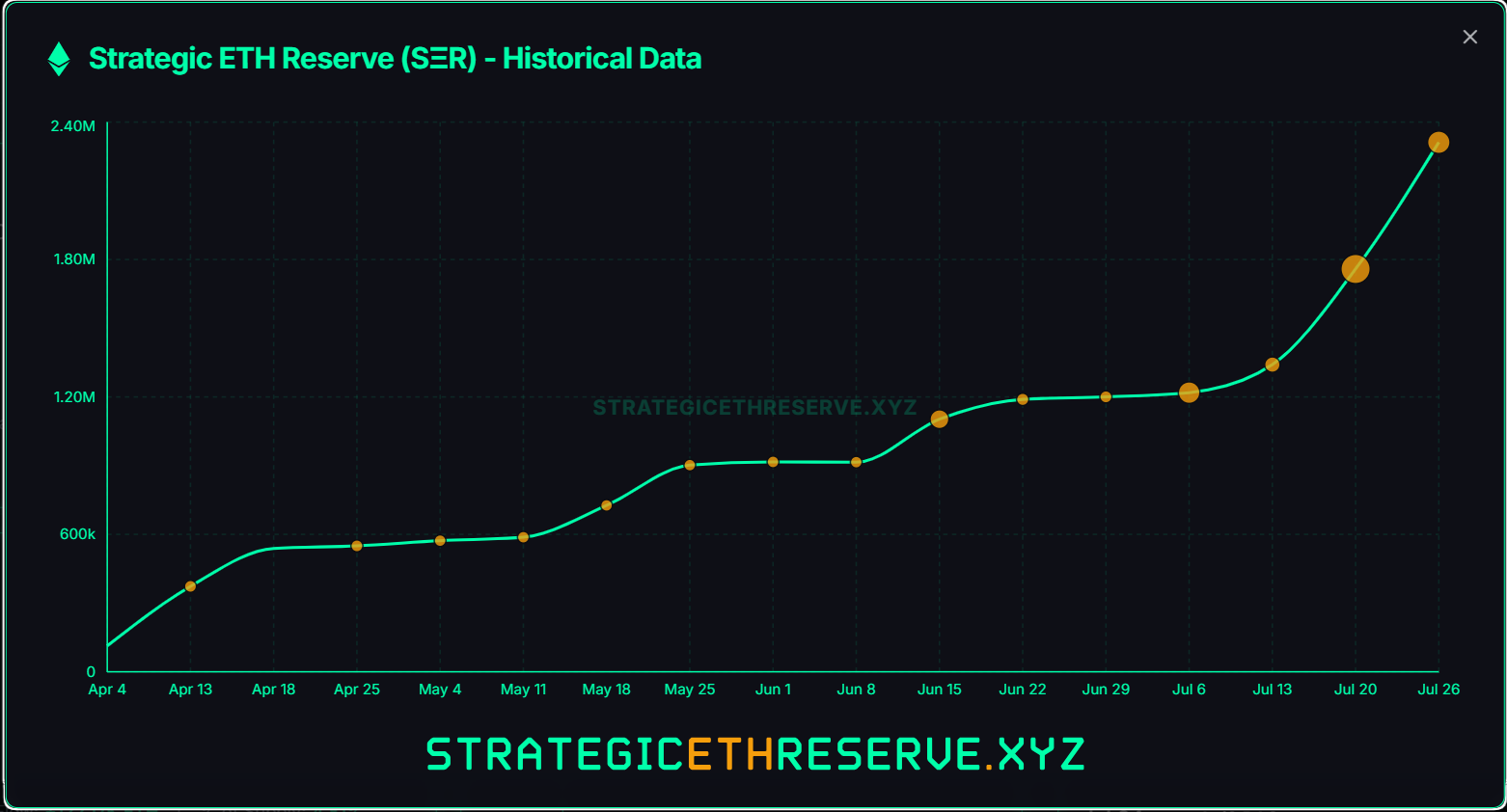

A complete of two.31 million ETH, value $8.65 billion, is held in strategic reserves by 63 members, accounting for 1.92% of Ethereum’s complete provide. The Ethereum Treasury Division has surged from $23 million to $8.6 billion in only a few months. Bitmine and Sharplink are main the costs, supported by Tom Lee and Joseph Lubin of Crypto Heavyweights. ETH Treasury is genuine and accelerates shortly.

The inflow of Ethereum ETFs has additionally been doing nice currently. BlackRock’s Ethereum ETF (ETHA) is in tears, including $430 million value of 120K ETH on Friday alone, pushing its complete inventory to about 3 million ETH. Spot ETH ETFs have posted a major 16 consecutive days of inflows and a major consequence of Bitcoin ETFs.

Whale and recent wallets promote ETH surges

The recent pockets is in the course of buying as 42,788 ETH, value $159 million, was added at this time alone. Since July 9, eight new wallets have scooped up 583,248 large ETH value $2.17 billion. Analyst Ali Martinez additionally notes that whales have been piled up over the previous two weeks because the whales snapped 113 million ETH value an astounding $4.18 billion.

He additionally shared that 170 new whales, holding over 10,000 Ethereum, have joined the community over the previous month. This can be a robust indication of rising institutional curiosity.

170 new whales, holding over 10,000 Ethereum $ETH, have joined the community over the previous month. This can be a robust indication of rising institutional curiosity! pic.twitter.com/q06hrhx9ie

– Ali (@Ali_Charts) July 26, 2025

Is $5,000 subsequent?

The availability held by Ethereum whales is soaking, however costs proceed to rise. That is an important shift since June 2025. Not like the February pump, this development reveals more healthy and sustainable progress, not pumps by a couple of main gamers.

Ethereum rose 24% this week and 56% this month. Inflow of robust establishments, with main Treasury buying and recording demand for ETFs, analysts be aware that $5,000 is not too far-off if TH helps and helps zones between $3,800 and $4,000.