After a risky week centered across the Black Friday sell-off, Bitcoin (BTC) costs have fallen about 2.3% over the previous 24 hours, buying and selling round $108,800. Nevertheless, whereas the worth remains to be struggling to get better, short-term holders (STH) appear to be shopping for on the dip, and the scale of their purchases might come into query quickly.

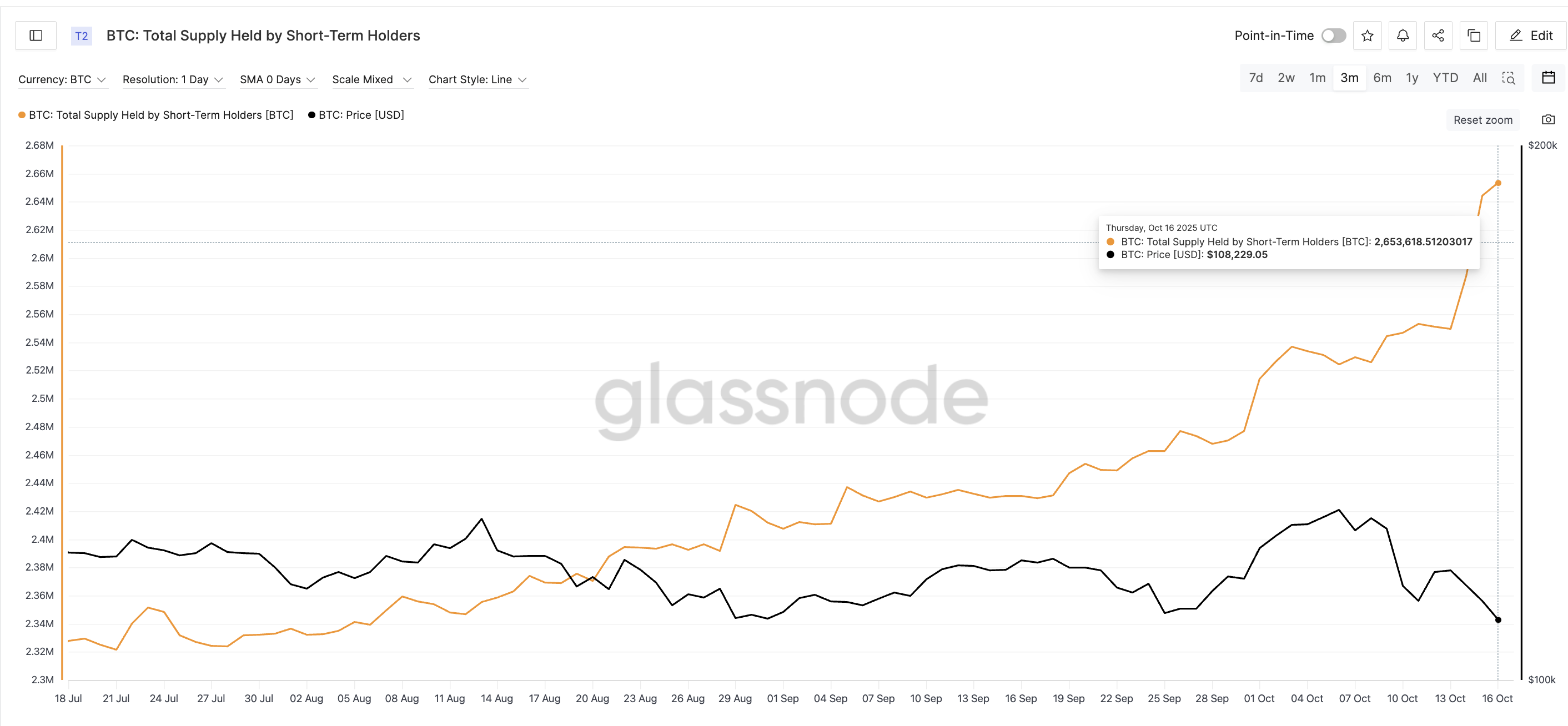

This sudden buildup, seen shortly after the Oct. 10 correction, suggests rising optimism, regardless that the general pattern stays cautious. However that is not all. The buildup pattern in STH is now in keeping with technical validation, suggesting a possible rebound in Bitcoin value, if not an uptick.

Brief-term holders soak up declines as losses widen

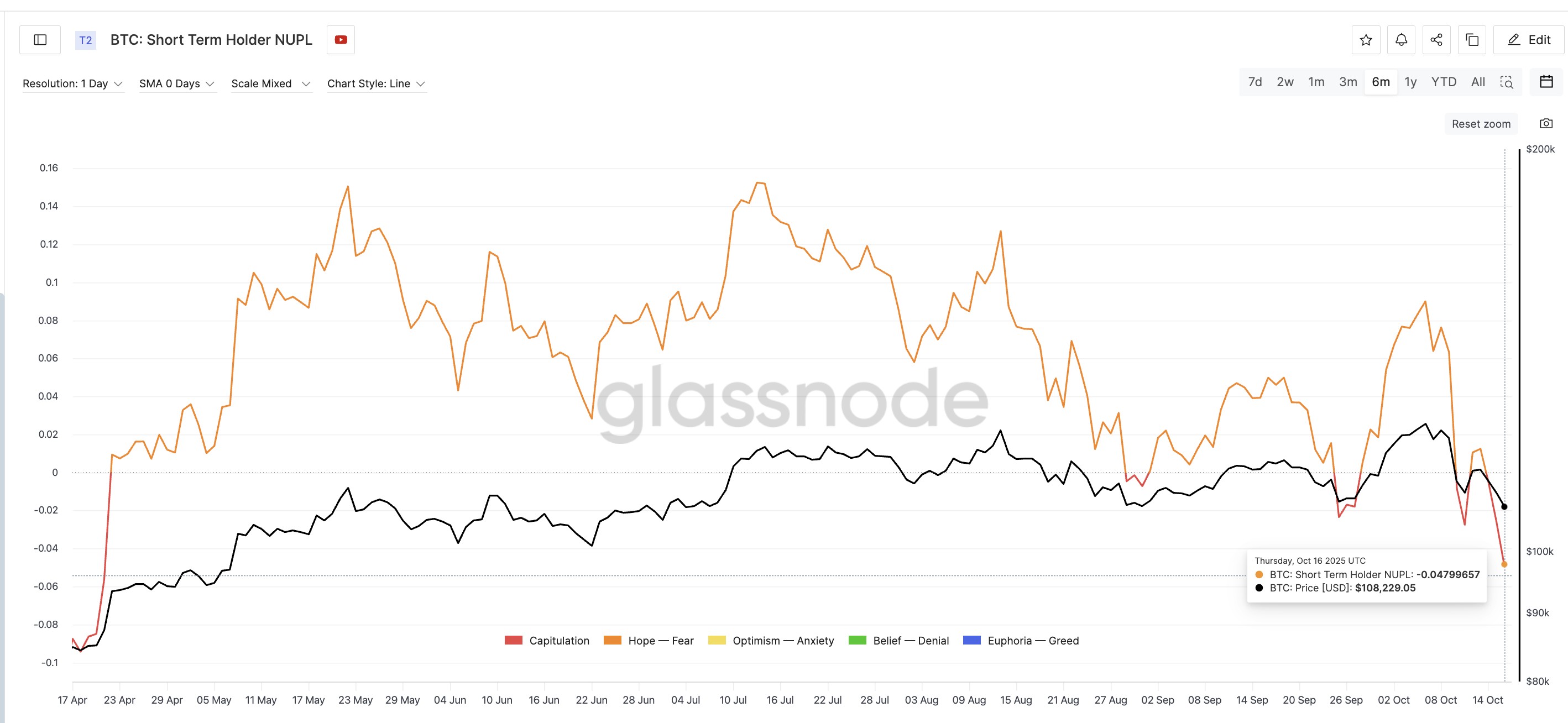

Brief-term holders’ internet unrealized good points and losses (NUPL), a measure of whether or not latest consumers are making a revenue or shedding cash, fell to -0.04, the bottom degree since April 20, 2025. Unfavourable values imply that almost all short-term holders are in losses, which frequently alerts that the market will attain a backside or start an early restoration as promoting strain eases.

Need extra token insights like this? Join editor Harsh Notariya’s each day crypto e-newsletter right here.

Brief-term Bitcoin holders are at a loss: Glassnode

Comparable lows have precipitated speedy rebounds earlier than.

- On September twenty fifth, when NUPL reached -0.02, Bitcoin rose 4.9% from $109,000 to $114,300 in simply 4 days.

- On October eleventh, NUPL fell once more to -0.02 and BTC rose 4.1% from $110,800 to $115,300 inside three days.

Now, as NUPL has fallen additional and losses have widened additional, short-term holders look like doubling down as an alternative of exiting.

In line with Glassnode, the full provide held by short-term holders (STH) has surged from 2.54 million BTC on October 13 to 2.65 million BTC as of October 16, a rise of 4.3% in simply three days. This rise signifies that short-term merchants added round 110,000 BTC (roughly $12 billion at present BTC costs), exhibiting energetic shopping for regardless of the drop. Moreover, STH provide is at a three-month excessive on the chart regardless of the worth weak point, indicating near-term confidence.

Brief-term BTC holders purchase any dip: Glassnode

This mix of unfavorable NUPL and growing provide sometimes signifies a part of quiet accumulation as short-term holders place for a possible rebound.

Bitcoin value nonetheless ready for affirmation — 7% rally required for breakout

Bitcoin’s 4-hour chart reveals that BTC value is forming a descending wedge. This can be a sample the place decrease highs and decrease lows are compressed right into a slender boundary, typically resulting in a bullish breakout.

Since October eleventh, BTC has been making lower cost lows, whereas the Relative Power Index (RSI), which measures the pace and power of value actions, has been making larger lows. That is known as a bullish divergence and is a technical sign indicating that momentum could also be trending upward.

For a rebound to be confirmed, Bitcoin would want to rise round 7.4% to flee the wedge above $115,900. Earlier than that, value wants to shut above $112,100 and $113,500, the 2 resistance zones which have rejected latest restoration makes an attempt.

Bitcoin Worth Evaluation: TradingView

If Bitcoin breaks above $115,900, it might pave the way in which to the subsequent main resistance degree at $122,500. Nevertheless, if the help at $107,200 fails, BTC might fall again to the cycle backside close to $102,000.

The short-term state of affairs is obvious. Brief-term holders are shopping for closely, momentum is steady, and key technical patterns recommend reassurance. Nevertheless, for this to develop right into a rally, Bitcoin would want to carry $107,000 and shut above $115,900. These two ranges will decide whether or not this $12 billion wave of purchases turns into one thing greater.

The publish Brief-Time period Bitcoin Holders Add $12 Billion After Crash – Is It Sufficient to Trigger a Worth Rally? appeared first on BeInCrypto.