Bitcoin costs have been traded almost $113,600 on the time of press, however have fallen 1.3% over the previous 24 hours. Whereas many merchants are anxious that costs will proceed to slide, a bunch of traders have proven indicators {that a} short-term bounce could also be on the way in which.

These patrons are quietly rising their holdings and accepting losses. A sample the place costs have been rebounded beforehand. Their actions might as soon as once more point out that the worst of this dip might already lie behind us.

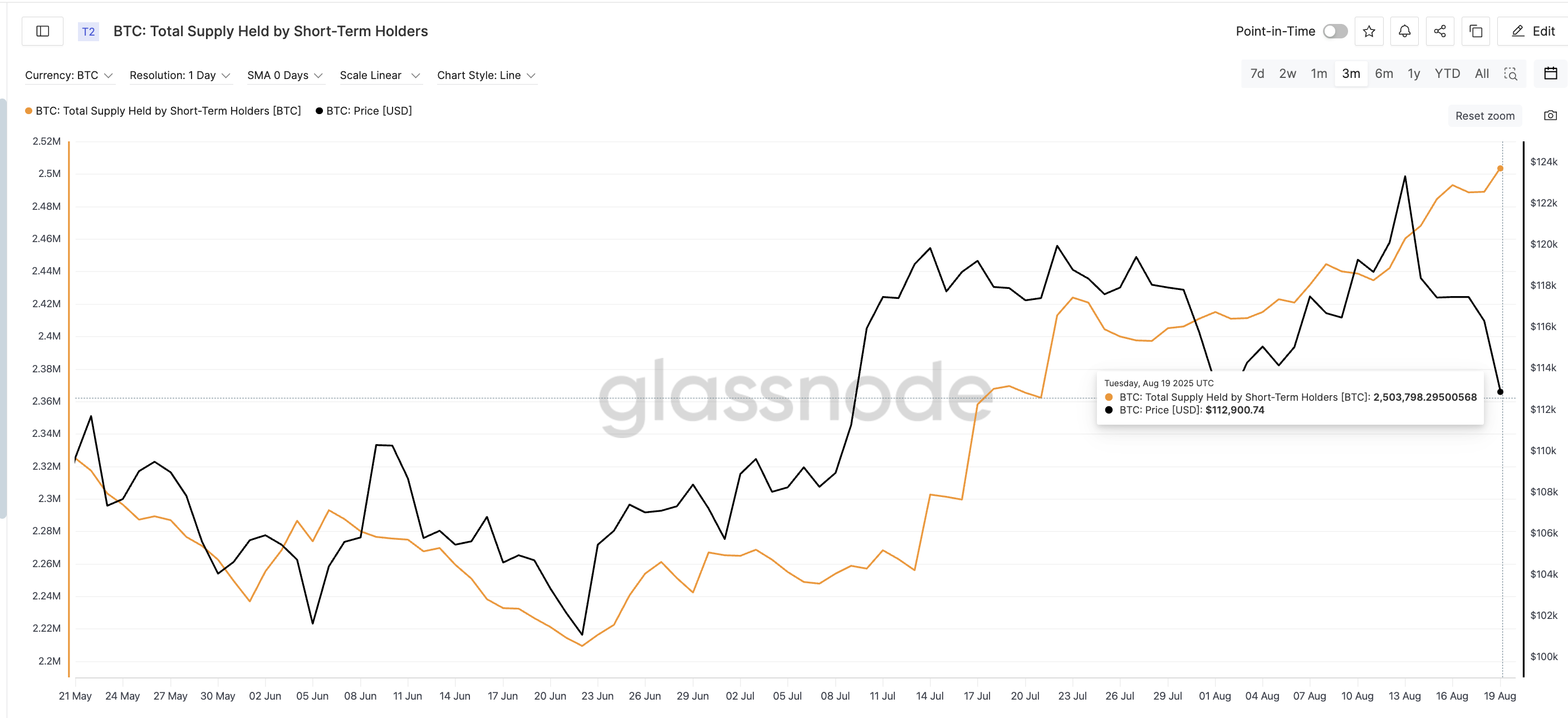

Quick time period holders are nonetheless shopping for dip

Pockets, a short-term holder that acquired Bitcoin throughout the final 155 days up to now few days, has elevated its provide at the same time as costs drop. Presently, the group holds 2,503,798 BTC from 2,460,514 BTC simply seven days in the past.

Which means that over 43,000 BTC accumulates throughout a sudden worth adjustment of between $123,000 and $112,000. Apparently, short-term holder provide is at present at a peak of three months.

Bitcoin Value and Quick-Time period Holder Provide: GlassNode

This development displays an analogous sample seen in early June. On the time, when Bitcoin costs fell from $105,900 to $104,700, short-term holders raised their provide from 2,275,000 BTC to about 2,287,000 BTC. After that accumulation, Bitcoin worth rose to $110,000.

This repetitive conduct is usually seen as a present of confidence in short-term bounce as new holders improve publicity throughout worth drops.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s each day crypto e-newsletter.

I misplaced it and offered it, however nonetheless purchased it

On the identical time, short-term holders are displaying their willingness to incur losses to purchase new BTC dips until they anticipate rebounds.

Quick-term holders fell to the bottom level on August 18th in additional than a month. Which means that the cash spent by this group had been offered for lower than they had been acquired. Merely put, they’re at a loss.

At press, the SOPR stays under 1.

SOPR, or used output revenue margin is METRIC compares the worth at which Bitcoin was on sale with the worth bought. A brief-term holder’s SOPR under 1.0 signifies that this group is on common reaching losses.

Quick-term Holder SOPR drops to month-to-month lows on August 18th: Encryption

That is usually thought-about a backside sign. In early August, an analogous SOPR drop (from 1.00 to 0.99) occurred simply earlier than Bitcoin reversed from $114,000 to a brand new excessive of almost $123,000. On the time, it was proven that short-term holders had surrendered by shedding and promoting. Shake-out required earlier than the rally begins.

Whereas some holders settle for the losses, the general provide between short-term wallets remains to be rising. This mix suggests emotional modifications, though in some instances, whereas extra patrons are intervening. It isn’t a panic sale.

Bitcoin worth restoration is at one stage

Bitcoin costs are nonetheless beneath stress, however there are indications that the reversal may very well be taking form. Costs fell simply $113,600 at present, down 1.3% on the 24-hour chart. The final word help is round $111,900. If that stage is achieved, restoration might start instantly.

Bitcoin Value Evaluation: TradingView

The benefit is that instant resistance is round $114,600. The following vital hurdles are $116,715 and $118,197. The latter is one of the best vital pivot of the earlier swing. A clear breakout of over $118,200 will affirm that momentum is within the bull’s favor.

This precise short-term holder setup has usually marked a neighborhood backside when short-term provide and destructive SOPR will increase occurred. Earlier instances have led to greater than $10,000 gatherings inside just a few days.

If the present sample is repeated, the worth of Bitcoin could also be prepared to extend one other push. Nevertheless, if it drops and loses the $111,900 stage, deeper corrections might proceed, invalidating the bullish speculation.

The short-term holder submit signalling Bitcoin rebound with offensive purchases first appeared on Beincrypto.