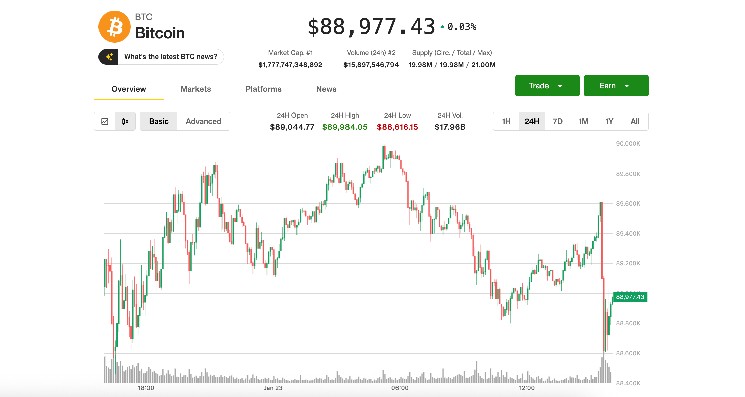

Bitcoin BTC$89,682.56 Friday’s U.S. buying and selling opened with one other sharp decline, falling to $88,500 and pushing silver above $100 an oz for the primary time in historical past, whilst treasured metals costs proceed their torrid rally. Gold is just under $5,000 an oz, whereas platinum soars 5% to a brand new all-time excessive. Though it’s not a treasured steel, at this tempo it could quickly change into a treasured steel. Copper rose 2.5%, just under its all-time excessive.

Cryptocurrency-related shares additionally fell. Coinbase (COIN) fell 2.6% and Technique (MSTR) fell 1.2%. Bitcoin miners Riot Platforms (RIOT) and MARA Holdings (MARA) fell 2%.

The drop in cryptocurrencies additionally meant that U.S. shares erased early losses and had been totally on the rise, with the Nasdaq rising 0.4% whilst Intel (INTC) fell 15% after earnings.

The corporate exceeded fourth-quarter revenue expectations, however was dissatisfied in its first-quarter outlook, due partly to AI chip provide constraints. The inventory value has elevated 17% because the starting of the 12 months.

Bitcoin within the US falls

CoinDesk senior analyst James Van Straten famous that when Bitcoin hit $98,000 final week, its cumulative return this 12 months throughout the U.S. buying and selling interval was as excessive as 9%. Since then, its return has fallen to simply 2%, highlighting weak point in demand. BTC From US buyers. This coincided with giant outflows from US spot Bitcoin ETFs, with buyers withdrawing greater than $1.6 billion over the previous 4 periods.

Jasper de Meere, desk strategist at crypto buying and selling agency Wintermute, famous a latest improve in stablecoin redemptions into fiat currencies, suggesting that some institutional buyers who re-entered the market earlier this 12 months might now be exiting.