Bitwise CEO Hunter Horsley says Solana might have the benefit over Ethereum within the staking change commerce fund (ETF) market.

Talking to Andrew Fenton, editor of Cointelegraph at Token 2049 in Singapore, Horsley argued that Solana’s speedy staking interval has a bonus over Ethereum for staking merchandise. Ethereum’s withdrawal queue has not too long ago reached a brand new excessive, however Solana is cleared quicker than typical. Horsley mentioned the distinction is necessary for issuers who want to have the ability to rapidly return property to buyers.

“That is a giant downside,” Horsley mentioned. “ETFs want to have the ability to return property in very brief time frames. So it is a massive problem.”

Staking helps you lock cryptocurrency and defend your community in change for rewards paid with the identical token. With property locked, withdrawals can face delays as they fluctuate primarily based on community demand.

https://www.youtube.com/watch?v=_gbfudrmny0

Horsley identified that Ethereum-based merchandise can keep away from this concern. For instance, Ethereum’s Staking Trade Commerce Merchandise (ETPs) from Bitwise in Europe use a credit score line to maintain the redemption fluid liquid. Nonetheless, such services are at a price, and there are “capability constraints,” he mentioned.

Another choice is liquid staking tokens reminiscent of Lido Steth. This represents a piling-driven property, permitting buyers to take care of the liquid whereas incomes rewards.

Horsley’s feedback got here after Ethereum’s staking entry queue rose to 860,369 ETH in early September, the very best stage since 2023.

The ETH staking queue is at present 201,984 ETH, with a mean latency of roughly 3 days. Based on OnChain knowledge, the exit queue is about 34 days, and over 2 million pile tokens are ready to be withdrawn in about 34 days.

Associated: Add staking for NASDAQ file utility BlackRock ISHARES ETH ETF

Sol and Eth ETFs face an October deadline

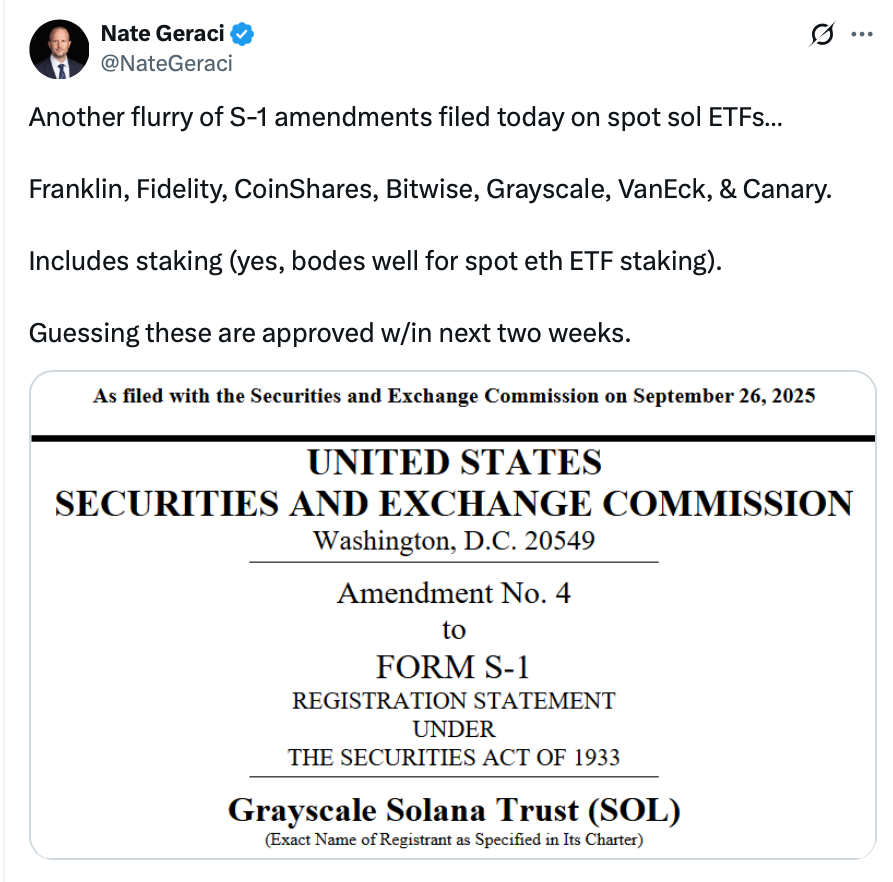

The Securities and Trade Fee (SEC) plans to determine on a number of pending functions for Solana and Ethereum Trade Gross sales Funds within the coming weeks, together with proposals with staking capabilities.

Amongst them are Bitwise, Constancy, Franklin Templeton, Coinshares, Grayscale Investments, Canary Capital, and Vaneck Solana ETFs. All of those have submitted an amended S-1 doc to SES to replace the staking provisions of present funds in SES.

sauce: Nate Gelach

In August, the SEC delayed its determination to approve ether staking for 2 ETFs from grayscale to the top of October.

Silent approval of BlackRock’s iShares Ethereum Belief was additionally pushed again on October thirtieth.

As Cointelegraph not too long ago reported, 16 crypto-related funds await a call from the SEC this month.