Solana blockchain recorded $1.6 trillion in spot transaction quantity in 2025. This determine equates to a world market share of 11.92%, surpassing main crypto exchanges resembling Bybit, Coinbase, and Bitget.

Solana, a high-performance sensible contract platform, recorded $1.6 trillion in spot buying and selling quantity on decentralized exchanges in 2025. Based on on-chain knowledge, this quantity represents 11.92% of worldwide spot market buying and selling quantity. The community’s buying and selling quantity exceeded that of all main exchanges, together with Coinbase, Bitget, and Bybit.

Solana’s spot buying and selling quantity is second solely to Binance and better than all CEX, L1, and L2

🚨Breaking Information: In 2025, @Solana will file roughly $1.6 trillion in buying and selling quantity, surpassing all L1, L2, and main centralized exchanges besides Binance.

Solana additionally surpassed Bybit, Coinbase International, and Bitget in whole buying and selling quantity in 2025. pic.twitter.com/jaKJSe1bpl

— SolanaFloor (@SolanaFloor) January 5, 2026

The community’s spot buying and selling quantity was solely behind Binance, which handles $7.27 trillion, accounting for 55.11% of the worldwide spot market. Binance’s market share has decreased considerably from the 80% recorded in 2022. Solana’s buying and selling quantity additionally exceeded the confirmed buying and selling quantity on all L1 and L2 platforms, together with Ethereum, Binance Good Chain, and extra.

knowledge Open-source DeFi knowledge aggregator DefiLlama exhibits that Solana’s buying and selling quantity peaked in January 2025 at $313.26 billion. March was the slowest month for DEX exercise, however Solana nonetheless led L1 and L2 with $79.73 billion. The information additionally exhibits that Solana had greater than $100 billion in buying and selling quantity in 9 of the 12 months this 12 months.

Ethereum recorded a complete buying and selling quantity of $950 billion in the course of the 12 months. Blockchain transaction quantity peaked in August and September, reaching greater than $100 billion every month.

Based on Artemis researcher ZJ, Solana was ranked fifth amongst main centralized exchanges only a 12 months in the past. Researchers attribute Solana’s improve in on-chain exercise to its proprietary automated market maker (propAMM) and central restrict order e book (CLOB), which have performed a pivotal position in shifting merchants, traders, and market contributors from centralized exchanges to decentralized platforms in Solana’s high-velocity surroundings.

Information and varied metrics improve uncertainty about Solana’s efficiency

Solana’s efficiency alerts transformative modifications within the decentralized ecosystem that would drive up asset costs. Nonetheless, varied on-chain metrics and analysis metrics present contrasting sentiments.

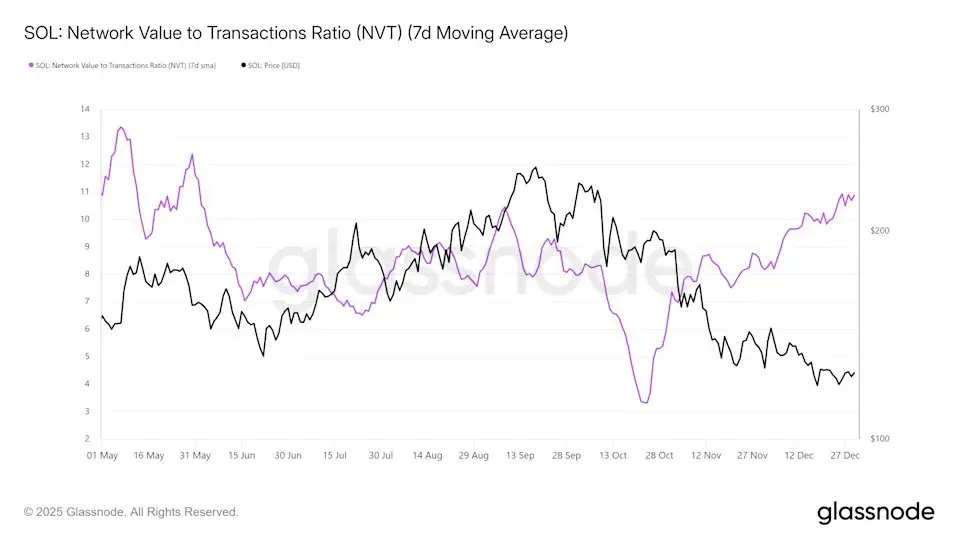

Supply: Glassnode. Solana community and transaction ratios

Based on knowledge from blockchain knowledge and intelligence platform Glassnode, Solana’s community value-to-transaction ratio is elevated quickly It reached a seven-month excessive, suggesting a doubtlessly bearish consequence.

Traditionally, rising NVT numbers have signaled an impending bearish development, placing stress on Solana’s worth and restoration makes an attempt. The information exhibits {that a} divergence exists as Solana’s market worth is rising sooner than the precise buying and selling demand. The disconnect additionally exhibits that Solana’s hype could also be outpacing the community’s precise financial exercise.

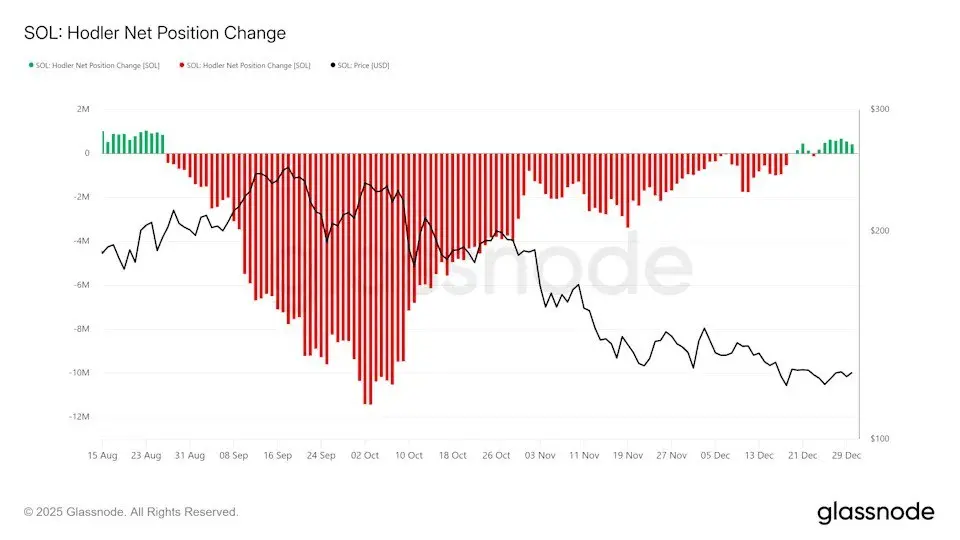

Supply: Glassnode. Hodler’s web place change

In the meantime, the conduct of long-term holders exhibits contrasting sentiments. Solana’s hodler web place is shifted From about 4 months of distribution to new accumulations prior to now week. Holders might be able to take stress off the skis and cut back bearish danger amid near-term uncertainty for Solana.

Information from ETF monitoring web site SosoValue, present The US Spot Solana ETF recorded inflows price $2.29 million on December thirty first, marking the third consecutive day of optimistic inflows. The information additionally exhibits that the ETF acquired important inflows in December and now has $1.02 billion in web belongings underneath administration.

Additionally earlier Cryptopolitan report highlighted Solana crypto fund merchandise recorded the best development fee, with $3.6 billion in inflows in 2025. This determine represents a 1000% improve from $310 million in 2024. This knowledge helps Glassnode’s Hodler Indicator and exhibits that long-term Solana holders are accumulating cryptocurrencies.

As of this writing, Solana is buying and selling at $134.34. Based on knowledge from cryptocurrency worth monitoring web site CoinMarketCap, the crypto asset was unchanged prior to now 24 hours regardless of gaining 8.58% over the previous seven days.