The S&P Dow Jones Index (S&P DJI) discusses the key exchanges, custodians and Defi protocols for licensing and itemizing tokenized variations of benchmarks, in response to US fairness director Stephanie Rowton.

Rowton instructed CointeLegraph that index suppliers are taking a “strategic method” to make sure that tokenized S&P merchandise are solely accessible on platforms that meet excessive requirements of transparency, safety and regulatory compliance.

“By establishing a lot of these relationships, we hope to have the ability to work collectively to take part in a sturdy infrastructure that helps buying and selling and accessibility of tokenized variations of the index.

The push to blockchain is as a result of institutional curiosity in tokenized monetary merchandise will speed up. S&P DJI entered the house by licensing the S&P 500 with Centrifuge on the S&P 500.

Lowton mentioned the transfer has already generated “rising curiosity and engagement” from each conventional finance (TRADFI) and decentralized finance (DEFI) market contributors. “This curiosity displays wider market tendencies as traders more and more search modern and environment friendly methods to work together with established monetary merchandise,” she added.

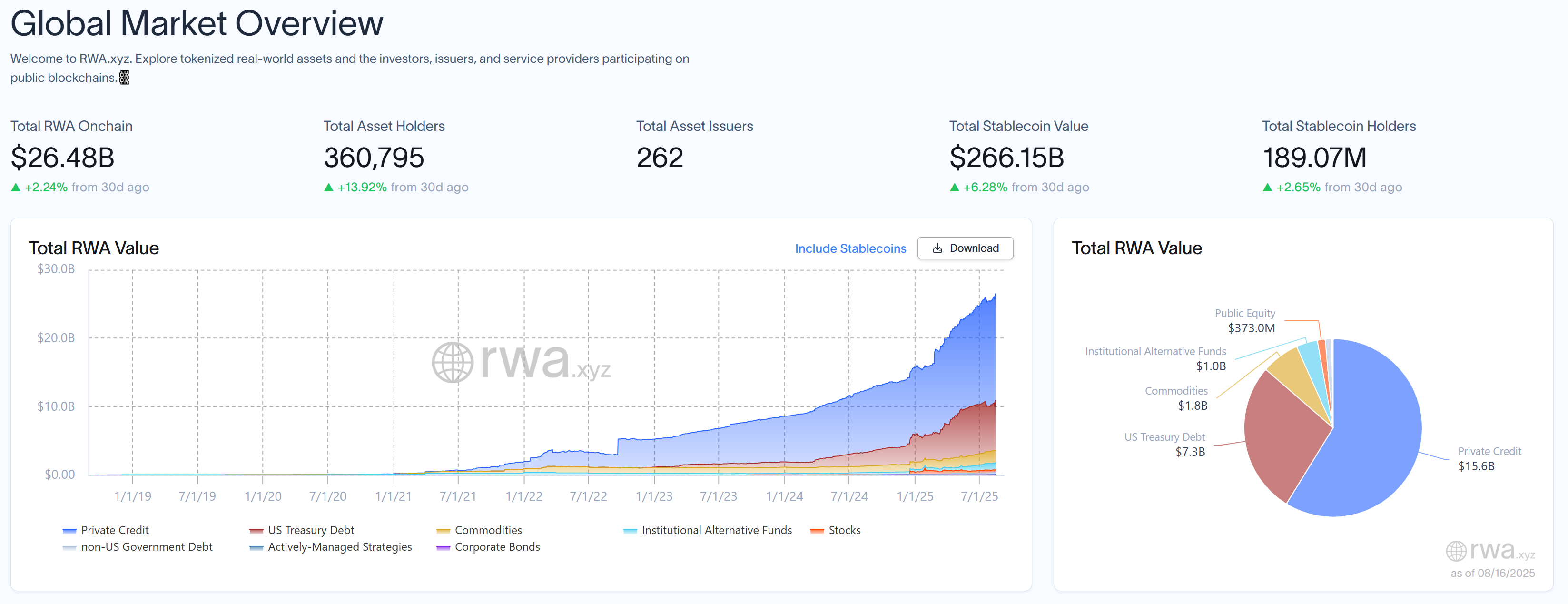

Overview of the worldwide RWA market. sauce: rwa.xyz

Associated: Former Binance deal maker joins the Hilbert Group to launch a tokenized fund platform

bridging tradfi and defi

Lowton mentioned blockchain know-how has “reworking potential” in monetary markets. “As demand for digital belongings grows, tokenization might play a key function in filling the hole between conventional finance and decentralized finance,” Lowton famous.

She added that S&P DJI’s tokenization technique is in keeping with the corporate’s mission to satisfy the wants of “a brand new era of traders in search of modern methods to deal with established benchmarks.”

Curiosity in tokenized index merchandise is probably the most highly effective amongst digital native traders, together with establishments in search of to diversify their portfolios, equivalent to crypto and blockchain contributors. Regionally, Europe, Asia and Ratum lead costs.

Lowton additionally revealed that the corporate is evaluating alternatives for tokenizing different flagship benchmarks, such because the Dow Jones Industrial Common and Theme Index. “We acknowledge that totally different investor segments might have totally different pursuits in a selected index and purpose to satisfy market demand accordingly,” she mentioned.

Associated: Animoca launches Nuva Market to unify the “fragmented” RWA sector

2030 Imaginative and prescient of Tokenized Indexes

Lowton mentioned that tokenized indexes can be “essential” in world markets by 2030, rising entry and liquidity to cross-border markets. This know-how can cut back conventional funding obstacles and permits new methods that leverage Defi options equivalent to fractional possession and automatic buying and selling.

Nonetheless, she pushed again the notion that tokenization threatened S&P DJI’s conventional licensing enterprise. As a substitute, she described it as a “complementary innovation,” increasing business alternatives and opening up index investments to new audiences with out compromising the integrity of the benchmark.

Rowton’s feedback present that tokenized shares proceed to achieve momentum, with the market capitalization of blockchain-based monetary merchandise reaching $370 million by the tip of July.

Final week, Openeden partnered with BNY Mellon to handle and detain the belongings behind Tbill, a tokenized US monetary product. That is the primary Moody “A” price tokenized monetary fund to make use of International Custodians.

journal: Will Robinhood’s tokenized shares actually take over the world? Professionals and Cons