SpaceX is working towards a inventory market itemizing that would worth the corporate at about $1.5 trillion, making it the biggest public market by that measure, in accordance with Bloomberg.

If that occurs, traders will not simply be shopping for rockets and satellites. Additionally they plan to amass corporations that maintain hundreds of Bitcoins and are already utilizing Dogecoin to fund missions to the moon.

Late Tuesday, Bloomberg reported that the corporate run by Elon Musk is shifting ahead with plans for an preliminary public providing that goals to lift “effectively over $30 billion,” valuing it at round $1.5 trillion and aiming to go public as early as mid-to-late 2026.

At that dimension, even small steadiness sheet allocations matter.

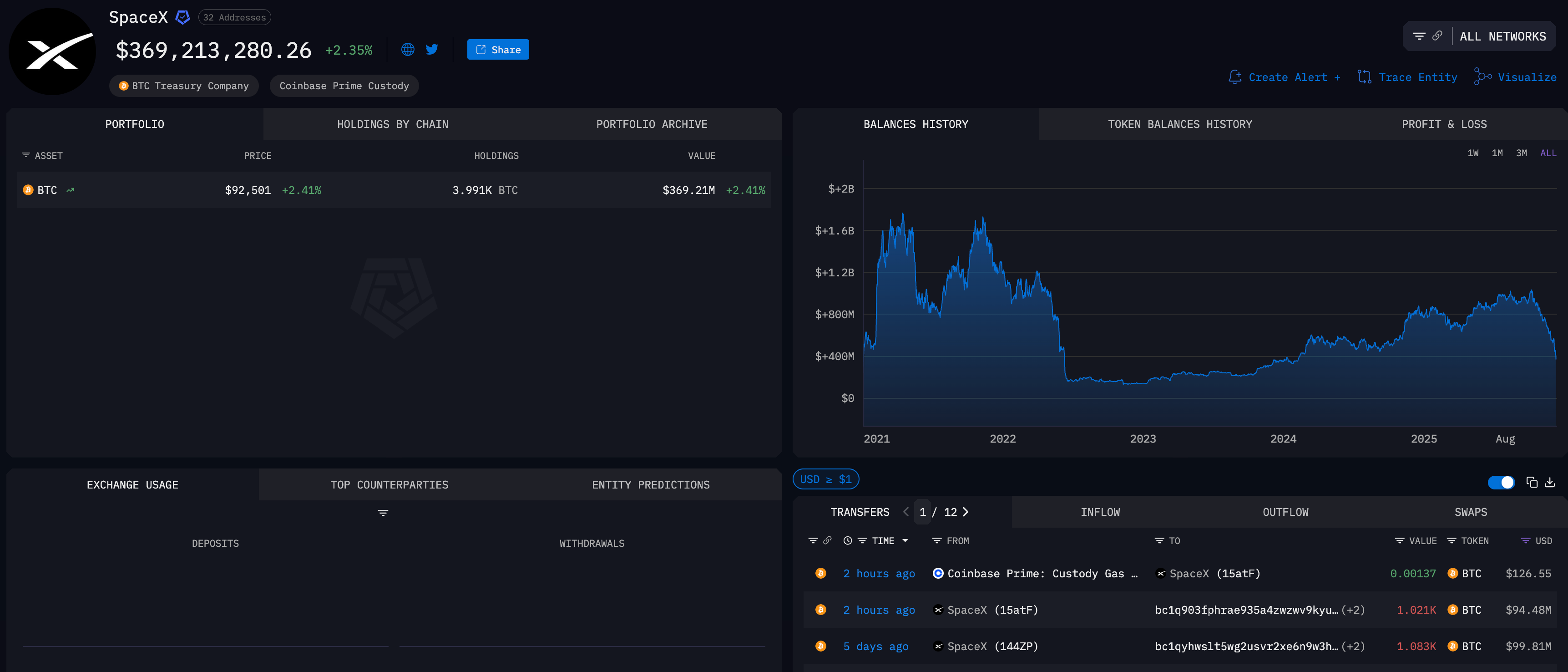

Arcam Intelligence, a blockchain analytics agency that tracks the recognized entities, reveals a cluster of wallets labeled “SpaceX” holding roughly 3,991 BTC, equal to roughly $369 million at a Bitcoin worth of roughly $92,500.

The handle is tagged as being held through Coinbase Prime custody, and the steadiness historical past graph reveals that the holding has fluctuated over the previous few years, rising sharply in the course of the 2021-2022 bull market, then falling, after which rebuilding in 2024-2025.

In Arkham’s view, current transfers have seen large-scale inner motion at Bitcoin’s base layer, with two transactions of simply over 1,000 BTC every up to now week, paralleled by smaller flows between Coinbase Prime and addresses within the cluster.

Please word that these transfers could also be inner transfers quite than gross sales.

Though the deal remains to be greater than a 12 months away and topic to market situations, Musk’s method to cryptocurrencies continues to amplify any developments.

Mr. Musk’s affect on Dogecoin is well-documented, as he accepted tokens for the DOGE-January exploration mission after posting a meme that moved the market to SpaceX.

His firm was one of many earliest institutional adopters of Bitcoin, with renewable vitality expertise firm Tesla reporting holdings of greater than 11,000 BTC on its steadiness sheet.

SpaceX’s IPO may give him new funding for Starlink growth and a chip-filled area knowledge middle, increasing his affect in areas involving each AI and crypto infrastructure.

In the meantime, early knowledge from prediction market Polymarket reveals rising confidence that SpaceX’s IPO valuation may exceed $1 trillion, with merchants pegging a 67% likelihood of its market cap exceeding the benchmark as of early Wednesday.