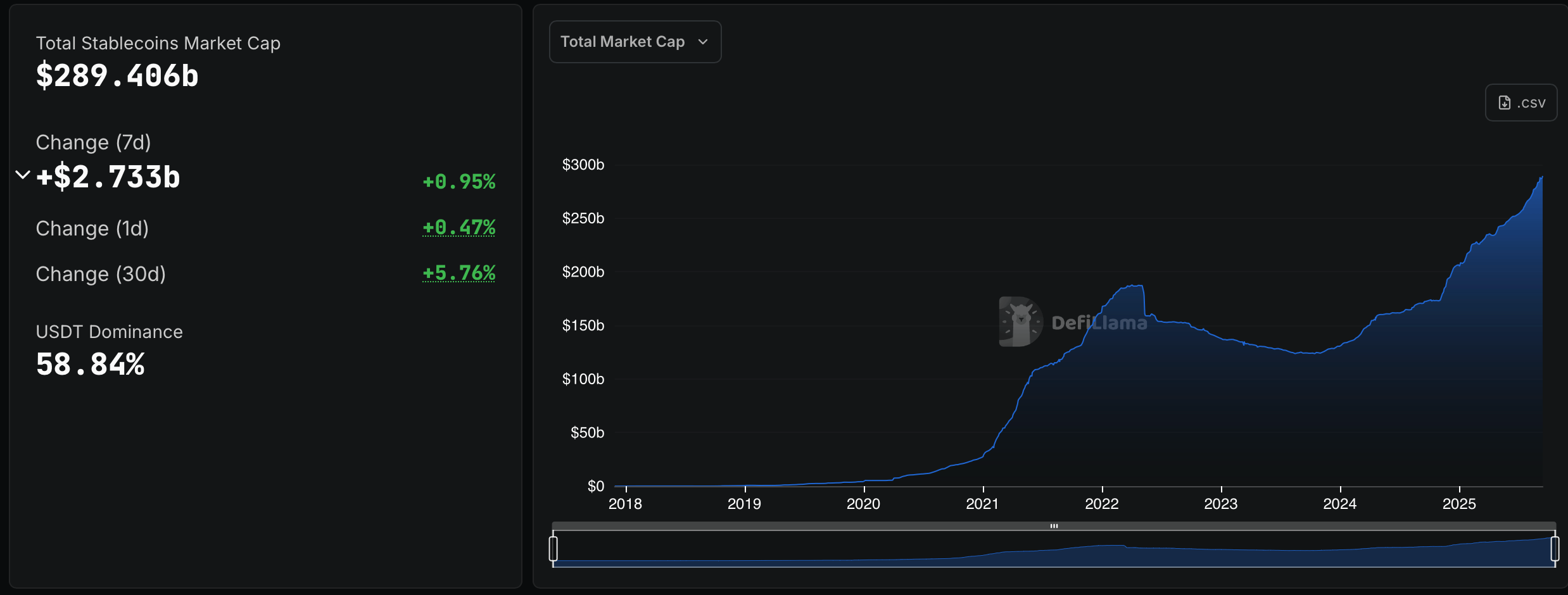

In response to the newest Stablecoin figures on Defillama.com, the market is approaching a $290 billion threshold, with a present valuation of $289.4 billion.

From Tether to Paypal: Stub Coin Battle for Billions

This week’s snapshot of Fiat Peg tokens by way of Defilama.com exhibits a sector that has expanded by $2.733 billion over seven days. Tether’s share slipped down, dropping under the 89% line to 58.84% of the entire. Tether (USDT) is barely shifting, nevertheless it manages a +0.86% improve for the week and rests at a market capitalization of $17.0273 billion.

Circle’s USDC has been secure with a light +0.48% improve, bringing its whole to $72.56 billion. Ecena’s USDE, which got here in third, targeted on $13.3 billion, up +4.87% from Sharp. Sky’s Dai soaked at simply -0.91% and settled at $5.038 billion. Sky Greenback (USDS) tripped violently, falling 4.70% to $451.5 billion, whereas World Liberty Monetary barely moved, rising 0.08% to $2.662 billion.

BlackRock’s Buidl skated from –1.71% to $2.195 billion, whereas Ethena USDTB countered Hefty +13.45% to $1.8115 billion. FALCON USD (USDF) rose to $1.624 billion with a rise of +5.39%, whereas PayPal’s PYUSD was $1.347 billion, lighting the charts with an A+14.72% leap. The corporate has gathered the highest 10 stubcoins by market capitalization, with a complete of $275.333 billion.

The tide of shifts throughout the stubcoin highlights the act of shaking dominance and balancing newcomers out there the place they outweigh their weight. With uneven provide progress throughout issuers, the info suggests a shift in demand for dollar-related liquidity, setting new levels of competitors amongst suppliers preventing for relevance. Of the 289 Stablecoins tracked by Defillama.com, the highest 10 heavyweight instructions had been the overwhelming command of 95.14% of the market, with tons of remaining discarding slivers.