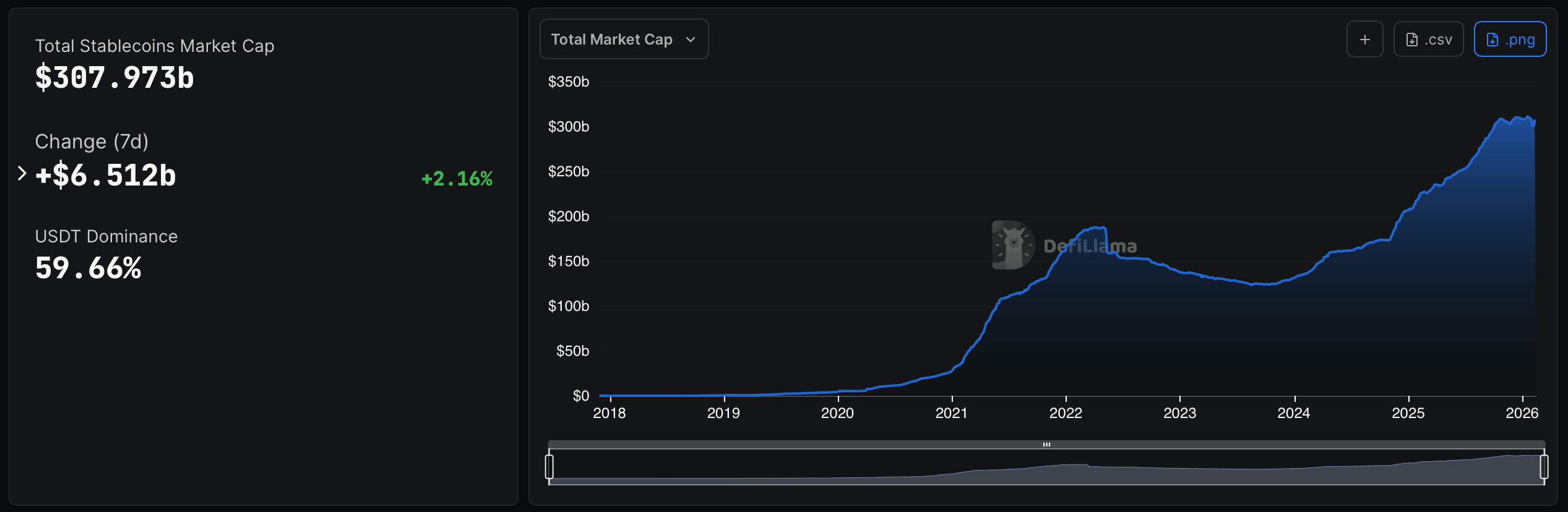

The stablecoin economic system hit a file peak of $311.837 billion about 27 days in the past this yr, however has fallen to $300.722 billion by February 1st. However over the previous two weeks, the sector has put $7.251 billion again on the tab, with most of that enlargement unfolding over the previous seven days.

Rising to $307 billion

Stablecoin statistics from defillama.com present that from February 7 to February 14, 2026, the fiat-pegged token sector elevated by 2.16% week-on-week, including $6.512 billion to the overall. This accounts for 89.81% of the $7.251 billion enlargement recorded over the previous two weeks, which means that nearly all the latest positive factors have occurred inside this slender vary.

Stablecoin market cap statistics through defillama.com for February 14, 2026.

As of Saturday, February 14th, the stablecoin economic system reached $307.973 billion, together with Tether ( $USDT) accounts for 59.66% of the overall. Over the previous week $USDT‘s market capitalization elevated by 0.14%, including $251.98 million to its stability sheet. At present, the market valuation of the dominant stablecoin is $183.727 billion. Circle’s $USDC This was adopted by a 1.39% improve to $73,559 million, reflecting a rise of $1,012 million in the identical interval.

Sky Greenback (USDS) confirmed a robust week-on-week enlargement, rising 3.72% and displaying a transparent improve in capital inflows. The market capitalization of USDS is $6.622 billion. The most important decline among the many high 10 teams was Ethena. $USDeindicating short-term contraction. $USDe The inventory fell 2.25%, with a market capitalization of $6.312 billion. World Liberty Monetary’s US greenback rose 1.63% to $5.302 billion by way of Saturday.

$DAI This was the steepest decline among the many weekly high 10, reflecting a big discount in circulating provide. $DAIThe inventory plunged 4.53%, leaving its market capitalization at $4.387 billion. paypal $PYUSD had the perfect weekly efficiency amongst main issuers, rising 5.07% over the seven-day interval and reaching a market capitalization of $4.022 billion. the placement of the raise $PYUSD It is without doubt one of the rising shares that can entice consideration this week.

BlackRock’s BUIDL had the sharpest rise throughout the high 10 cohort, rising 23.07% week over week to achieve a valuation of $2.363 billion. The transfer follows weeks of capital outflows from the BUIDL market and marks a decisive reversal. Its important rise far outpaces the broader stablecoin sector and alerts renewed demand for tokenized greenback merchandise linked to conventional monetary rails.

falcon finance $USDfIn distinction, it fell by 0.67% throughout the identical interval. The recoil was discovered to be comparatively suppressed in comparison with different weekly contractions; $USDf With a market capitalization of $1.637 billion, it maintains its place throughout the high 10 rating.

Rounding out the checklist, Ripple’s RLUSD has risen 1.85% over the previous week, rising its market cap to $1.522 billion. This improve displays a measured enlargement on the decrease finish of the highest tier, reinforcing a broader sample of incremental development amongst fiat-backed new entrants, even because the sector’s largest tokens proceed to account for almost all of provide.

The newest numbers present that the stablecoin market is neither stagnant nor overheated, however is realigning in actual time as capital modifications fingers between established corporations and rising issuers. Tethering ( $USDT) and $USDC Whereas provide continues to help the sector, smaller new entrants are steadily carving out market share by way of focused development spurts and area of interest positions. The fiat-backed token area seems to be systematically gaining momentum as whole valuations as soon as once more strategy all-time highs.

Incessantly requested questions ❓

- What’s the stablecoin market dimension as of February 14, 2026? The stablecoin economic system reaches $307.973 billion.

- How a lot has the stablecoin sector grown this week? The market added $6.512 billion from February seventh to February 14th, a weekly improve of two.16%.

- Which stablecoin holds the most important market share? Tether ( $USDT) is dominant with 59.66% of the overall market.

- Which stablecoin made essentially the most cash every week? BlackRock’s BUIDL rose 23.07% whereas PayPal’s BUIDL rose 23.07%. $PYUSD It has elevated by 5.07% previously 7 days.