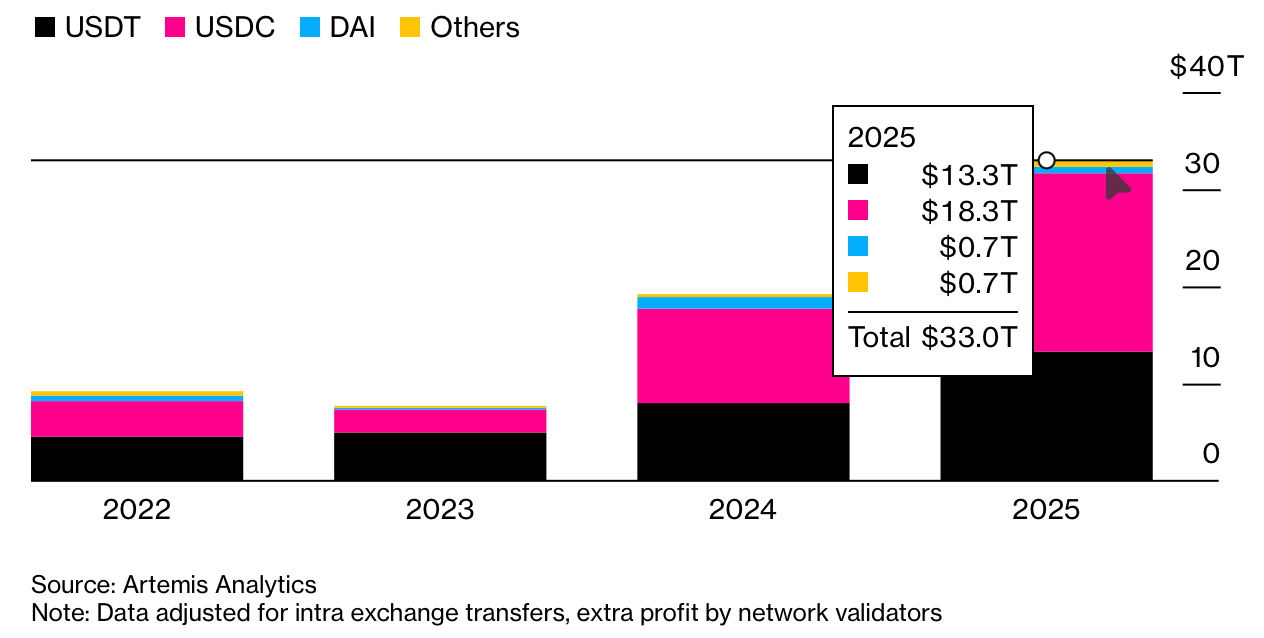

On account of favorable US insurance policies and elevated institutional adoption, stablecoin buying and selling quantity soared to a file excessive of $33 trillion in 2025. Knowledge reveals that USDC is main the commerce circulation whereas USDT continues to dominate market worth.

Professional-Crypto US Information stablecoin exercise within the local weather

Stablecoin utilization surged to a brand new excessive in 2025, with transaction quantity rising 72% yr over yr to $33 trillion, in response to knowledge compiled by Artemis Analytics. This development was fueled partly by a extra cooperative regulatory atmosphere in america beneath President Donald Trump’s secret foreign money administration.

USDC accounted for the most important share of exercise, with annual transaction worth reaching $18.3 trillion. Tether’s USDT adopted with $13.3 trillion. Collectively, the 2 tokens dominated international stablecoin flows as adoption expanded past crypto-native customers.

Coverage modifications performed an necessary position. The passage of the Genius Act in July established a transparent authorized framework for stablecoins and fostered broader institutional curiosity. Firms like Walmart and Amazon are exploring stablecoin initiatives, and Trump household enterprise World Liberty Monetary launched its personal token, USD1, in March.

Artemis knowledge additionally reveals a shift in the place stablecoins are used. Though total buying and selling volumes have elevated, the proportion of transactions on decentralized crypto platforms has decreased, suggesting that mainstream and real-world utilization is rising.

Despite the fact that USDT is the most important stablecoin with a market capitalization of $187 billion, USDC is closely utilized in DeFi and subsequently dominates the transaction circulation. In distinction, USDT is commonly used for funds, enterprise transfers, and shops of worth.

learn extra: Trump-linked World Liberty Monetary seeks Nationwide Belief Financial institution approval for $1 stablecoin

Development reveals little signal of slowing. Stablecoin transaction worth reached $11 trillion within the fourth quarter alone, up from $8.8 trillion within the earlier quarter. Bloomberg Intelligence estimates that complete stablecoin fee flows might attain $56 trillion by 2030.

Incessantly requested questions 💵

• Why did stablecoin buying and selling quantity skyrocket in 2025?

Annual buying and selling quantity has reached an all-time excessive of $33 trillion, pushed by U.S. Procrypt insurance policies and elevated institutional adoption.

• Which stablecoin led international buying and selling exercise?

USDC dominates $18.3 trillion in transaction flows and exceeds USDT in on-chain utilization.

• Why is USDT nonetheless main in market worth?

USDT stays the most important by market capitalization because of its widespread use in funds and storage of worth.

• How are stablecoins used exterior of the crypto market?

On account of elevated real-world utilization, exercise is shifting from DeFi to mainstream funds.