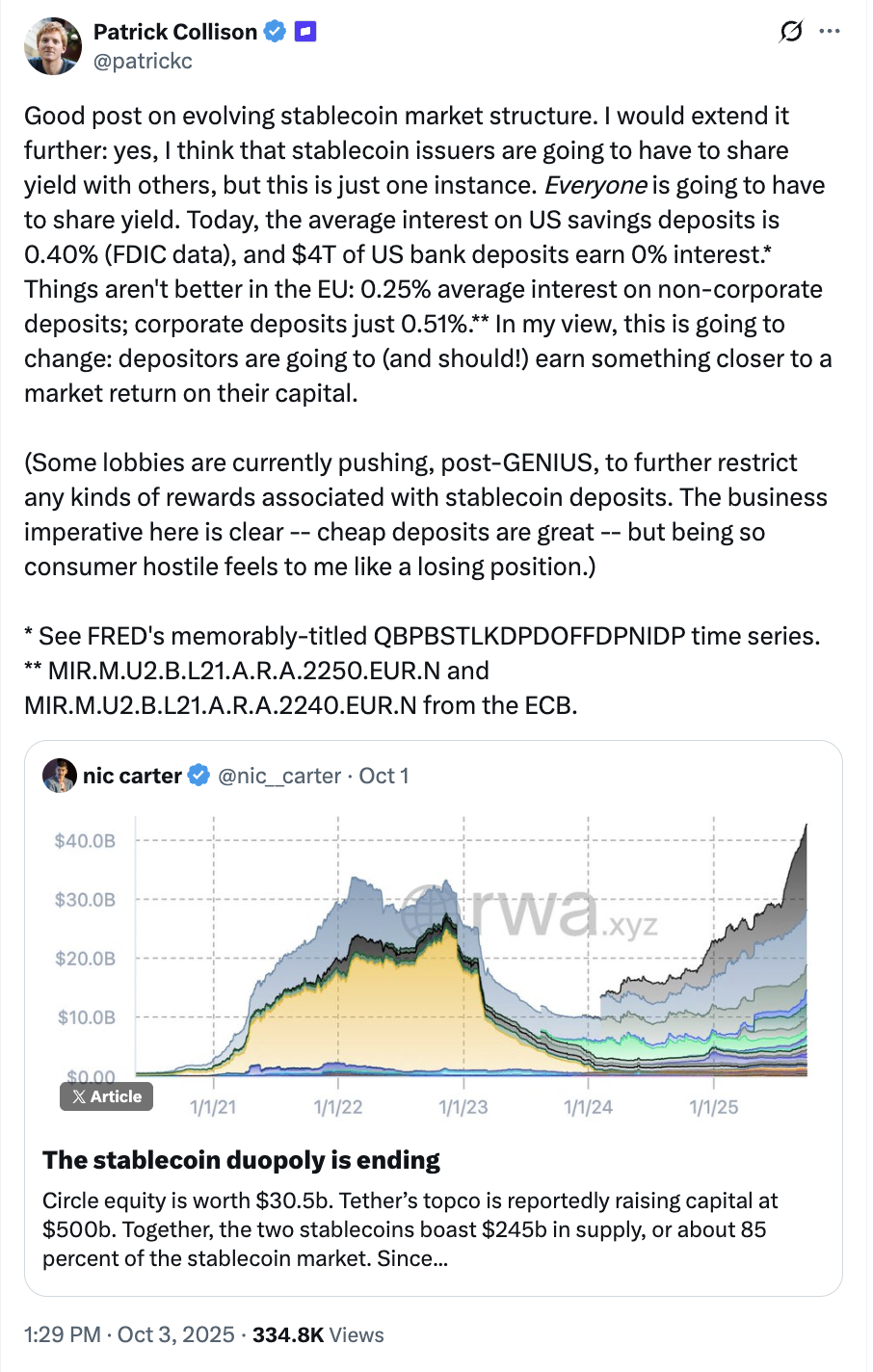

Based on Patrick Collison, CEO of Funds Firm Stripe, the tokenized model of Fiat forex transferring by blockchain rails will in the end drive banks and different monetary establishments to remain aggressive with the yields of deposit prospects.

The common rate of interest for US financial savings accounts is 0.40%, and within the EU, the typical charge for financial savings accounts is 0.25%, stated Collison outlined the rise in secure cash to bear the yield and the way forward for the sector, in response to the X-post of VC Nic Carter. Collison added:

“Depositors are anticipated to get one thing near the market returns of capital, and a few lobbies are presently pushing to additional restrict any sort of compensation related to post-Zenius deposits.

The enterprise necessities listed here are clear. A budget deposits are nice, however being a shopper resident looks like a shedding place to me,” he continued.

sauce: Patrick Collison

Stablecoins has grown steadily since 2023 in market capitalization and consumer adoption, following the passage of the US genius Stablecoin invoice. The Genius Invoice paved the best way for the regulated stubcoin business however banned yields.

Associated: The growth to the 300B to Stablecoin Market Increase is “Rocket Gasoline” from Crypto Rally

The banking business fights to restrict the alternatives for secure however yields

A report by American Banker stated that whereas U.S. lawmakers deliberate what provisions to incorporate within the remaining draft of the genius Stablecoin laws, the financial institution’s foyer opposed the stubcoin of curiosity.

Banks and their parliamentary allies have argued that stubcoins, which offer shoppers with the chance to realize curiosity, would undermine the banking system and erode market share.

“Wish to make Stablecoin issuers extra fascinating? In all probability not. As a result of if they’re issuing curiosity, there is not any motive to place your cash into your native financial institution.”

Nonetheless, crypto business executives see the rise of stubcoin as the subsequent logical development, predicting that stubcoin will devour legacy fiat funds.

“Each forex shall be stubcoins. So even Fiat forex shall be stubcoins. It would merely be known as the greenback, the euro or the yen,” Reeve Collins, co-founder of Tether, the issuer of Stablecoin, informed Token2049’s Cointe Legegraph.

journal: Crypto needed to overthrow the financial institution, however now they’re turning into them on Stablecoin Struggle