Stablecoins ended 2025 on a excessive be aware, with tackle exercise at its peak. The Ethereum-based stablecoin confirmed exercise that marked the height of the cycle, far exceeding earlier spikes in exercise.

Stablecoins on Ethereum reached peak exercise on the finish of 2025. Exercise ranges on the finish of the yr weren’t uncommon. As an alternative, the speedy progress pattern over the previous few months has been prolonged.

In 2025, energetic addresses reached new file ranges a number of occasions. Over the previous few days of 2025, roughly 593,000 energetic customers moved their stablecoin daily.

This yr, stablecoins skilled actions not seen in earlier market cycles, each by way of complete provide and utilization. In 2025, there can be over $314 billion of stablecoins in circulation, with a much more various vary of issuers than in earlier market cycles.

On the market peak in early 2022, energetic stablecoin addresses reached 285,000 per day, the best throughout the complete growth cycle.

Stablecoins remained energetic even under market worth data

Though crypto valuations fell under their peak ranges on the finish of 2025, stablecoin customers maintained excessive exercise ranges. Ethereum exercise is impartial of BTC and ETH worth cycles and represents a structural shift in digital asset exercise.

Stablecoins have a number of use instances, together with arbitrage, P2P transfers, lending, and inter-whale and inter-institutional funds. In earlier cycles, the surge in stablecoin exercise was short-lived, however exercise in 2025 remained at a excessive baseline and continued to develop.

Transferring stablecoins has turn into one of many essential technique of deploying capital. Excessive exercise can also point out altering positions looking for optimum liquidity area. Somewhat than getting used to lock in worth, stablecoins had been used as mortgage collateral, DEX buying and selling pairs, and different energetic allocations. As a result of availability of yield, stablecoin gross sales have additionally expanded considerably.

In previous crypto cycles, excessive exercise in stablecoins has indicated accumulation slightly than distribution. Although BTC has fallen from its highs, stablecoin exercise confirmed that the market continues to be exploring alternatives.

Ethereum turns into a high-value stablecoin hub

Ethereum has turn into a hub for high-value transfers, with USDT and USDC among the many high 5 sensible contracts on the community. In accordance with Cryptopolitan, stablecoins had been additionally one of many predominant causes for Ethereum’s current buying and selling file. reported. Ethereum’s high three stablecoins stay USDT, USDC, and DAI, the legacy stablecoin of the Sky ecosystem.

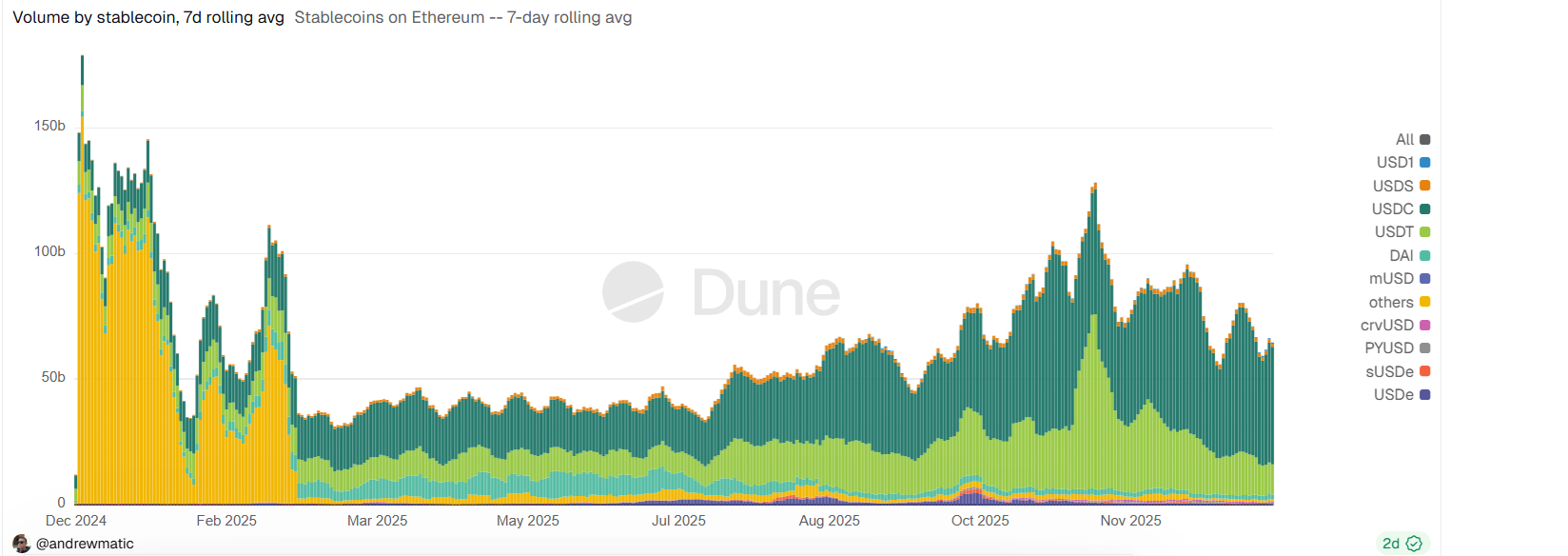

Over the previous yr, USDC has expanded its affect over the switch of worth, shifting nearly all of its worth onto Ethereum, although the variety of transactions was small. |Supply: Dune Analytics

USDT has a bonus of 54.77%, whereas USDC is round 37% primarily based on buying and selling ranges. Each tokens grew their buying and selling exercise nearly exponentially over the last months of 2025.

Nonetheless, USDC is turning into a worth chief and has extra buying and selling quantity regardless of much less exercise.

The prevalence of USDC remittances for high-value transactions indicators additional adjustments in 2025. USDC buying and selling has elevated over the previous 12 months as merchants migrated to totally regulated and accepted tokens. Whereas USDC can be utilized by merchants within the US and Europe with out restrictions, USDT maintains a global position exterior of those markets.