Greater than 30 Nationwide Basketball Affiliation (NBA) officers have been arrested, leaving the sports activities business in shock.

The investigation, which FBI Director Kash Patel described as “mind-boggling,” spans 11 states and entails tens of millions of {dollars} allegedly obtained by unlawful playing and gaming fraud in the course of the 2023-2024 season.

Prosecutors say the scheme concerned inside data and arranged crime exercise and tarnished the league’s status in quite a few methods.

Given the scope of the issue, the query for traders concerned within the sports activities business is straightforward. Which shares to look at after the NBA playing scandal?

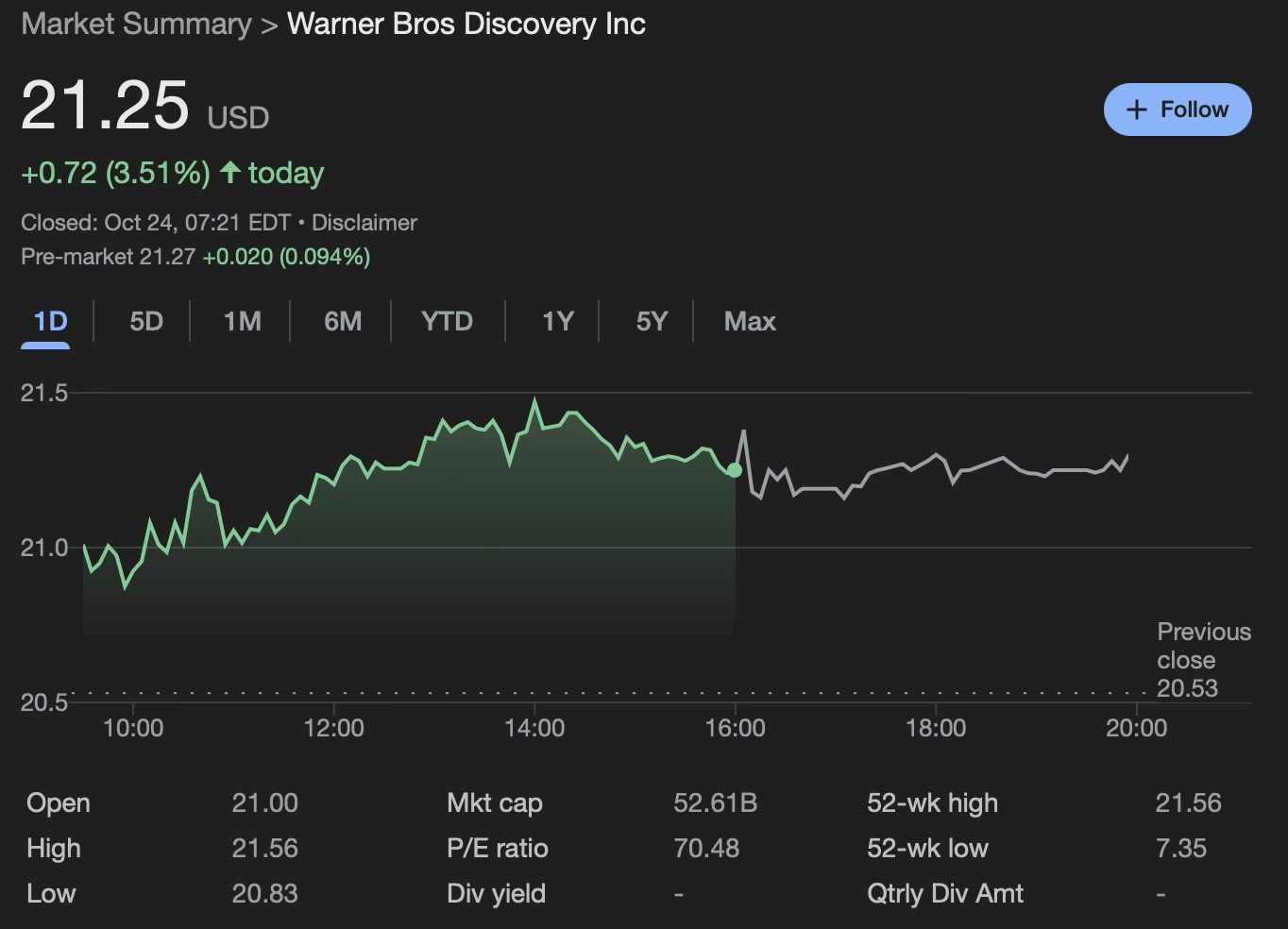

Warner Brothers (WBD)

Warner Bros. (NASDAQ: WBD), one of many NBA’s main broadcast companions, seems unfazed by the federal investigation. Quite the opposite, this 12 months has been all about earnings, with the inventory almost doubling since January and buying and selling at $21.25 on the time of writing, up one other 3.5% on the every day chart.

Nevertheless, the corporate’s future trajectory is at present within the steadiness, with a number of candidates reportedly contemplating buying half or the entire firm. For instance, Warner Bros. has already rejected three bids for Paramount Skydance, the final of which was for slightly below $24 per share.

administration stated CNBC The corporate introduced on Tuesday, October 21, that it’s going to proceed to overview all future bids whereas transferring ahead with its present plan to separate into two separate entities: the streaming and studio enterprise platform and the worldwide community enterprise.

CEO David Zaslav stated the method would permit the media large to “establish the most effective path ahead” and “maximize the worth of our property.” So regardless of the future holds, WBD is certainly value keeping track of.

Madison Sq. Backyard Sports activities (MSGS)

Madison Sq. Backyard Sports activities (NYSE: MSGS) is a number one sports activities holding firm that manages the New York Knicks. Though not as robust as Warner Bros., MSGS has additionally been trending larger, with shares up almost 18% up to now six months and buying and selling at $226.16 at press time, up 0.29% on the day and 0.24% pre-market.

MSGS is a very fascinating case because it approaches its third quarter earnings report, scheduled for November seventh. Whereas the Knicks don’t seem like immediately concerned within the betting controversy, a perceived decline in confidence within the league as an entire might theoretically put strain on the inventory worth, and any new doubtlessly damaging findings by regulation enforcement authorities might theoretically put strain on the inventory worth.

Nevertheless, it is usually value noting that the group’s efficiency this season has not had a lot of an impression on the supervisor’s inventory. So despite the fact that the Knicks made it to the Jap Convention Finals for the primary time in 25 years, and the 2026 title is on the road, Madison Sq. Backyard Sports activities inventory has solely risen 3.4% over the previous 12 months.

Moreover, working margins stay low. Regardless of the playoff income, the corporate reported a complete lack of $22.6 million on the finish of its final fiscal 12 months. Moreover, the mixed worth of each groups is roughly $13.5 billion, whereas MSGS’ enterprise worth is barely $6.6 billion.

In brief, MSGS gives publicity to the NBA at a deep low cost, and if the hole between private and non-private valuations in some way narrows, the inventory might rise, particularly if the dream of a brand new title comes true, however there are such a lot of components at play for the time being that it is tough to foretell how the state of affairs will play out. Nonetheless, this inventory is value watching within the coming weeks.

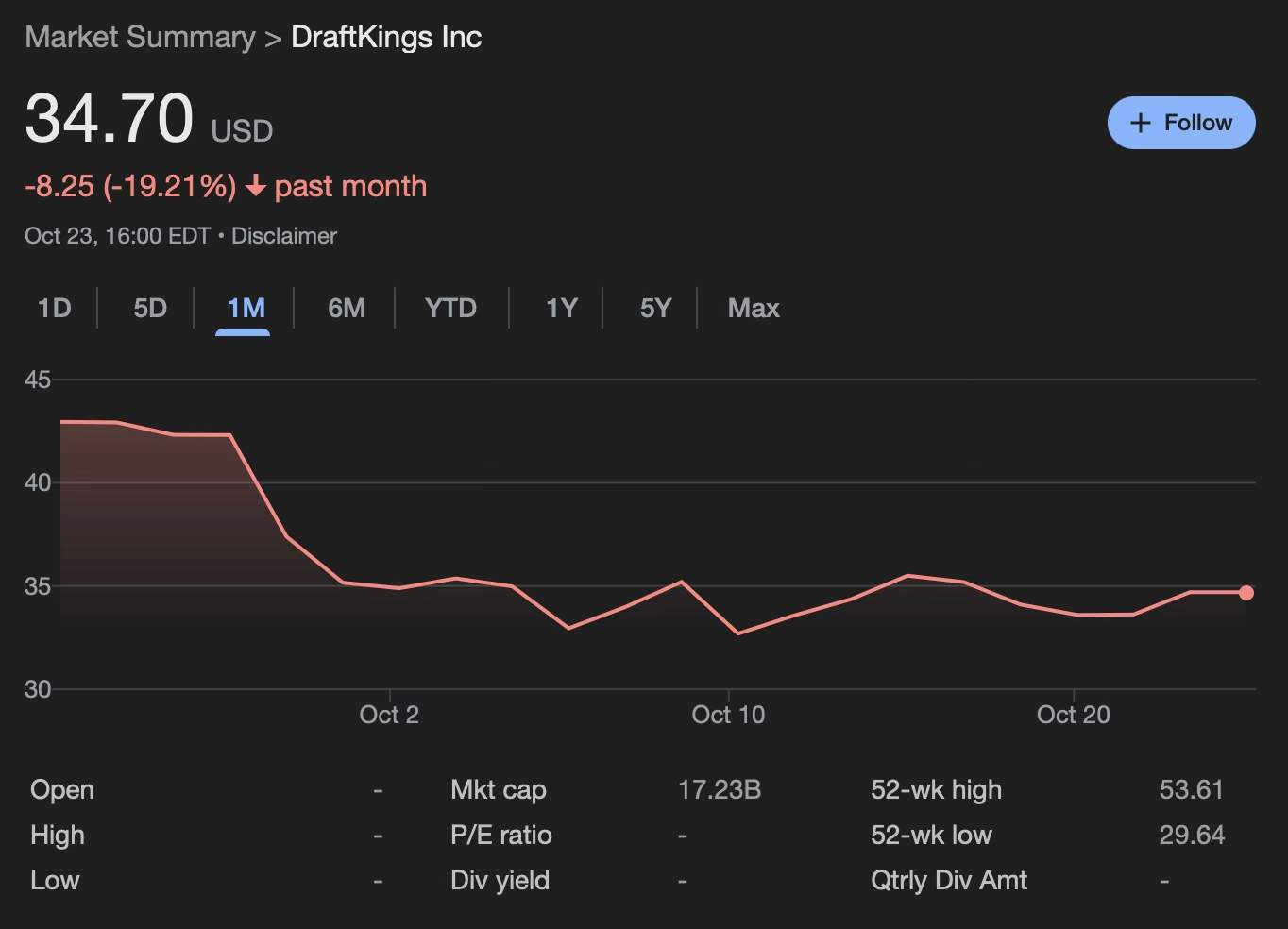

DraftKings (DKNG)

DraftKings (NASDAQ: DKNG), a well-liked Boston-based betting firm that covers the NBA and different main American sports activities leagues, has been struggling in current weeks, with its inventory plummeting almost 20% on the month-to-month chart and buying and selling at $34.70 at press time.

Now, with the well being of sports activities betting severely affected, DraftKings is in an much more precarious place, with its inventory susceptible to additional losses. Nonetheless, a number of current developments have as soon as once more captured the eye of traders, most notably: Polymarket.

Congratulations to @DraftKings on their acquisition of @RailbirdHQ!

We’re proud that Polymarket Clearing is the designated clearing home for entry into the prediction markets house.

— Shayne Coplan🦅 (@shayne_coplan) October 22, 2025

Extra exactly, DraftKings plans to launch its new DraftKings Predictions cellular app within the coming months, protecting markets throughout finance, tradition, and leisure. Polymarket itself is at present in preliminary negotiations to boost capital at a valuation of $12 billion to $15 billion, a big improve from its June 2025 valuation of $1 billion. As could be anticipated, current backers and potential new traders alike shall be paying shut consideration to betting platforms.

Featured picture by way of Shutterstock