Strategic inventory fell 1.4% in buying and selling after opening hours, regardless of earnings of $10 billion within the second quarter as CEO Phong Le known as the Bitcoin Holding Firm “probably the most misunderstood and undervalued inventory” available on the market.

The technique’s working revenue rose 7100% year-on-year to $14 billion, Michael Saylor co-founded it, stated in a income assertion Thursday.

This marked the second reporting interval through which truthful worth accounting was utilized, together with unrealized earnings from Bitcoin (BTC).

The technique has additionally introduced plans to purchase extra Bitcoin by elevating one other $4.2 billion price of shares by one in every of its most popular shares. That is a part of our long-term aim of buying $84 billion price of cryptocurrency underneath the upgraded “42/42” plan.

Methods are misunderstood and underrated: von Le

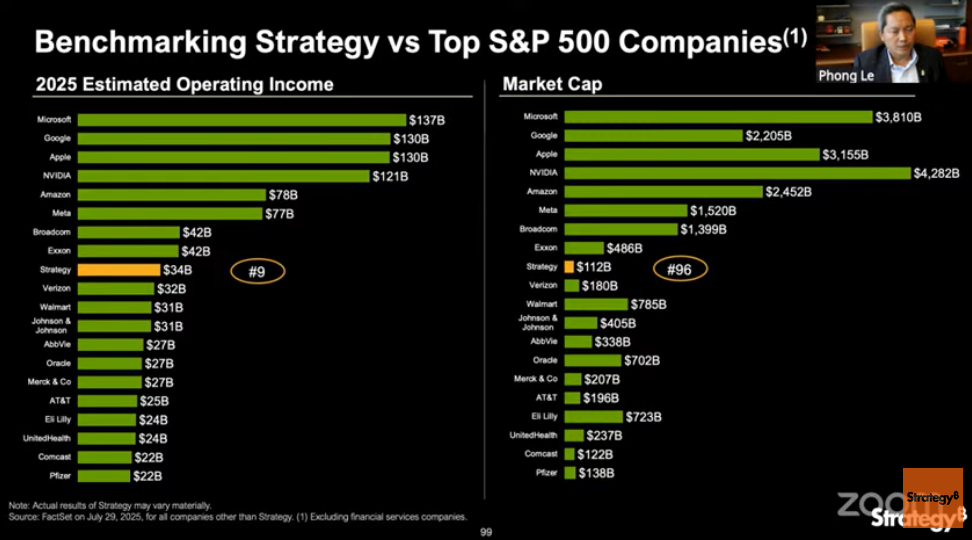

The technique’s estimated working revenue for fiscal yr 2025 is presently $34 billion, the ninth largest income amongst Normal and Poor’s 500 (S&P 500) firms, Le says in his income name.

He stated the technique boasts 96th largest market capitalization and one of many lowest revenue to income multiples amongst S&P 500 firms.

“We use probably the most modern applied sciences and property in human historical past. In the meantime, we’re maybe probably the most misunderstood and undervalued shares in america and doubtlessly undervalued worldwide.”

Comparability of working revenue and market capitalization for methods with different prime S&P 500 firms. supply: technique

Technique’s software program arm, which covers enterprise intelligence merchandise and subscription providers, generated income of $114 million in quarter.

Technique’s widespread inventory, MSTR, rose 1.73% to $401.86 on Thursday, however fell 1.4% exterior of enterprise hours, Google Finance knowledge exhibits.

The technique raises the usual for Bitcoin metrics

The technique, which has gathered 628,791 BTC, price $73.3 billion, stated it had already reached the technique’s year-end goal, with “BTC yields” rising 25% within the second quarter and “BTC $ achieve” exceeding $13 billion.

BTC yields characterize the speed of change between the technique Bitcoin and its anticipated diluted shares, whereas “BTC $ achieve” displays the earnings of Bitcoin values measured in US {dollars}.

Consequently, the technique has raised its full-year “BTC yield” and “BTC $achieve” targets to 30% and $20 billion, respectively, Le stated.

“Corporations that may double their goal all year long will contemplate their success.”

Technique to lift $4.2 billion to purchase extra Bitcoin

In the meantime, the technique stated it has concluded an settlement to concern and promote as much as $4.2 billion price of shares, one of many most popular inventory presents used to purchase extra Bitcoin.

The Variable Charge Sequence A Everlasting Stretch Most popular Inventory, STRC Ticker is likely one of the principal funding instruments in its technique to strengthen Bitcoin Holding by what firms describe as “clever leverage.”

This marks the most important US inventory elevate ever in 2025 because the technique raised $2.5 billion from STRC at first of July, which as soon as purchased 21,021 Bitcoin.

At present market costs, the technique should purchase a further 36,128 Bitcoin from a $4.2 billion wage improve.