Binance CEO Richard Teng lit up the Bitcoin dialog together with his assertion that cryptocurrencies are modern-day digital gold. This has been mentioned many instances earlier than.

However this time, Michael Saylor, the person behind Technique Inc. and the person who turned the software program’s stability sheet right into a Bitcoin vault, mentioned one phrase: “Sure.”

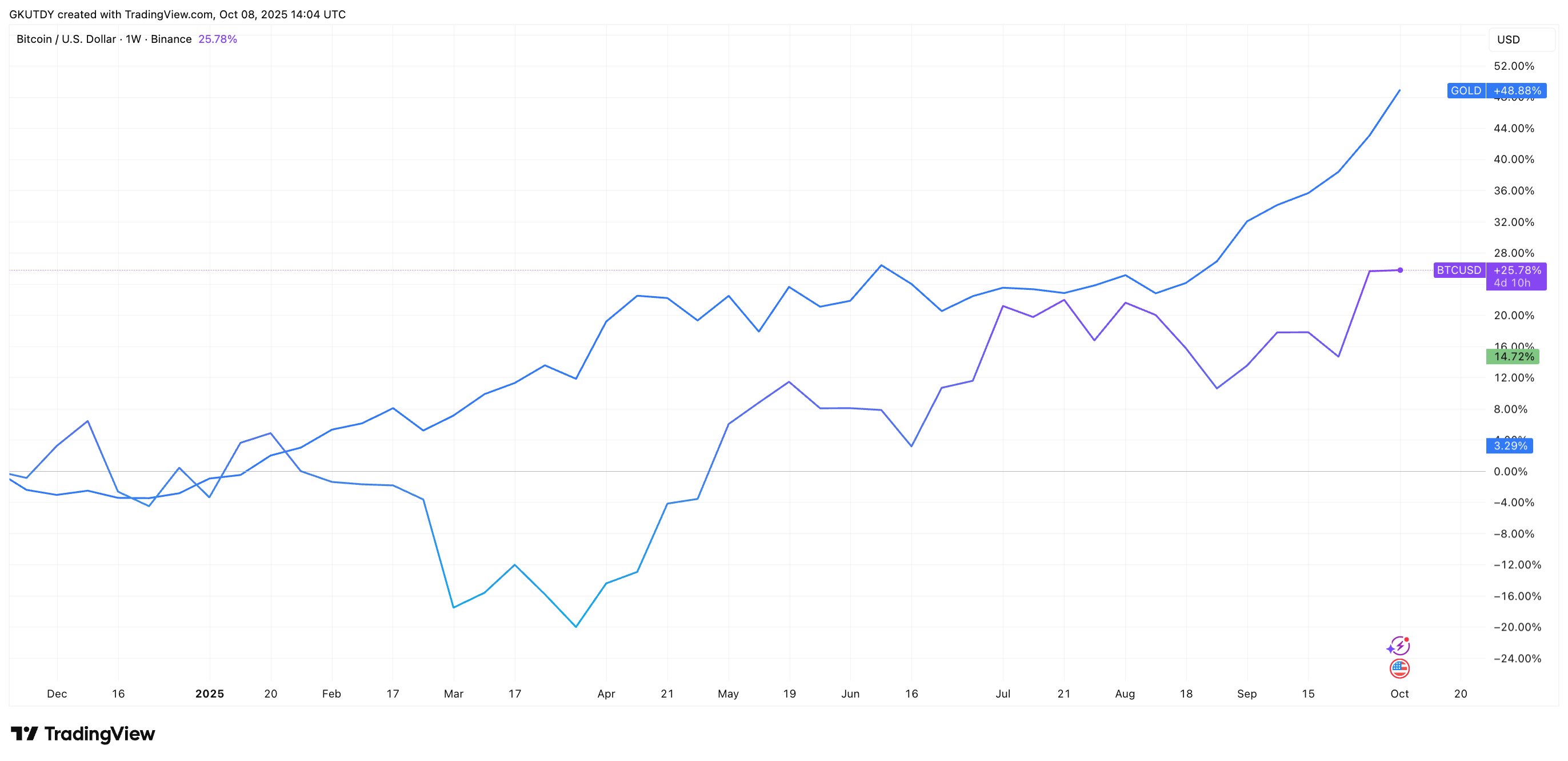

Behind this temporary affirmation just isn’t solely a public settlement from two of the largest names within the trade, but additionally a BTC/gold ratio graph displaying that 1 Bitcoin is at the moment equal to round 30 ounces of gold. That is down from a peak of 37 circumstances earlier this 12 months, however nonetheless far larger than mid-cycle ranges in 2023.

sure

— Michael Saylor (@saylor) October 8, 2025

For merchants, this chart is extra helpful than any slogan, because it reveals that even after corrections that scale back spot costs by 1000’s of {dollars}, cryptocurrencies preserve their worth when it comes to the oldest accumulation of wealth.

Gold is doing higher than “digital gold”

12 months-to-date numbers inform a distinct story, with the shock outperformance in 2025 reportedly up round 54% and Bitcoin up 30%. So anybody who blindly adopted the “digital gold” mantra this 12 months might argue that the unique steel is performing higher.

However that is exactly the purpose the place Thaler’s sure reply seems. He treats cultural claims as definitive, no matter month-to-month proportion adjustments. To him, Bitcoin is already gold, whether or not it lags or leads the charts, and the $78.9 billion he has invested proves this.

So if Ten makes an announcement and Saylor approves it, the message shall be much less about which TradingView line is larger this quarter and extra about fixing the narrative: Bitcoin has already remodeled from a speculative asset to a digital substitute for gold, and it would not want a brand new chart to make that case.