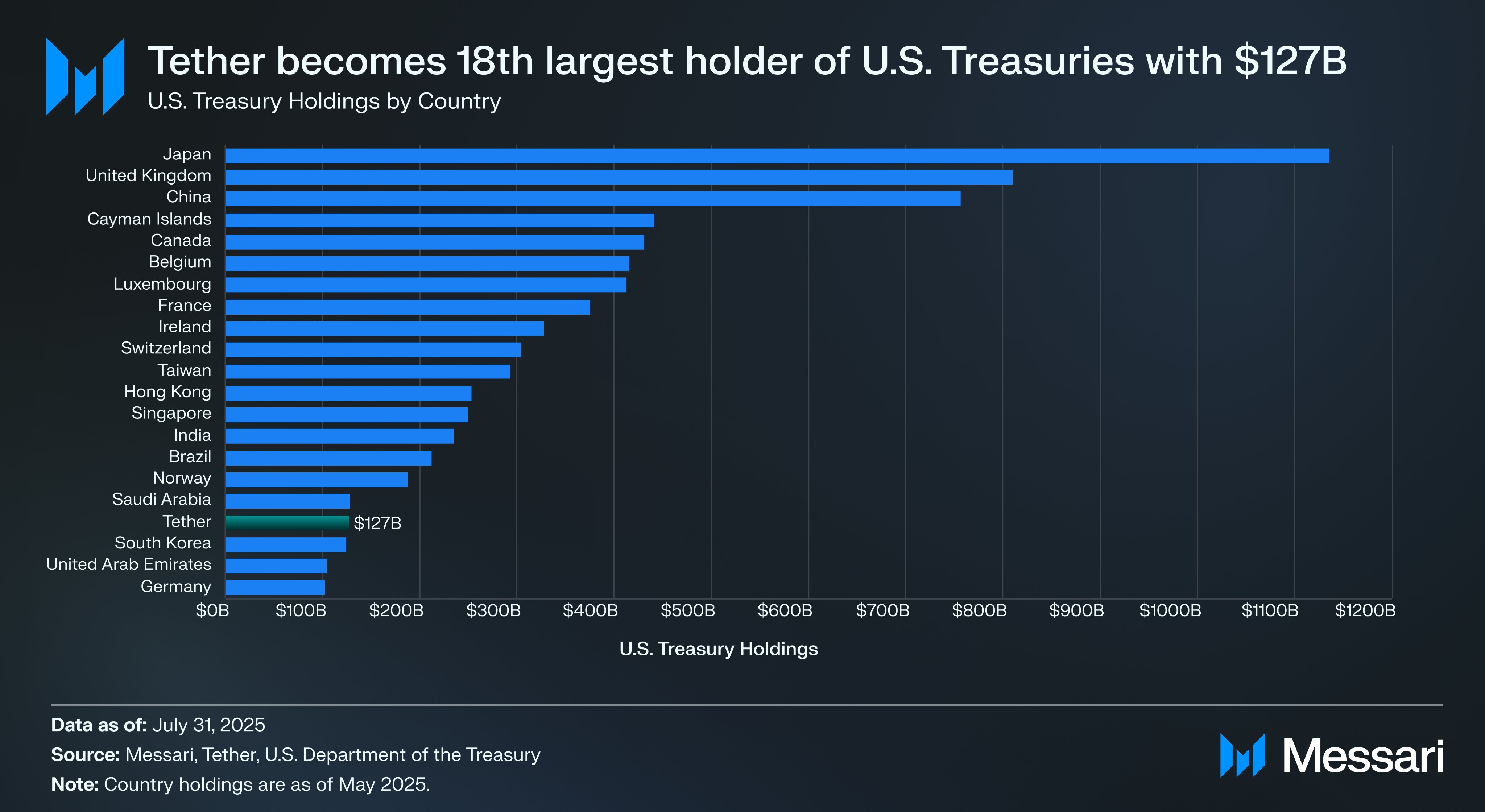

Stablecoin Issuer Tether surpasses South Korea within the variety of US Treasury bondholders after issuing extra belongings with full publicity to the US Treasury. How a lot US debt does the corporate maintain?

abstract

- Tether’s US Treasury outperforms South Korea, Germany and the United Arab Emirates.

- Tether continues to generate internet earnings, reaching $4.9 billion within the second quarter of 2025 alone.

In keeping with information from analytics agency Messari, the Paolo Ardoino-led firm surpassed the ranks and surpassed three sovereign states within the variety of US Treasury bonds it holds. On August 1st, the corporate was in a position to outperform South Korea. South Korea presently holds lower than $127 billion in bonds.

Within the second quarter of 2025, the USDT Stablecoin issuer considerably expanded its US authorities debt holdings, reporting greater than $127 billion in US Treasury, together with $100.5 billion in direct holdings and $21.3 billion. This marks a rise of $8 billion from the primary quarter, rising Tether’s standing as one of many largest holders of US debt worldwide, corresponding to a sovereign state.

Sovereign states, motion.

Tether will change into the 18th largest proprietor of the US Treasury. https://t.co/2gwzldt1j2

– Messari (@messaricrypto) July 31, 2025

Primarily based on Messari’s evaluation, Stablecoin Agency stays the one firm on the record with extra US Treasury departments than different states listed. Aside from South Korea, Tether (USDT) additionally holds extra U.S. Treasury bonds in comparison with the United Arab Emirates and Germany.

Each international locations every maintain US debt in extra of $100 billion.

Tether will change into the 18th largest proprietor of the US Treasury | Supply: Messari

You would possibly prefer it too: Tether shops $800 million value of gold in a secret Swiss secure: Report

Tether reserves exceed 2Q liabilities

Aside from the US Treasury milestones held, the report additionally confirms that tether reserves exceed liabilities, with whole belongings exceeding $162.6 billion in liabilities of $157.1 billion.

The corporate holds shareholders’ fairness capital of $5.47 billion in as a protected fairness buffer, strengthening its monetary power and solvency. Extra importantly, the US Treasury Division’s $127 billion will function the primary help for the US Greenback, making certain excessive liquidity and low threat for token holders.

Within the second quarter of 2025, the USDT issuer was pushed by US Treasury holdings and revenues from strategic reserves in Bitcoin (BTC) and gold, producing internet earnings of round $4.9 billion. Of the whole annual revenue of $5.7 billion, $3.1 billion comes from secure and repeated revenues, with the remaining $2.6 billion rising earnings from the mark to the market.

This monetary efficiency permits companies to repeatedly reinvest and $4 billion has already been deployed in US strategic initiatives, together with tasks equivalent to XXI Capital and Rumble Pockets.

You would possibly prefer it too: Tether CEO proclaims up to date Stablecoin Portfolio roadmap: Bitcoin mining, Tradfi and merchandise buying and selling